Yellow metal suffered heavy losses in the first half of the week. Gold prices fell to their weakest level since September 2021. Broad-based dollar strength amid rising recession fears and worsening demand outlook for the yellow metal has caused gold to close in negative territory for the fourth week in a row, according to market analyst Eren Sengezer.

Economic risks still on the table

In the absence of high-impact macroeconomic data releases, gold remained relatively quiet at the start of the week. It even closed almost unchanged on Monday. The Independence Day holiday in the US caused market action to remain calm throughout the day.

With American investors returning to the market on Tuesday, safe-haven flows began to dominate the markets. This provided support for the safe-haven dollar. Some reports see it as likely that China will begin imposing lockdowns in the face of rising coronavirus infections and the worsening global economic outlook. This greatly affected the market sentiment.

Kristalina Georgieva, Managing Director of the International Monetary Fund (IMF), said the global economy had ‘dimmed considerably’ since April. She also noted that given the increasing risks, they cannot rule out the possibility of a global recession next year.

India raises duty on gold imports: Negative in terms of demand

As it is known, India is the second largest gold consumer in the world. However, India has announced that it has increased the basic import duty on gold from 7.5% to 12.5%. This further blurred the demand outlook for gold. The World Gold Council, in its 2022 Gold Mid-Year Outlook, made the following assessment:

We expect a widespread economic slowdown that will suppress consumer demand for gold, especially given that domestic gold prices have risen significantly in many markets. High domestic inflation, uncertainty over the economic outlook, and a surprise increase in the gold import tax, partly aimed at mitigating the effects of rupee weakness, will likely weigh on the recovery of consumer demand for gold.

Fed’s hawkish tone remains decisive

By the way cryptocoin.com As you follow, the FOMC has released the minutes of its June policy meeting. It revealed that respondents agreed that high inflation requires restrictive interest rates. He also noted that there is a possibility of a more restrictive stance if inflation continues. On Wednesday, the ISM Services PMI survey results came in. Data indicated that business activity in the services sector continued to grow at a strong pace in June. However, it showed that the Employment component fell below 50, indicating a contraction in service sector employment.

Strengthened by the Fed’s hawkish tone and intense flight to safety, the US Dollar Index reached its highest level in nearly 20 years, above 107.00. This put pressure on gold prices and forced the yellow metal to take a step back.

On Friday, the U.S. Bureau of Labor Statistics (BLS) announced that Non-Farm Employment rose 372,000 in June, compared to the market forecast of 268,000. In the same period, annual wage inflation decreased from 5.3% to 5.1%. The Labor Force Participation Rate decreased from 62.3% to 62.2%. The dollar lost some strength after this report. However, gold prices failed to gain momentum amid rising US Treasury yields.

Is there any chance of recovery for gold prices?

