Gold prices failed to make a convincing move in either direction last week. However, according to market analyst Eren Sengezer, it is possible that August inflation data from the US will trigger a significant reaction. The analyst also notes that the technical outlook for gold indicates a lack of recovery momentum.

What happened in the markets last week?

Rising interest rates put more pressure on gold

Trading action was suppressed on Monday as US financial markets remained closed for the Labor Day holiday. Risk aversion became evident in the markets as trading volumes returned to normal levels on Tuesday. Thus, the dollar started to gather strength, causing gold to fall. Also, growing concerns about a deepening energy crisis in the euro area provided additional support for the dollar.

Meanwhile, ISM reported Tuesday that its Services PMI rose to 56.9 in August from 56.7 in July. Employment Index returned to over 50 expansion zone. The Index of Prices Paid, which is the component of inflation, decreased slightly from 72.3 to 71.5 to 71.5. Following these data, the probability of a 75 basis point rate hike by the Fed in September exceeded 70%. This, in turn, increased US Treasury bond yields and further depressed gold.

Gold prices hit a one-week high on Friday

Data from China showed earlier on Wednesday that Imports and Exports increased at a softer-than-expected pace in August. Disappointing trading figures forced gold to stay afloat in the first half of the day. However, the yellow metal reversed direction in the American session. The Federal Reserve’s Beige Ledger showed U.S. firms made progress in labor supply and price pressure in July. This, in turn, caused DXY to slip away from its two-year high of 110.78.

cryptocoin.com As you follow on Thursday, the European Central Bank (ECB) increased key interest rates by 75 basis points, as expected. ECB President Christine Lagarde took a cautious stance on future rate hikes. However, the 10-year U.S. Treasury yield rose more than 10%. This caused the gold to be damaged. On the other hand, gold prices recorded daily losses despite the weak performance of the dollar. In his speech the same day, FOMC Chairman Jerome Powell reiterated that they should act strongly on inflation. Besides, he said history has warned against premature easing of policy. However, these statements did not have a lasting impact on the dollar’s performance against its rivals.

A positive shift in risk sentiment ahead of the weekend triggered a deep dollar sell-off. As a result, gold prices rose to a one-week high at $1,729.55. However, some profits towards the end of the European session limited the precious metal’s gains.

What is on the agenda of the next week for gold prices?

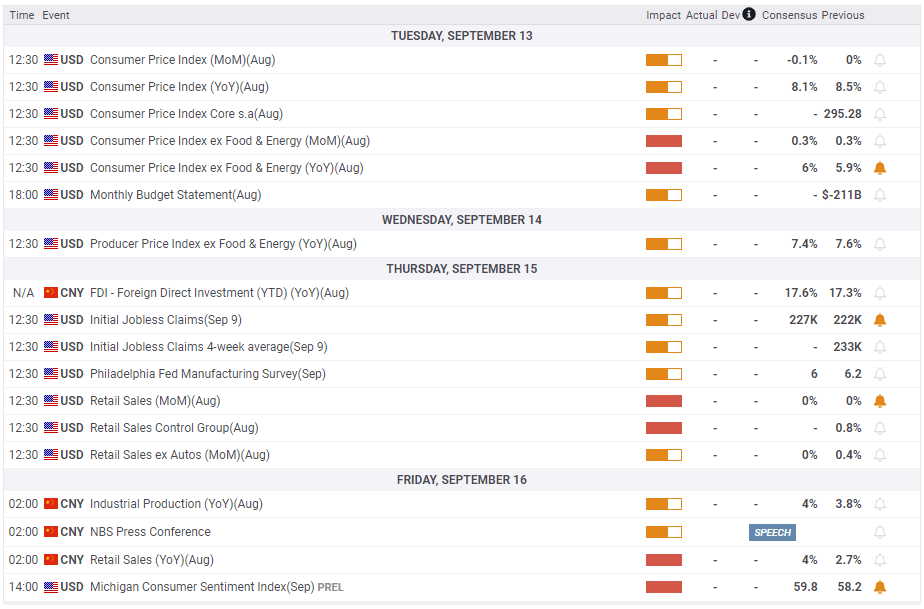

Event of the week for gold prices: US CPI data

The U.S. Bureau of Labor Statistics will release August Consumer Price Index (CPI) data on Tuesday. Expectations are for the CPI to decrease by 0.1% on a monthly basis. Core CPI, which excludes volatile food and energy prices, is expected to remain unchanged at 0.3%. FOMC policymakers declined to approve a 75 basis point rate hike in September. Therefore, it is possible for a soft inflation report to increase the probability of 50 basis points. The analyst continues:

