Gold suffered heavy losses for the fifth week in a row. The yellow metal broke below $1,700 for the first time in nearly a year. Demand outlook for the yellow metal weakens amid US dollar strength and rising recession fears. This continues to put pressure on the gold price. Meanwhile, the Fed entered a period of blackout on July 16. What happened in the markets and what are the expectations? We have prepared it for our readers with the comments and analyzes of market analyst Eren Sengezer.

Gold price fluctuated wildly on Wednesday

Safe-haven flows dominated financial markets at the beginning of the week. China continues its quarantine to contain the spread of the Omicron sub-variant. Therefore, renewed concerns forced investors to take shelter. In Europe, the annual maintenance of the Nord Stream 1 Gas Pipeline has begun. On the other hand, it has revived fears that Russia is deliberately delaying its reopening to further reduce gas supplies to Europe. The dollar held firm on Monday and gold closed in negative territory.

Following Tuesday’s volatile market action, gold price moved wildly on Wednesday. US CPI increased by 9.1% YoY in June from 8.6% in May. Thus, inflation jumped to its highest level in forty years. In addition, this data exceeded the market expectation of 8.8%. cryptocoin.com As you follow, gold fell to $ 1,700 with the first reaction. However, America managed to rebound in the late session and posted small daily gains.

Horse’s price hits lowest level since August 2021

However, investors reassessed the interest rate outlook on the Fed’s hot inflation report. Therefore, the US dollar rally gained momentum on Thursday. Atlanta Fed President Raphael Bostic was asked if the FOMC would consider a full percentage point hike after the latest CPI figures. Bostic replied ‘everything is fine’.

CME Group’s FedWatch Tool showed that the probability of a 100 basis point rate hike in July rose to over 80% from 10% just a week ago. In contrast, the US Dollar Index (DXY) hit a nearly 20-year high above 109.00. The price of the horse, on the other hand, saw its lowest level since August 2021 at $ 1,697.

The probability of a 100 basis point increase in the Fed declines

Commenting on the latest market developments, Federal Reserve Chairman Christopher Waller argued that the markets may have outdone themselves by pricing a 100 basis point (bps) rate hike in July. Waller said he favored a 75 basis point increase in July. However, he added that if retail sales and housing data come in stronger than expected, it could be headed for a larger rate hike. Following these comments, the probability of a 100 basis point increase in July dropped to 50%. The USD then entered the consolidation phase, allowing gold to hold just over $1,700.

US Retail Sales came in on Friday. Sales rose 1% month-on-month to $680.6 billion in June. This data exceeded the market forecast of 0.8%. However, the US dollar continued to lose altitude. Bostic, which pointed to a 100 basis point gain just a day ago, changed its tone on Friday. Bostic said too dramatic a move could weaken the positive aspects of the economy and increase uncertainty. DXY extended its downward correction as the probability of a 100bps rate hike for July dropped to 30%.

