The Bitcoin and altcoin market has had a tough time in the past few weeks. Bitcoin’s value has dropped below the $28,000 support price. As a result, Altcoins suffered greater losses. However, there is a possibility that the market may reach a critical point right now. You are probably thinking of investing in altcoins before the new year starts in 2023. We have compiled a list of the top 5 Altcoins to buy in June 2023.

Top 5 altcoins for June

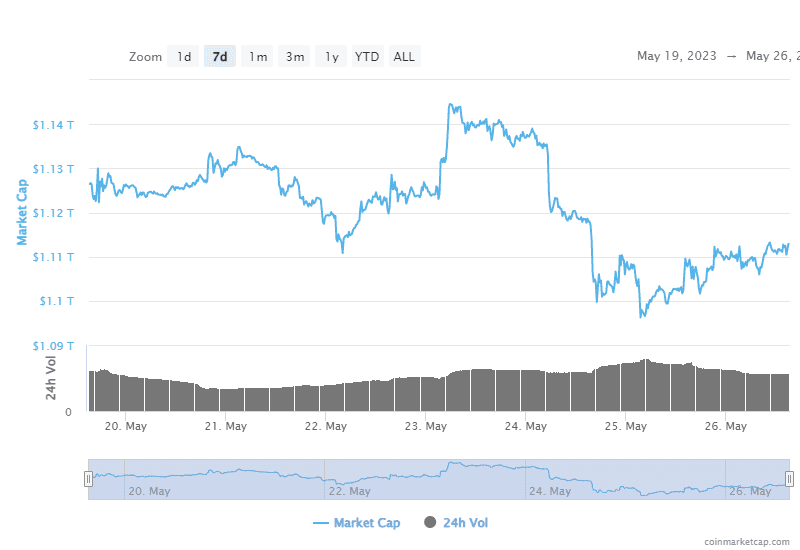

cryptocoin.com As we mentioned above, the crypto market experienced a slight decline in the past week. Accordingly, the decline caused the total market value to decline from $1.122 trillion to $1.112 trillion. GMX, SUI and FTM were among the top losing altcoins. GMX suffered a significant 15% drop. On the other hand, it was followed by SUI with a decrease of 13% and FTM with a decrease of 10%. These fluctuations in prices are associated with a number of factors, including market sentiment, regulatory developments and investor behavior.

The first cryptocurrency is Cardano (ADA). Altcoin ADA price has performed well so far in 2023. It has gained more than 50% in value since the beginning of the year. Cardano will likely benefit from technical innovations such as the Vasil update in September 2022. In the coming weeks, the positive trend in ADA price is likely to continue. A possible Altcoin bull run will increase the price by 20% or more.

XRP and Tron

The XRP price has performed stronger in the last few weeks compared to the beginning of the year. This is due to the growing optimism of the community regarding a possible decision in Ripple’s legal dispute with the SEC. A possible altcoin bull run will cause the XRP price to rise sharply. Therefore, in the long run, XRP carries a higher risk due to the uncertainty of regulation by US authorities. However, we can see a bullish trend in the coming weeks. On the other hand, Tron or TRX token, which is among the top 10 cryptocurrencies, has seen strong increases recently. Over the past few days, we’ve seen TRX rise by more than 10%. Other altcoins have made little gains in this regard. This trend could continue in the coming weeks, making Tron the third best altcoin to buy for June 2023.

Other cryptocurrencies

June 2023 presents a favorable time for investors to consider MATIC as a potentially profitable investment. One of the most important factors that makes MATIC an attractive investment tool is its price, which is well below its value. Despite its enormous potential, MATIC is trading at a relatively lower price. This makes it an attractive option for those looking for undervalued assets in the crypto market. In addition, the continued use of the Polygon network by leading companies in the web3 space further strengthens MATIC’s position.

As these companies continue to adopt and use the Polygon network, it will potentially increase its price, increasing the utility and demand for MATIC tokens. With the likely bull run, many analysts and experts expect significant growth in MATIC price. In addition, this situation reveals that it will become an attractive choice for investors looking for higher returns. However, as with any investment, it is necessary to conduct extensive research before making an investment decision. Therefore, it is important to consider several factors.

Increase expectation for Altcoin Stellar

XLM (Stellar Lumens) is currently trading below 10 cents. It offers an interesting investment opportunity as it continues to be below its value. This low price point positions XLM as an attractive option for investors seeking potential growth in the cryptocurrency market. Moreover, XLM’s price is closely tied to Ripple’s developments. Also, Ripple’s recent legal victory over the SEC has the potential to positively impact the price of XLM in the upcoming bull run. As Ripple’s partner and a major player in the cross-border payments industry, Stellar continues to benefit from Ripple’s success. There is increased credibility and renewed market confidence in Ripple’s legal transactions. This potentially leads to a domino effect. In this context, there is a possibility that this will benefit XLM’s price performance.