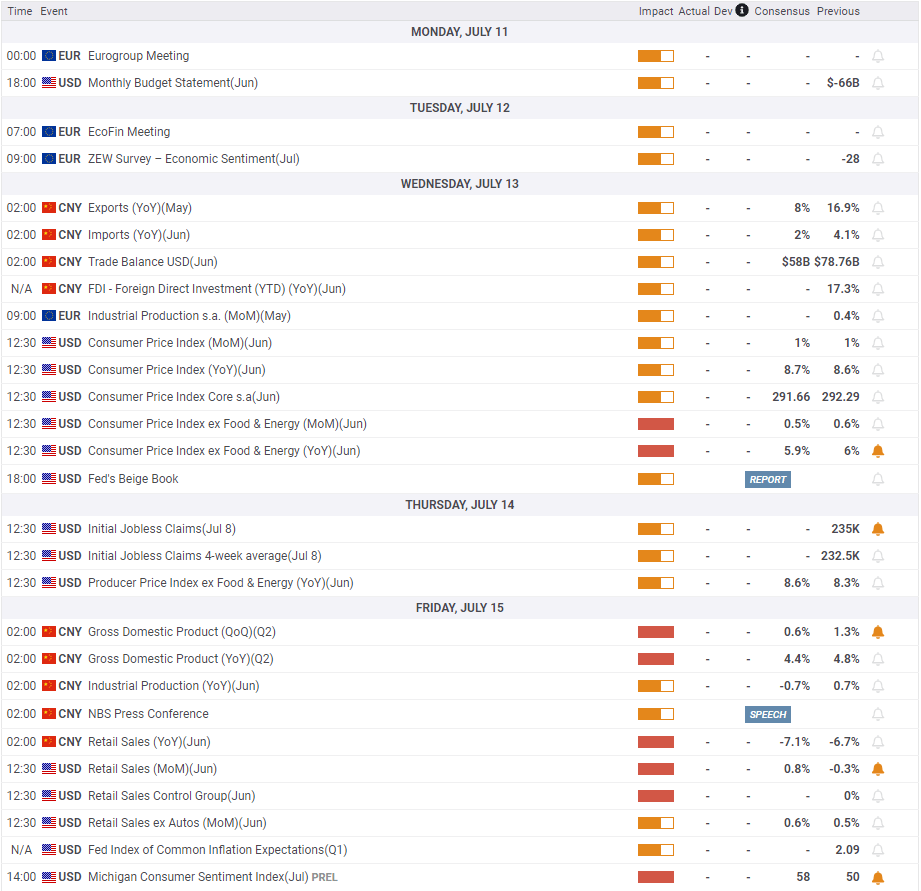

On Wednesday, the BLS will release June Consumer Price Index (CPI) data. Markets expect annual CPI to rise to 8.7% from 8.6% in May. Core CPI, which excludes volatile food and energy prices, is expected to decline from 6% to 5.9%.

Meanwhile, markets almost completely priced in a 75 basis points (bps) rate hike in July. Inflation figures are unlikely to change that. According to the FedWatch Tool, there is only a 30% probability of a 75 bps rate hike in September. The analyst interprets the issue as follows:

Therefore, there is room for additional strength for the dollar should inflation pressures exceed analysts’ forecasts. On the other hand, a soft inflation report is likely to trigger a downside correction in the dollar. It is possible that this will allow gold to make a recovery.

“The demand outlook for gold is not expected to improve in the near term”

Meanwhile, the Fed will release the Joint Inflation Expectations Index on Friday. Earlier in the week, Bloomberg reported that the Fed pays close attention to this indicator when setting monetary policy. Market pricing on the Fed’s rate outlook is likely to be affected by these data ahead of the weekend, according to the analyst. June Retail Sales data and the University of Michigan’s Consumer Sentiment Index for July will also be in the US economy on Friday. The analyst generally concludes:

In the current market environment, traders may struggle to find a good enough reason to bet on gold’s steady recovery. The demand outlook for gold is not expected to improve in the near term. Market participants are likely to avoid a risk rally. If inflation data from the US revive hopes of the Fed taking its foot off the accelerator in the last quarter of the year, it would not be surprising if gold reverses its direction. However, recovery attempts may be limited.

