After the steady rise on Friday, the gold price climbed above $1,900, closing the fourth consecutive week in positive territory. Risk perception and the performance of US Treasury bond yields may drive gold’s movement next week as high-level macroeconomic data from the US is not released.

Gold price started the week with a rise

Dove Fed bets dominated financial markets at the beginning of the week, after data from the US showed that wage and input price inflation in the US softened in December. The inversely correlated gold price managed to boost Friday’s gains as the 10-year US Treasury yield fell to 3.5% on Monday.

Risk flows dominated financial markets on Tuesday, as Fed policymakers tried to push back expectations for a Fed policy pivot. By contrast, the US Dollar struggled to find demand and allowed gold to continue rising. With no high-impact data released on Wednesday, investors refrained from making big bets ahead of the highly anticipated US inflation data on Thursday.

US CPI continued to fall, gold crossed $1,900

cryptocoin.com As you follow, the US Bureau of Labor Statistics reported that the Consumer Price Index (CPI) fell from 7.1% in November to 6.5% in December, meeting the market expectations. On a monthly basis, CPI fell by 0.1%. In addition, the core CPI, which does not include volatile food and energy prices, increased by 0.3% in November, while the annual rate decreased to 5.7%. With the initial reaction, the US dollar came under heavy selling pressure and the gold price climbed above $1,900 on Thursday for the first time since May.

Meanwhile, Philadelphia Federal Reserve Chairman Patrick Harker and Atlanta Fed Chairman Raphael Bostic expressed their support for the Fed’s 25 basis points (bps) rate hike at the beginning of February, raising expectations for a slowdown in tightening. Following the CPI figures and the dovish Fed comments, the probability of a 25 basis point Fed rate hike has risen to over 90%. Thus, the 10-year US T-bond yield fell below 3.5% for the first time in three weeks, accelerating gold’s rally.

Ahead of the weekend, the University of Michigan (UoM) reported that its Consumer Confidence Index rose to 64.6 in early January from 59.7 in December. More importantly, the UoM said in its statement that “year-ahead inflation expectations fell from 4.4% in December to 4.0% in January, for the fourth month in a row.” With this report closing the door for recovery in US T-bond rates, the gold held its ground. Accordingly, the yellow metal gained about 2% on a weekly basis.

What will be on the agenda next week?

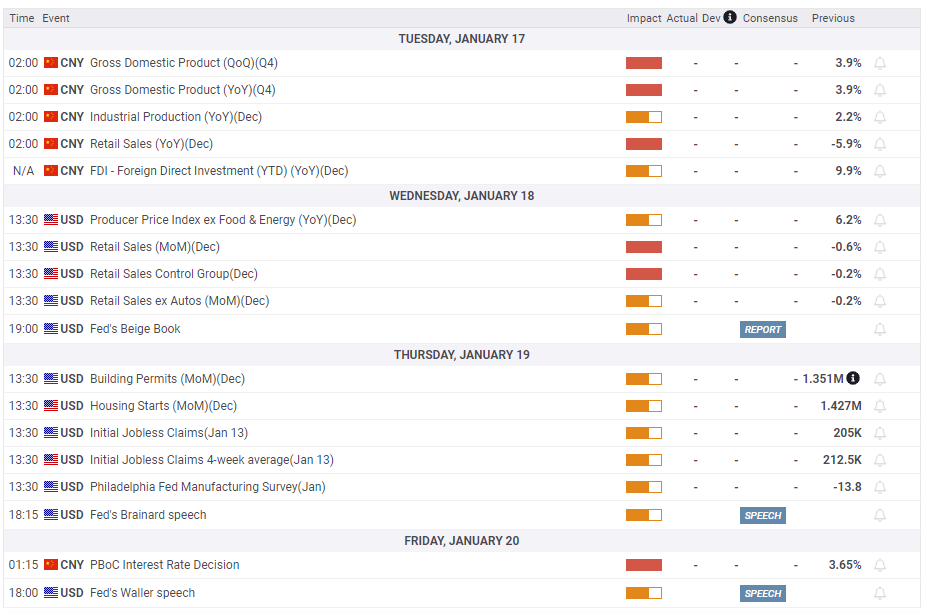

On Tuesday, the fourth quarter Gross Domestic Product (GDP) data from China and December’s Retail Sales and Industrial Production data will be watched closely by market participants. Better-than-expected economic performance in China, the world’s largest gold consumer, could help gold rise, according to market analyst Eren Şengezer. On the other hand, the potential negative impact of a disappointing GDP data will likely be short-lived given the increasing number of coronavirus infections in December.

