HashKey, a licensed cryptocurrency exchange based in Hong Kong, is facing wash trading allegations as its 24-hour trading volume increased to $4.8 billion, approaching the levels of industry giant Binance. CoinGecko data revealed a significant increase, raising concerns about the legitimacy of trading activity on the platform. Here are the details…

Concerns have increased for the cryptocurrency exchange

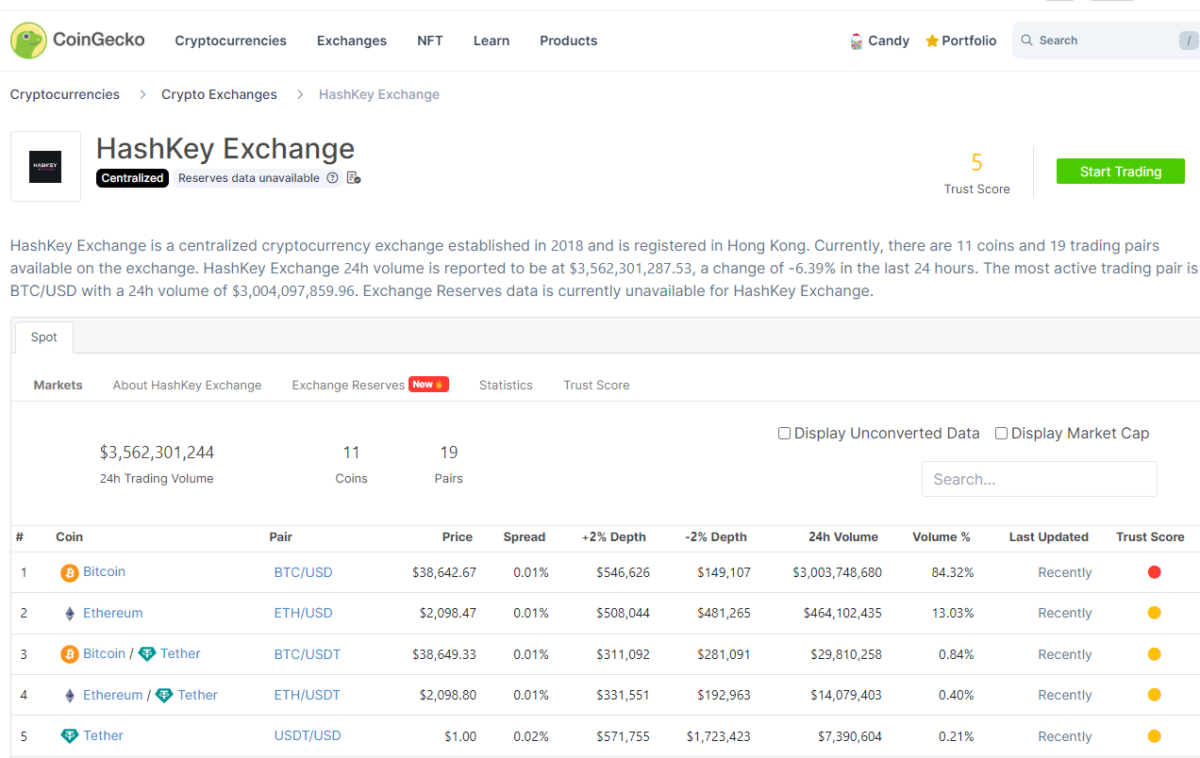

Recent data from CoinGecko highlighted HashKey Exchange’s trading activity, showing that 24-hour trading volume increased to $4.8 billion. This significant increase has raised eyebrows in the cryptocurrency community, especially when compared to daily trading volume of less than $1 billion over the past week. The distribution of trading volume shows a significant portion of $3.4 billion coming from the BTC/USD pair, while the Ethereum pair contributed $617 million. The third largest pair, BTC/USDT, recorded a volume of $43 million. Such rapid and significant growth led to suspicions of wash trading.

And questioned whether such wash behavior is within the scope prohibited by the Hong Kong SFC. CoinGecko also gave Hashkey a highly untrustworthy BTC/USD ETH/USD trust score.

— Wu Blockchain (@WuBlockchain) December 1, 2023

Wu Blockchain, a prominent name in the cryptocurrency space, questioned whether the increase in trading volume on HashKey was linked to wash trading practices by market makers aiming to make platform coins. Concerns have also been raised about the compliance of such conduct with the scope of what is prohibited by the Hong Kong Securities and Futures Commission (SFC). CoinGecko, a widely used cryptocurrency market data provider, assigned HashKey a highly unreliable trust score for the BTC/USD and ETH/USD trading pairs. These developments point to potential irregularities that could attract regulatory scrutiny.

Some details about HashKey

HashKey Exchange, part of HashKey Group, entered the market in August this year. Demonstrated compliance with regulatory requirements by obtaining a cryptocurrency license in Hong Kong. The exchange offers fiat deposit and withdrawal services, retail trading pairs. It also says it has a secure storage system. However, recent wash trading allegations have cast a shadow over the credibility of the exchange. It has prompted industry participants to closely monitor developments and the reactions of regulators.

Wash trading is a deceptive trading practice in which an individual or organization artificially inflates trading volume by repeatedly buying and selling a financial asset to create the appearance of significant market activity. In trading transactions, the same person or organization essentially deals with themselves by placing buy and sell orders without any change in their ownership or economic interests. The primary purpose of this is to manipulate the perceived liquidity and trading activity of an asset.