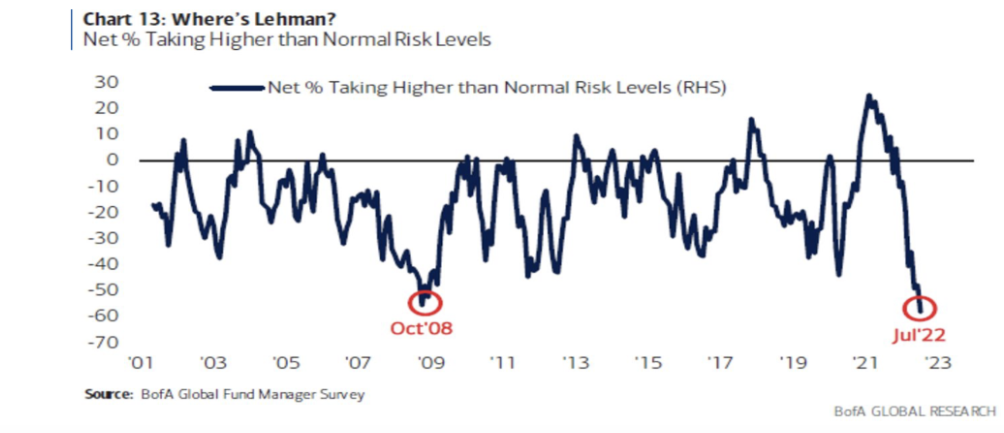

An old Wall Street mantra says when investors collectively feel worse and hold cash, most of the price drop has already happened. Then, selling stalls, eventually paving the way for a new bull run.

Bank of America’s monthly fund manager survey, conducted between July 8 and July 15, shows dire levels of investor pessimism and increased preference for cash. And bitcoin (BTC) is showing signs of life along with stocks. The leading cryptocurrency by market value peeped above $24,000 early today, claiming the highest price since June 13.

However, crypto market pundits are divided on whether extreme negative sentiment implies a bear market bottom and a renewed bull run in risk assets, including bitcoin.

Bank of America’s survey, which included 259 participants with $722 billion under management, showed fund managers’ allocation to stocks plunged to the lowest since October 2008, while cash holdings surged to a 21-year high of 6.1% from 5.6% a month ago, pushing risk exposure below levels seen following the crash of Lehman Brothers in 2008.

Further, long U.S. dollar, long oil and short stocks were crowded trades alongside persistent fear of stagflation and increased expectations for an economic recession. What’s more, BofA’s Bull and Bear Indicator remained “max bearish”.

According to liquidity provider Folkvang Trading’s CIO Jeff Anderson, the survey result indicating extreme pessimism and defensive positioning in safe havens like the dollar is a contrary indicator – the one that tells you it might be a good time to step away from the herd and invest in risky assets.

“It’s a case of overstretched positions in thin, illiquid markets which yields bad data, good price,” Anderson said.

Chart shows extreme caution on part of investors. (Bank of America)

The bad news is increasingly becoming good news for markets. Both stocks and bitcoin have found a footing in the past seven days. The dollar has come under pressure as recession fears and the drop in commodity prices have eased inflation concerns and the possibility of bigger and faster rate hikes by the Federal Reserve (Fed). The dollar index, which tracks the greenback’s value, against major fiat currencies, has dropped 2.6% to 106.94 since July 14.

However, Dick Lo, founder and CEO of TDX Strategies, said, “the BofA survey results are consistent with the backdrop of rampant inflation and monetary policy tightening across the globe, and so extreme pessimism can prevail for a prolonged period before the market bottoms out.”

Lo warned that the ongoing bounce in risk assets is counter-cyclical and could be fleeting given the macro overhang and favored downside protection strategies like hedging long positions with a put option offering insurance against price drops.

And Lo may be right. While the recent decline in energy and commodity prices may pull down inflation, the Fed is unlikely to ditch its hawkish stance unless there is a marked decline in inflation metrics.

According to BofA’s survey, the core personal consumption expenditure price index (core PCE, the Fed’s preferred inflation gauge, needs to drop below 4% for the central bank to turn dovish. The core PCE stood at 6.3% on a yearly basis in May.

Further, the central bank may want to see a marked decline in the headline consumer price index (CPI), which includes the volatile food and energy component, before pulling the plug on policy tightening. The spending habits of the so-called main street, representing average Americans, are more sensitive to the changes in the headline CPI.

Ipek Ozkardeskaya, a senior analyst at Swissquote Bank, said record pessimism might be a contrary indicator; however, corporate earnings will likely have the final say in determining how pessimistic the market has become compared to the economic reality.

In other words, risk appetite could return if corporate earnings show underlying strength in the world’s largest economy. According to FactSet data quoted by Market Watch, about 10% of the S&P 500 companies have reported earnings so far this quarter, and 69% of those have topped analyst expectations.