The US economic chart will show December Retail Sales on Wednesday. Since this data is not adjusted for price changes, it is unlikely to have a noticeable impact on risk sensitivity or the valuation of the US Dollar. Next week, investors will also pay attention to fourth-quarter earnings numbers. Morgan Stanley, Goldman Sachs, and Netflix Inc. It is one of the noteworthy companies that will announce a profit next week. During the US trading hours, the performance of Wall Street’s major indices could provide a directional clue to the gold price. According to the analyst, an improving market mood could help gold maintain its balance. Naturally, the opposite is also true.

It’s also worth noting that 3.4% is aligned as key support for the 10-year US Treasury yield. In early December, the 10-year bond yield showed a strong recovery after testing this level. A similar move could trigger a downside correction in the gold price. On the other hand, a drop below 3.4% is likely to open the door to a prolonged decline in yields and provide support for gold.

Gold price technical view

Market analyst Eren Şengezer draws attention to the following levels in the technical outlook of gold. Gold’s near-term technical outlook points to overbought conditions, with the metal trading just above the ascending regression channel since early November and the daily Relative Strength Index (RSI) above 70. Therefore, the gold price may make a technical correction before expanding its uptrend.

On the downside, $1,880 (Fibonacci 61.8% retracement of the latest downtrend, midpoint of the ascending channel) aligns as initial support ahead of $1,860 (lower boundary of the ascending channel). Should the second support fail, gold could continue to decline towards $1,830, where the 20-day Simple Moving Average is located. If gold stabilizes above $1,900 and confirms this level as support, it is likely to target $1,920, $1,940 and $1,960, all of which are static levels from April 2022.

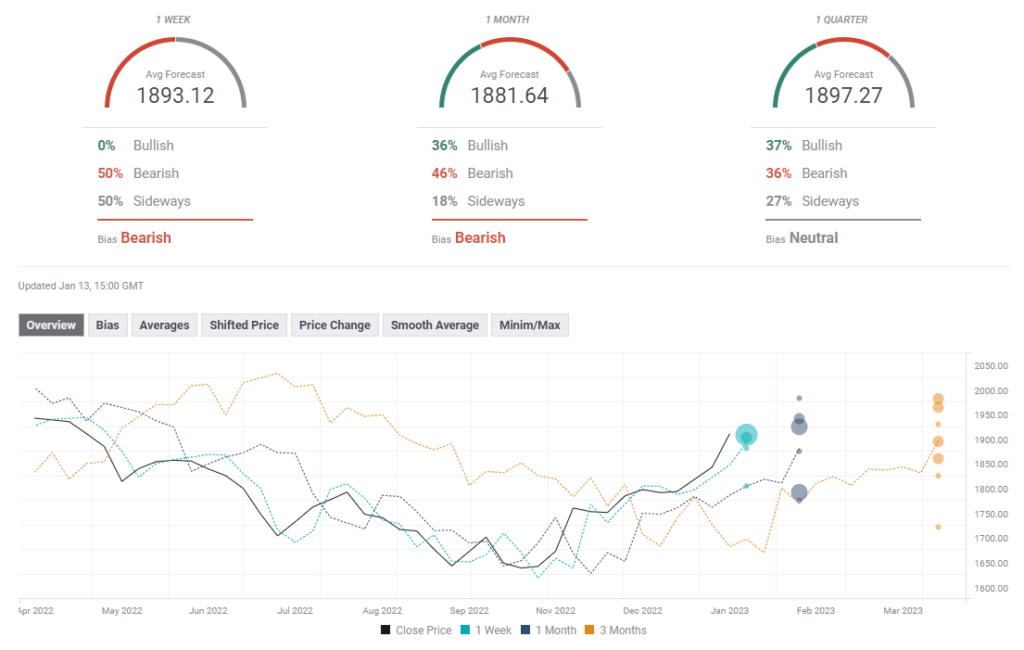

Gold price prediction survey

According to the FXStreet Forecast survey, experts do not expect the gold price to see significant increases next week. It also shows that the average target of the one-week view is $1,893. The one-month outlook paints a mixed picture.