Gold prices technical outlook and gold sentiment survey

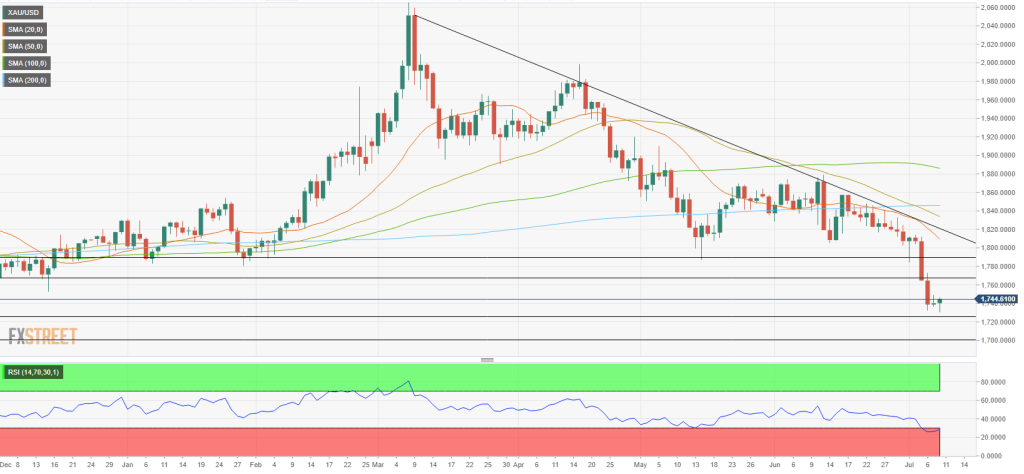

Market analyst Eren Sengezer illustrates the technical outlook for gold as follows. Following this week’s price action, the Relative Strength Index (RSI) indicator on the daily chart has dropped below 30 into the oversold zone. When the daily RSI last fell below it in August 2021, gold made a technical correction. Therefore, a similar transaction is likely in the short term.

On the upside, $1,765 is aligned as initial technical resistance ahead of $1,790. A daily close above the second level is likely to open the door for a long recovery towards $1,800, where the descending trendline from early March and the 20-day SMA are located.

However, as long as this level remains, sellers are likely to dominate gold’s action following the correction. On the downside, $1,730, $1,720, and $1,700 are forming temporary support ahead.

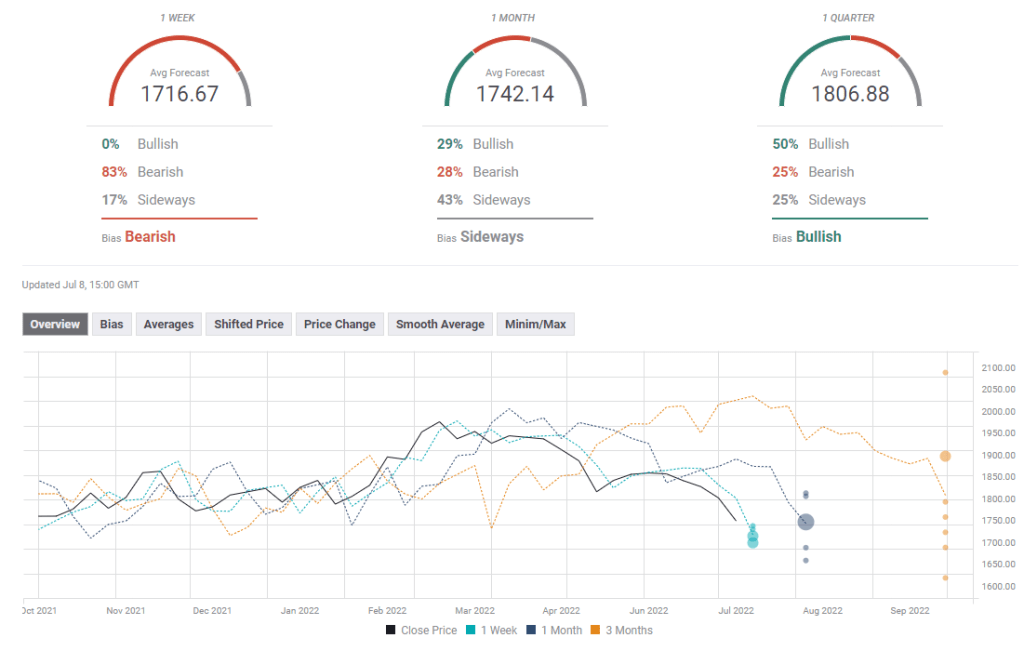

The FXStreet Forecast Survey shows that experts are overwhelmingly bearish on gold prices in the short term. He also notes that the average target in the one-week view is $1,716.