A cryptocurrency company backed by Singapore-based investment firm Temasek is in danger of ‘bankruptcy’ as it secretly started laying off hundreds of people since December. The latest statement came from a senior executive of the company.

Cryptocurrency company amid bankruptcy rumors made a statement

A senior executive of Temasek-backed cryptocurrency platform Amber Group said that “business as usual” after the bankruptcy claims were published. The bankruptcy allegations were the subject of tweets from Chinese blockchain researcher Wu Blockchain today. In particular, Wu reposted his tweets about the Amber Group back in September, writing:

After laying off around 30-40% in September, Temasek’s invested Amber Group started laying off hundreds of people again in December, asking Chinese employees to work from home and vacate their offices, according to former employees.

After layoffs of about 30%-40% in September, the Amber Group invested by Temasek began to lay off hundreds of people again in December, and asked Chinese employees to work from home and clear their offices, according to former employees. Exclusive https://t.co/bmKMvuQtr8

— Wu Blockchain (@WuBlockchain) December 6, 2022

Lookonchain: Amber Group appears to be on the verge of bankruptcy

This claim came from the Twitter account of analytics platform Lookonchain, which added to Wu Blockchain’s tweet. Later, a senior executive from Amber Group replied to the tweet to bring clarity to the allegations. Lookonchain says they only have $9.4 million left, in a tweet where the executive said “everything’s fine”:

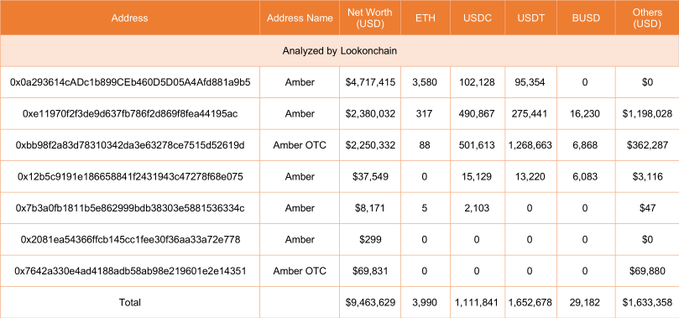

Amber Group appears to be on the verge of bankruptcy. We analyzed Amber’s 6 Ethereum wallets and found: – $9.46 million in total. Amber transferred ~36 million BUSD to Paxos and 10,422 ETH ($13.12 million) to a new address.

1/ @ambergroup_io appears to be on the verge of bankruptcy.

We analyzed 6 Ethereum wallets of Amber and found:

– $9.46M assets in total.

– Amber transferred ~36M $BUSD to Paxos and 10,422 $ETH ($13.12M) to a new address.

– Amber traded 4 hours ago.

👇https://t.co/vbHIlEvdJr— Lookonchain (@lookonchain) December 6, 2022

Lookonchain also shed light on Amber’s current reserves. He listed the $9.46 million holdings in Amber’s 6 Ethereum wallets:

- 3,990 ETH ($5 million)

- 1,111,841 USDC

- 1,652,678 USDT

- 29,182 BUSD

Cryptocurrency investors are worried

Wu Blockchain and Lookonchain’s bankruptcy claims later worried Amber’s customers as well. Pu Jing on Twitter, “are my client funds safe?” she asked. Annabelle Huang, Managing Partner of Amber Group, replied:

It’s safe. We continue to trade as usual. If you have any concerns, withdrawals are welcome as always.

It is. We continue to operate business as usual. If you have any concerns, withdrawals are open as usual.

— Annabelle Huang (@_annabellehuang) December 6, 2022

Amber Group’s senior manager says that contrary to the allegations, “business is as usual”. A statement reassuring customers amid the news came from the official Twitter account of the Amber Group:

Amber Group and WhaleFinApp are running business as usual to update our customers and relevant stakeholders. We need to continually adjust and steer our business strategies, product offerings, and ultimately our internal teams and functions, which change with market cycles.

To update our clients and relevant stakeholders, we can confirm Amber Group and @WhaleFinApp are business as usual. Weathering through market cycles, we have to constantly adjust and pivot our business strategies, product offerings, and, as a result, internal teams and functions.

— Amber Group (@ambergroup_io) December 6, 2022

cryptocoin.com As we reported, Binance CEO said in CZ that the influencers of FTX will remain in the market for a while. Currently nearing bankruptcy at Genesis alongside the Amber Group. Due to bankruptcy, the company currently has $1.8 billion in debt.