The Ethereum merge will be completed in about 48 hours. The expectation is quite high as it has been an expected event since 2015. However, as the historic upswing draws to a close, altcoin investors are taking positions to short.

Latest version of Ethereum before Merge, leading altcoin shorting

Less than 2 days left until the completion of the Ethereum rise. The current difficulty is 58617786 P and the hash rate is 857 TerraHashes/sec. The final merge upgrade Paris will be released when the total terminal difficulty reaches P 58750000. At the current hash rate, Ethereum will reach the milestone in 1 day and 19 hours. Many predict that Ethereum’s price will rally after the merger. Crypto investors are taking action against Ethereum to fail the upgrade.

The merge is still expected to happen around Sep 13-15. What's happening today is the Bellatrix hard fork, which *prepares* the chain for the merge. Still important though – make sure to update your clients!

— vitalik.eth (@VitalikButerin) September 6, 2022

Which direction are crypto investors positioning before the merger?

Reports highlight that investors are shorting Ethereum in the derivatives market. The funding rate of perpetual contracts for Ethereum has reached its highest negative value since July 2021. Perpetual contracts do not expire, instead they use funding rates to maintain leveraged position.

Perpetual contracts allow investors to trade an asset for its price without actually owning it. Funding rates ensure that the price of that asset in a perpetual contract depends on the asset’s actual price in the market. Funding rates are negative when there is tremendous interest in a short position. In such a scenario, short trades pay interest to long positions and vice versa.

Meanwhile, Ethereum’s high negative value reveals that investors are extremely interested in unleashing ETH.

Why are altcoin investors shorting Ethereum?

According to Ledger Prime’s Zaheer Ebtikar, the short request may not be due to an Ethereum merge failure. The expert says that many investors hold long positions on Ethereum in the spot market. Being a short ETH position in the derivatives market is a way to hedge risks.

Investors should also take into account the technical difficulty of rising. Merge will change Ethereum’s consensus mechanism from PoW to PoS. The task requires a lot of technical rigor. If something goes wrong, the downside momentum is very high for Ethereum price. However, every support in this direction, especially $1,500, is vital. Developers and investors will be on their toes for a while until the merge is complete.

Ethereum price predictions

Crypto analyst Justin Bennett also shared his view on the appreciation of Ethereum in recent days. In his latest tweet, Bennett warns the community against the volatility imposed by the Fed. This is because the next Federal Open Market Committee (FOMC) meeting is scheduled for September 20-21, which kicked off historically short-term volatility among crypto assets, including Ethereum.

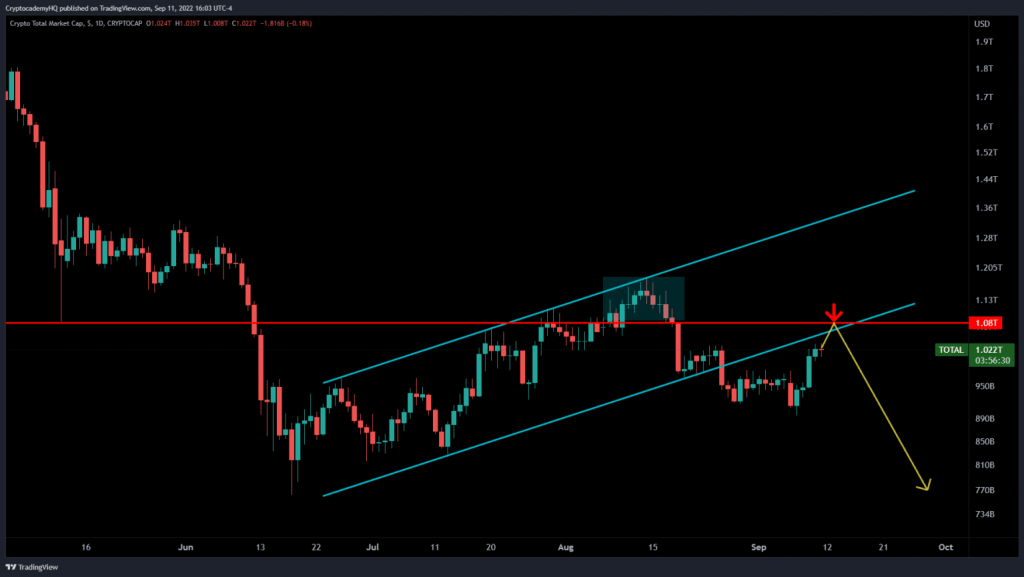

According to his analysis, the crypto market sits 5% below a “major resistance area.” It will also likely see another rise before the “next drop”. cryptocoin.com As you follow, Ethereum is currently trading around $1,600. Especially today, it lost around 8% of its value.