Standing out with its data in the crypto money market, CoinShares shared weekly statistics for various altcoins. Accordingly, institutional investors sold AVAX and TRON. On the other hand, he bought XRP, Cardano and “short” Bitcoin. Here are the details…

Institutions AVAX sold TRON

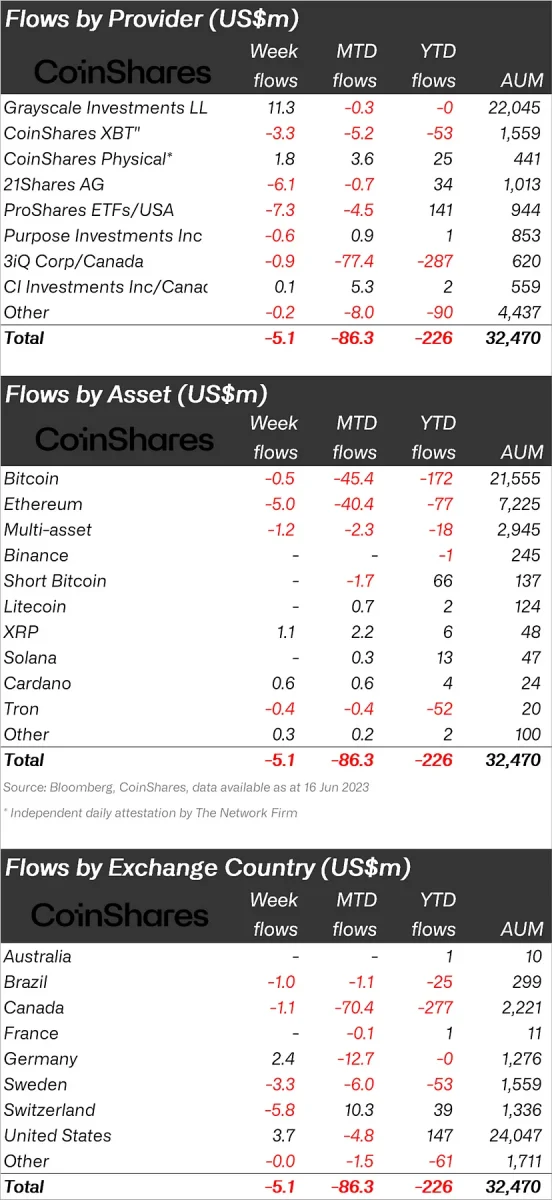

Crypto-asset investment products saw small outflows of $5.1 million last week. However, towards the end of the week, some positive news came as one of the world’s largest asset managers applied for a Bitcoin Exchange Traded Product (ETP) in the United States. This announcement led to minor entries, though not enough to completely offset the earlier exits. As a result, the industry recorded its ninth consecutive weekly exit with a total of $423 million.

In terms of regional trends, small inflows of $3.7 million and $2.4 million were seen in the United States and Germany, respectively. Considering the year-to-date total, the United States continues to be at the forefront with inflows of $147 million. On the other hand, there was an outflow of 277 million dollars in Canada. Despite regulatory improvements in Hong Kong, there has been no significant flow of funds to ETPs so far this year. Also, total assets under management (AuM) in Hong Kong’s crypto-asset investment products remains low at just $39 million.

Biggest exits seen since FTX

The drop in altcoin prices in the previous week prompted investors to increase their positions, resulting in $2.4 million in inflows. Notably, XRP, Cardano, and Polygon were the main focus of these entries, receiving $1 million, $0.6 million, and $0.2 million, respectively. Among individual cryptocurrencies, Ethereum experienced the biggest outflows, with a total of $5 million leaving the platform. Tron and Avalanche also faced exits of $0.4 million each. In the blockchain equities industry, outflows reached their highest level since the FTX bankruptcy, amounting to $12.3 million. This development signals some caution among investors in the blockchain stock market.

Recent fluctuations in crypto-asset investment products and related industries highlight the volatility and uncertainty that continues to characterize the cryptocurrency market. Despite positive regulatory developments in certain regions, it remains important for investors to carefully assess the risks associated with these investments and closely monitor the market for potential opportunities.