Gold prices erased some of their weekly gains on Friday as US Treasury yields gained momentum on better-than-expected labor market data. Gold remains on track to close higher for the third week in a row, but recent price action suggests that it may be difficult for the yellow metal to make decisive moves in either direction unless it breaks out of the $1,840 to $1,875 range, according to market analyst Eren Sengezer.

US interest rates rise after US data

Monthly data released by the US Bureau of Labor Statistics on Friday revealed that US Nonfarm Payrolls (NFP) rose 390,000 in May . This data exceeded the market forecast of 325,000. Additionally, April’s 428,000 data was revised to 436,000.

Further details of the report showed the Labor Force Participation Rate rose to 62.3% as expected and annual wage inflation fell to 5.2%, matching analysts’ forecasts. The benchmark 10-year US Treasury bond yield rose to 3% in the initial reaction to the optimistic employment report, causing gold to turn south after a two-day rally.

Next catalysts for gold prices

As we covered in Cryptokoin.com news on Thursday, CNBC Lael Brainard, Deputy Governor of the US Federal Reserve, stated that it was very difficult for him to see a pause in interest rate hikes in September. “We will certainly do whatever it takes to pull back inflation,” Brainard added, noting that the US economy still has a lot of momentum. The analyst assesses the impact of Brainard’s speech on the markets as follows:

These hawkish words failed to trigger a higher foot in US Treasury yields and allowed gold to continue trading in the upper half of its weekly range on Thursday.

Next week, the European Central Bank (ECB) will announce its interest rate decision and publish monetary policy documents. The ECB is expected to raise the policy rate by 25 basis points (bps) in July. On the other hand, several ECB policymakers have said over the past few weeks that the bank may need to start considering 50 basis point hikes to rein in inflation. Eren Sengezer interprets the effects of the developments on the ECB side on gold prices as follows:

In the European economy, the signs that the growth momentum is lost put the central bank in a difficult situation. Should the ECB announce a hawkish rate outlook, XAU/EUR could come under heavy bearish pressure and cause XAU/USD to drop as well. However, the market valuation of the dollar will also be adversely affected in this scenario, helping gold to limit its losses.

Next Friday, the BLS will release May inflation data. On an annual basis, the Consumer Price Index (CPI) is expected to fall to 8.2% from 8.3% in April. According to the analyst, the market reaction to inflation data will be that a lower-than-expected CPI data will put pressure on US T-bond rates and provide a support for gold. Analyst, the reverse is also true.

Gold prices technical view

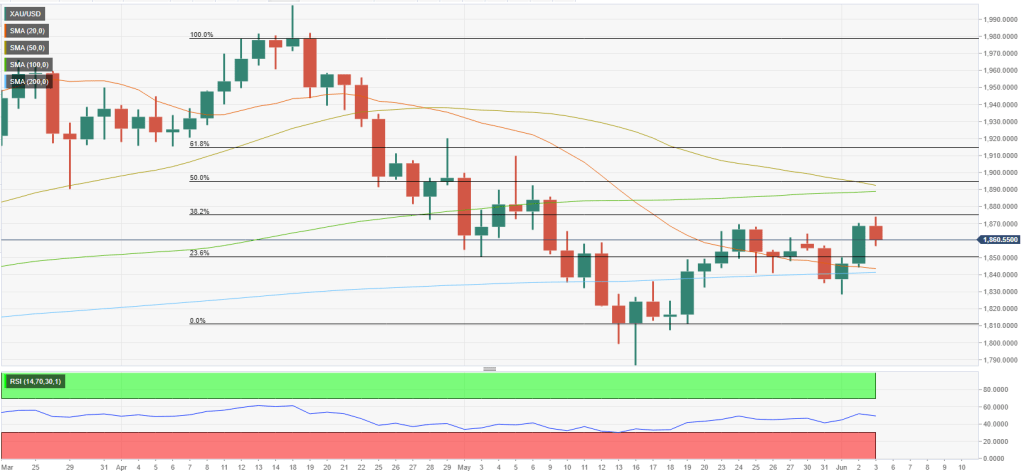

According to market analyst Eren Sengezer, gold prices seem to have entered the consolidation phase with the Relative Strength Index (RSI) indicator moving sideways near 50 on the daily chart. .

While gold was able to close above the 200-day SMA for two days, Fibonacci noted that the 3.2% retracement of the latest downtrend appears to have formed hard resistance at $1,875. states. The analyst draws attention to the following levels:

With a daily close above this level, gold can target the $1,890/1,900 area and then $1,915. On the downside, $1,850 is aligned as temporary support before $1,840. Should the latter turn into resistance, this could be seen as a significant bearish development and could attract sellers. In this scenario, additional losses could be seen towards $1,830.

In summary, the analyst emphasizes that gold must exceed the $1,875-1,840 range to determine its next short-term direction.