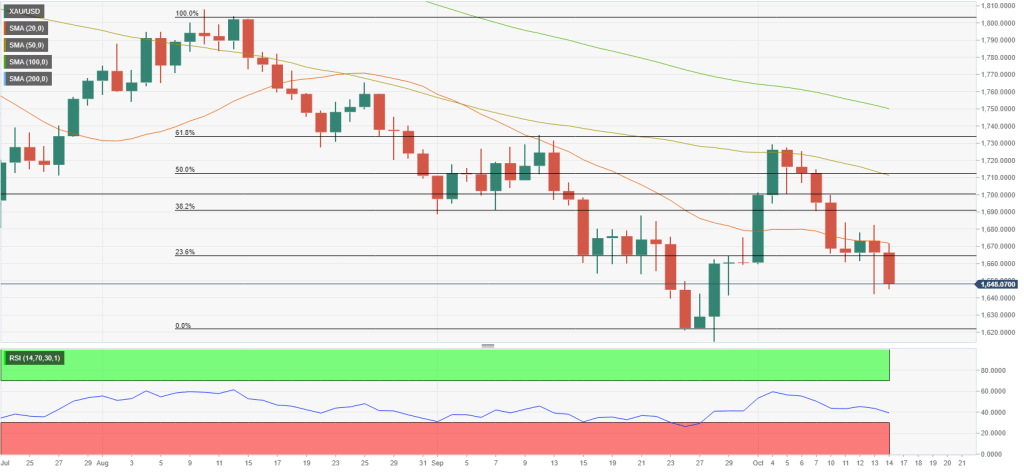

Market analyst Eren Şengezer notes that gold broke its two-week winning streak after the $1,700 support failed. Gold prices must stabilize above $1,670 to stave off the bearish pressure.

What will be on the agenda next week?

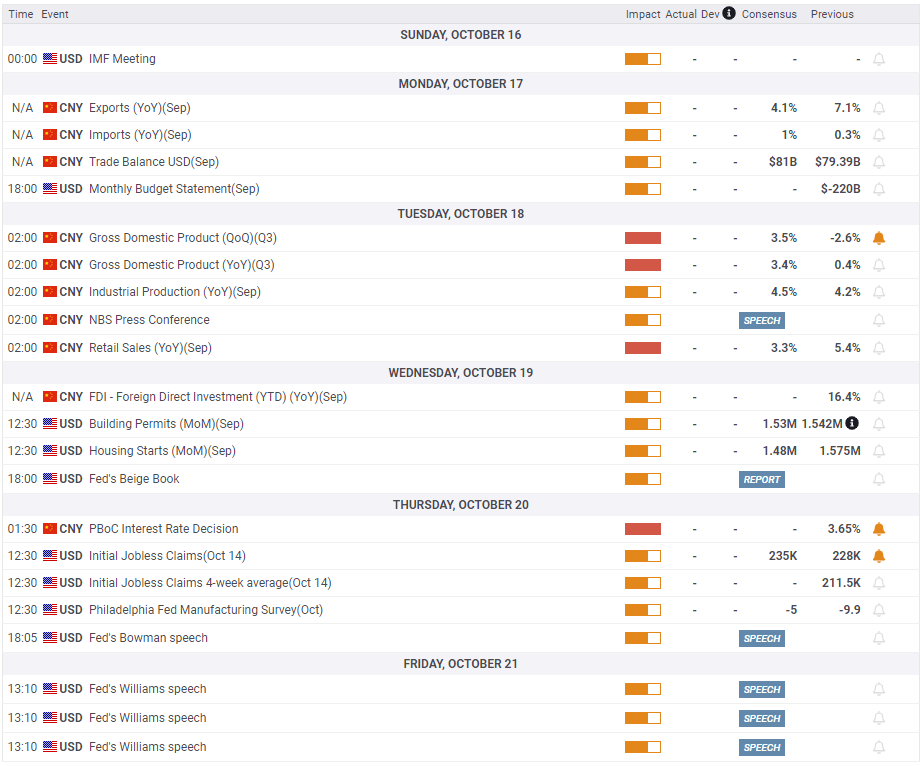

As you know, China is an important market for gold. Third quarter Gross Domestic Product (GDP) data for the country will be released on Tuesday. Forecasts are for the Chinese economy to grow at an annualized rate of 3.4% in the third quarter, after a dismal 0.2% growth in the second quarter. According to the analyst, if the GDP data comes below the market expectations, it is possible that gold will have difficulty in finding demand. The opposite is likely as well.