In this scenario, US T-bond yields are likely to fall sharply, triggering a decisive rally below. On the other hand, stronger-than-expected CPI data may lead to a 75 basis point rate hike. This may not allow gold to return to the north. However, the markets have already acknowledged an extremely large increase. Therefore, it is worth noting that the potential gains of the dollar will likely be limited.

Thursday and Friday data are important for gold

August Retail Sales figures for the US economy will be released on Thursday. However, the analyst considers it highly unlikely that investors will react to this data, as they are not adjusted for price changes. On Friday, Industrial Production and Retail Sales data from China in August will be looked at to give new impetus. Both data are expected to reveal a stronger expansion than the one recorded in July. According to the analyst, if these numbers are disappointing, investors are likely to lose hope of a steady recovery in gold demand. Therefore, gold is likely to have difficulty finding demand.

Finally, the University of Michigan’s flash September Consumer Sentiment Index report will be released on Friday. Market participants are likely to pay attention to the long-term inflation expectations component of the survey rather than the Confidence Index heading. The analyst sees the decline in 5-10-year consumer inflation expectations as likely to damage the dollar. However, he notes that an unexpected increase will help strengthen the dollar and gain weight on gold prices.

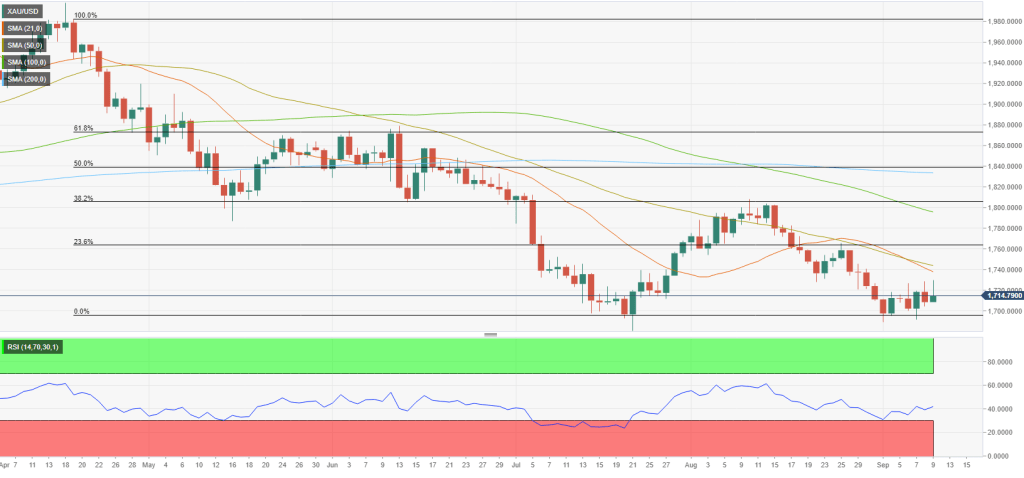

Gold prices technical view

After a quiet start to the past week, gold prices fell. However, it managed to stay afloat above $1,700. Gold extended its upward correction as the dollar faced heavy selling pressure ahead of the weekend. Accordingly, it hit a ten-day high near $1,730 on Friday. Still, gold prices failed to maintain their bullish momentum. Therefore, it closed the week with little change below $1,720. Market analyst Eren Sengezer analyzes the technical outlook for gold for the next week as follows.

Following this week’s indecisive price action, the short-term technical outlook for gold points to a neutral/bearish trend. The Relative Strength Index (RSI) indicator on the daily chart has not yet reached 50. This shows that although gold is struggling to gather bullish momentum, it has more correction room on the upside.

On the upside, $1,740 (20-day SMA, 50-day SMA) stands as key resistance. With a daily close above this level, additional gains towards $1,760 and $1,790 are possible. $1,700 remains intact as an important support. If gold falls below this level and starts using it as resistance, the bears will likely target $1,680 and $1,675.