Next week’s data agenda and its implications for gold

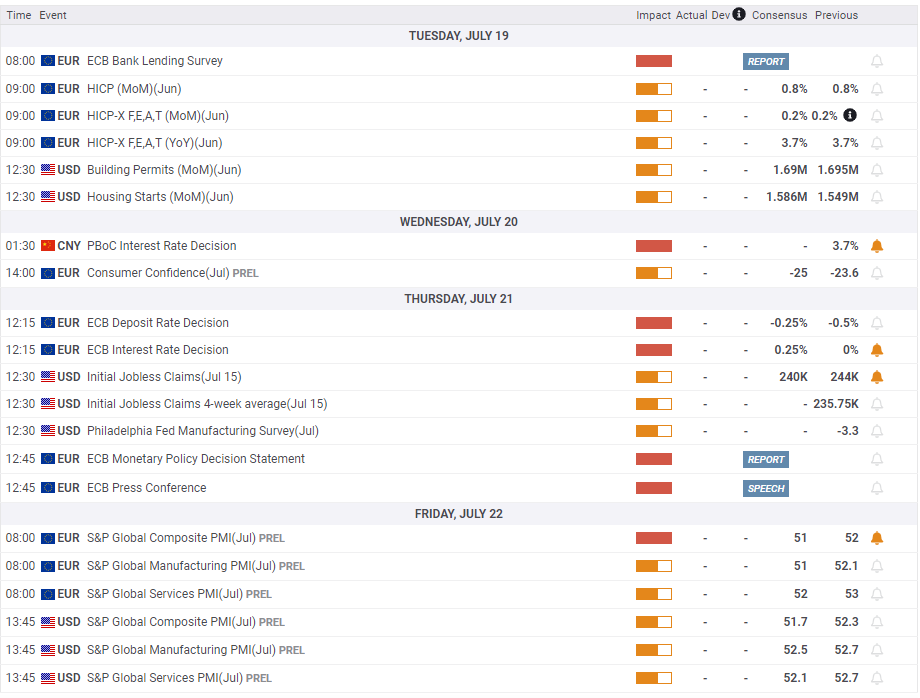

The US economic report will not include high-impact data releases earlier in the week. On Monday, market participants are likely to react to the NAHB Housing Market Index data for July, according to the analyst. The index is expected to rise from 67 to 68 in June. Policymakers pay close attention to housing market conditions. The analyst says a weak data will cause the US dollar to weaken. Naturally, the opposite is also true. On the same note, investors will examine Tuesday’s Housing Starts data for fresh momentum.

On Thursday, the European Central Bank (ECB) will announce its policy decisions. The bank is expected to raise interest rates by 25 basis points for September and signal a 50 basis point increase. The ECB continues to lag well behind the tightening curve. The US dollar could benefit from exits from the euro if the bank can’t convince markets it is ready to tighten its policy aggressively, he said.

On Friday, S&P Global will release its July Manufacturing and Services PMI preliminary reports. Investors expect business activity in the private sector to continue to expand at a modest pace. Should any of these PMIs drop below 50 and signal a contraction, the USD is likely to lag behind ahead of the weekend. In summary, the analyst makes the following assessment:

Investors will have only a few mid-range data releases to take into account when assessing the extent of the Fed’s rate hike in July. Therefore, gold may struggle to make a decisive move in either direction.

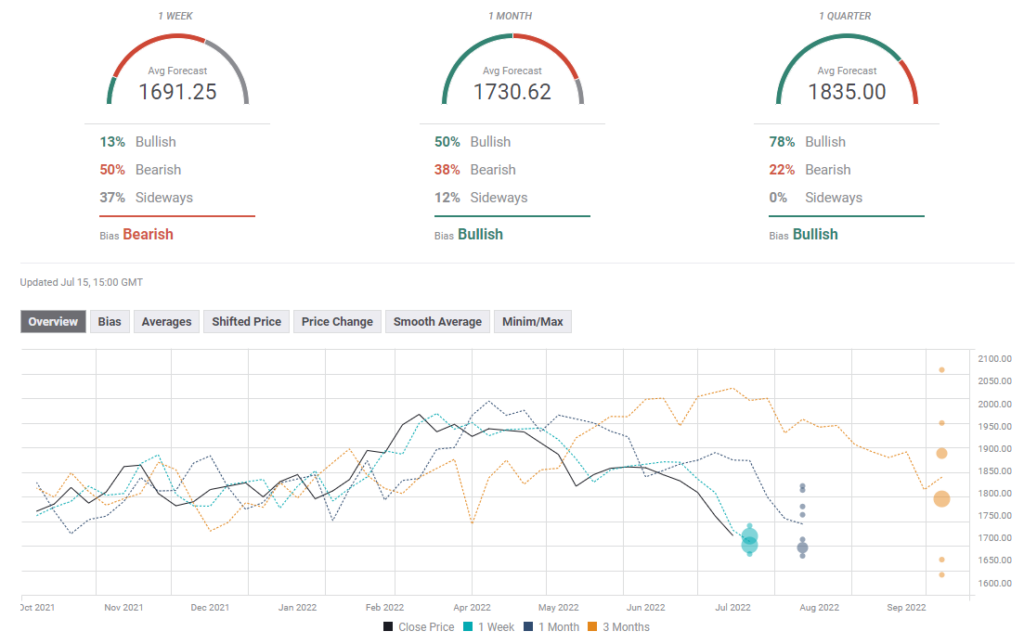

Gold price technical view and gold sentiment survey

Market analyst Eren Sengezer draws the technical picture of gold as follows. Data indicate that gold continues to be oversold. It also shows that the price is staying below the lower boundary of the long-term descending regression channel. Additionally, the Relative Strength Index (RSI) indicator on the daily chart remained below 30 for the 10th consecutive trading day on Friday.

$1,740 stands as the first resistance before $1,760 should gold make a technical correction next week. On the downside, additional losses towards $1,680 and $1,670 are likely if the sellers manage to turn $1,700 into the resistance.

Half of the experts in the FXstreet Forecast Survey predict that the gold price will be lower next week. However, the weekly average target of $1,691 is a sign that losses are expected to remain relatively limited. The one-month outlook paints a mixed picture, while the quarterly outlook is overwhelmingly bullish.