In dollar terms, on Wednesday, September Housing Starts will appear on the US economic calendar. That’s why Wednesday is important. The housing market suffers from rising interest rates. Also, FOMC policymakers are voicing their concerns about a “fix”. The analyst makes the following assessment:

A significant drop in these data will likely cause the dollar to weaken. It is possible that this will also help gold rise. September Existing Housing Sales will also arrive on Thursday. This will have a similar effect on the dollar.

There will be no other high-impact data releases from the US. Gold is likely to remain sensitive to fluctuations in US bond yields. Markets have already priced in another 75 bps rate hike by the Fed in November. That’s why the analyst says US yields don’t have much room on the upside. Therefore, according to the analyst, gold prices may see this as an opportunity to make a technical recovery/correction.

Gold prices technical outlook and gold sentiment survey

Market analyst Eren Şengezer analyzes the technical outlook of gold as follows. This week’s price action once again proves how important a $1,700 pivot point is for gold. After falling below this level at the beginning of the week, the yellow metal continued its decline. It slid to the $1,630 level before erasing some of its losses in the second half of the week. Thus, it marked the weakest level in two weeks. With this cryptocoin.com As you can follow, it lost more than 2% on a weekly basis. This resulted in him ending his two-week winning streak.

The Relative Strength Index (RSI) indicator on the daily chart has dropped below 50. Also, gold prices tested this level twice in the second half of the week. However, it failed to close above the 20-day SMA. This indicated a downward trend.

On the downside, $1,640, $1,620, and $1,600 hold as initial supports. If gold rises above $1,665, it is likely to face resistance near $1,670 where the 20-day SMA is located. A daily close above this level is likely to attract buyers. Besides, it is likely to open the door for a long recovery towards $1,690.

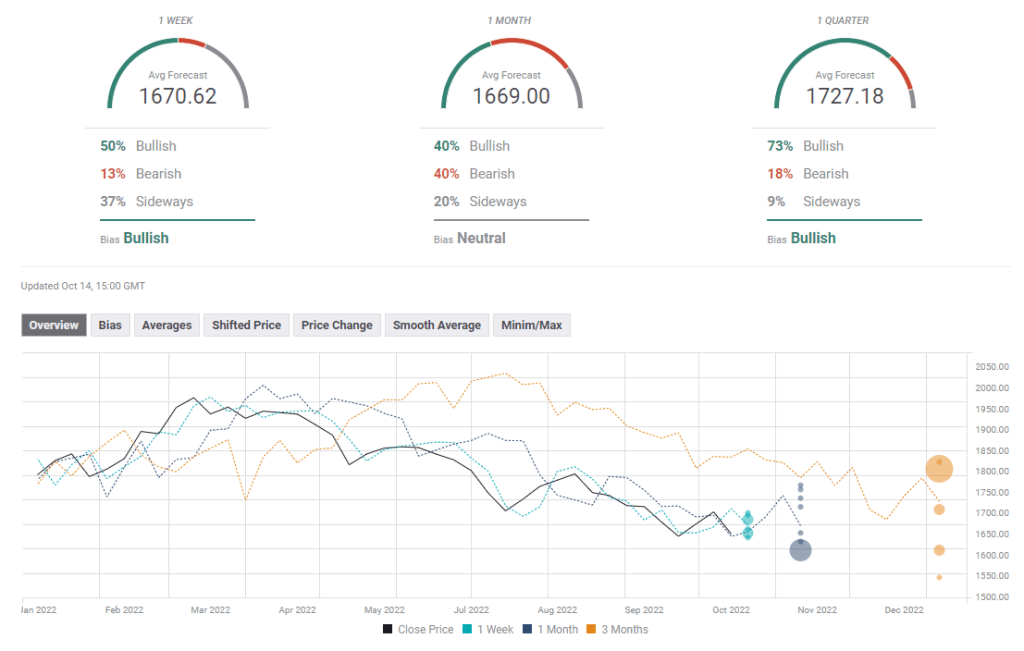

Half of the experts surveyed by FXStreet expect gold to rebound next week as the average one-week target aligns at $1,670. The one-month outlook paints a mixed picture. However, the quarterly outlook shows that the majority of experts forecast the yellow metal to be above $1,700 by the end of the year.