Avalanche (AVAX) testing a critical support point at $ 19, while the market uncertainty continues. Avax, which moves in a symmetrical triangular formation in a 4 -hour graph, may face the risk of decrease if it cannot perform a upward break.

What does the current movement of Avalanche (Avax) say?

Currently traded for $ 19,56, AVAX said that 0.20 %increased in the last 24 hours. However, price movements give signals of uncertainty as to whether this level can be protected.

The AVAX price tests the 19 dollar level, which has been a powerful support. The symmetrical triangular formation shows that there is an instability between buyers and sellers.

If AVAX can exceed the upper limit of the triangle, it may experience a short -term rise. However, if this support level is lost, the price may decline further and a deeper correction may be seen.

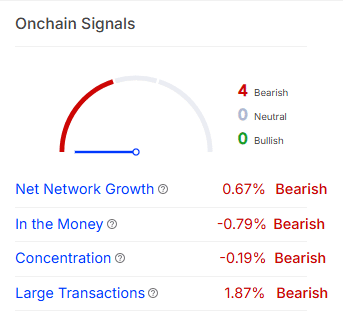

On-se data gives signals of decrease

When AVAX’s on-Chain data is examined, the overall appearance tends to decline. The network growth rate shows a slight decrease with -0.67 %, which indicates that the activity on the network is reduced.

Furthermore, the “In The Money” mistress, which shows whether investors were in the snow, decreased by -0.79 %, ie the number of investors in the snow decreased. However, large transactions have decreased by -1.87 %, which shows that large investors did not show much interest in the market.

These data suggest that it does not have a strong rise momentum and it may be difficult to maintain Avax’s support level.

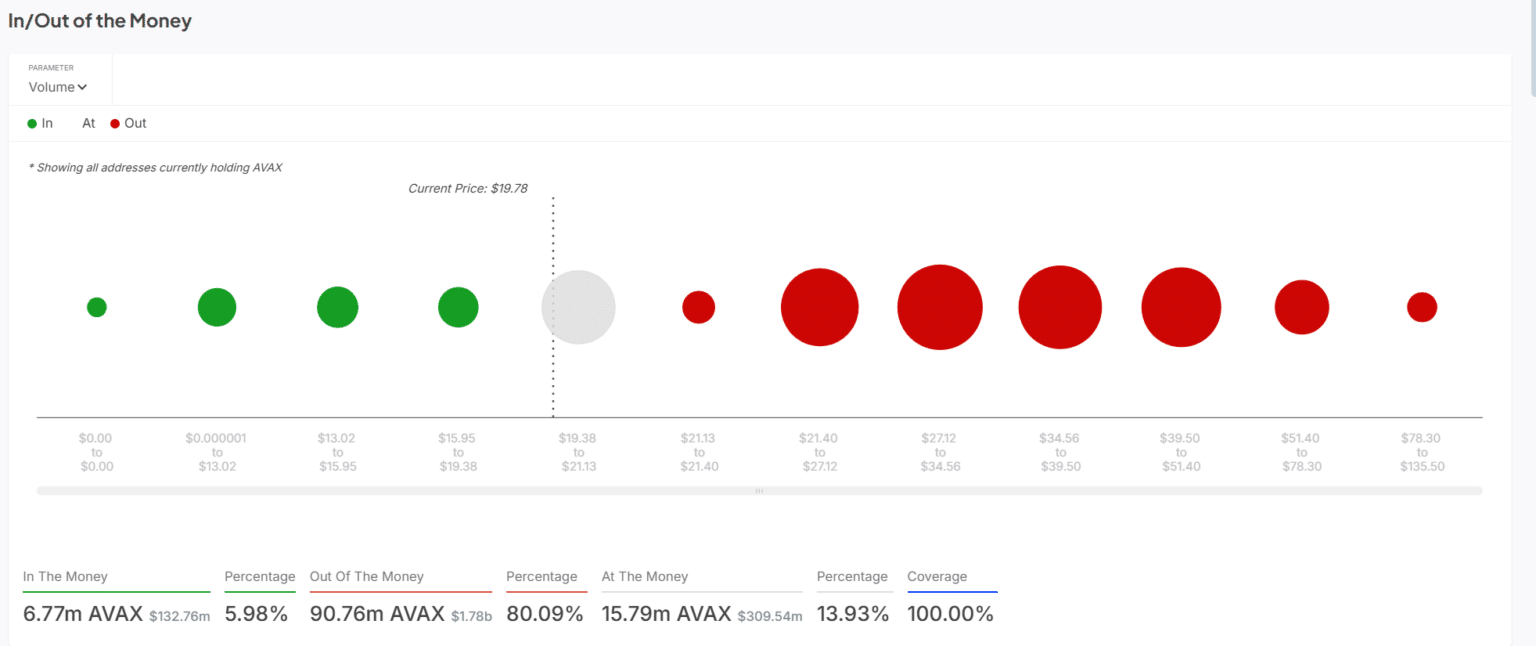

How does the rate of investor rates in snow and loss affect the price?

The top -of -chain data reinforces the decline tendency on Avax. Currently, 80.09 %of the addresses holding AVAX are in loss. Only 5.98 %of the current price levels in profit.

This shows that many investors are damaged and that sales pressure may increase if the price goes below 19 dollars. If it cannot maintain the current level, AVAX may face the risk of further drop.

Will the Avalanche price maintain $ 19 in March 2025?

We are at a critical turn for AVAX and the next hours can be decisive for price movement. Considering the symmetrical triangular formation and over -chain data, the possibility of decrease seems more dominant. Due to the sales pressure in the market and the majority of investors are at loss, AVAX is likely to decrease if AVAX lost $ 19 support.

Kriptokoin.comAs we mentioned, one of the factors that strengthened the sales pressure was to evacuate AVAX stocks.