Today, a large amount of Bitcoin and Ethereum option will expire. Therefore, this will create a significant expectation in the crypto money market. The maturity of crypto options usually leads to a significant price volatility. For this reason, traders and investors closely follow these developments.

Crypto Money Options Maturity Day: Option of $ 2.04 billion will end!

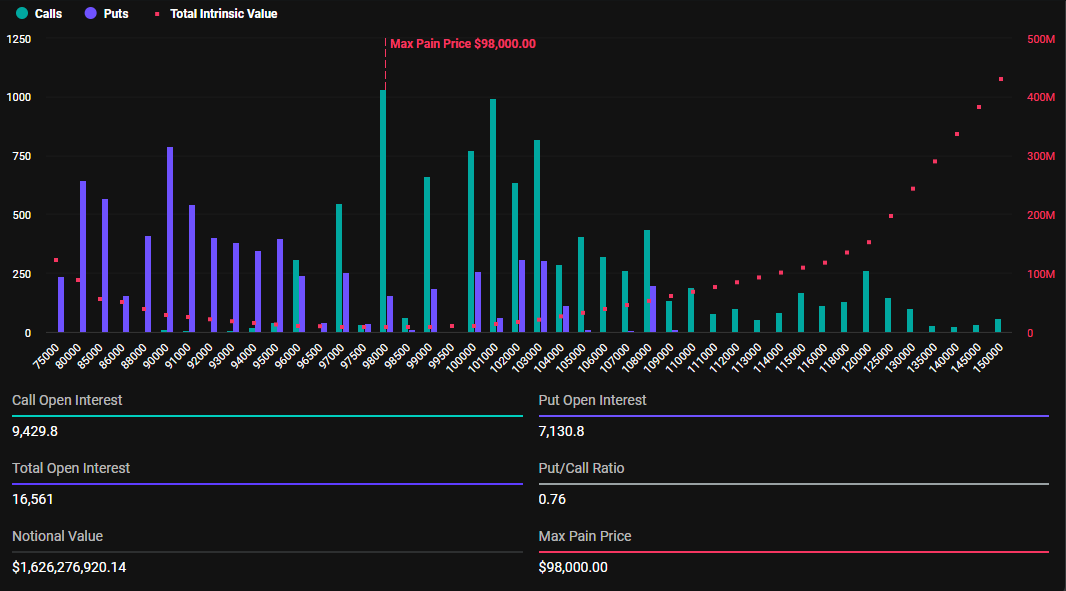

Kriptokoin.comAs you have followed, the market follows a slightly wavy course. Today, the nominal value of Bitcoin options are $ 1.62 billion. The idol/call ratio of the contract is 0.76. In addition, the maximum pain of these options is 98,000 dollars.

Bitcoin options that have survived. Source: Deribit

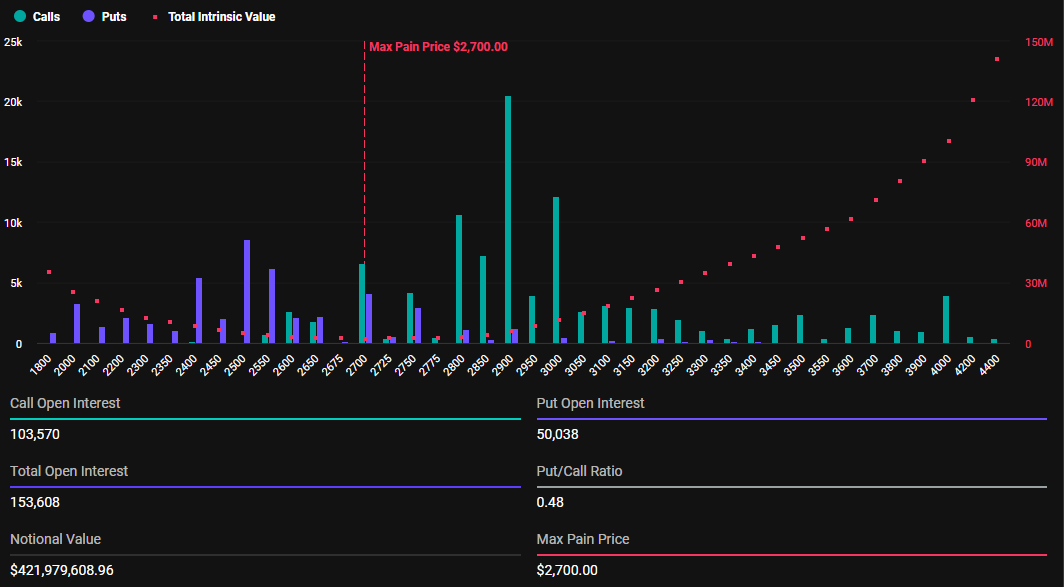

Bitcoin options that have survived. Source: DeribitOn the other hand, Ethereum has a 153,608 agreement with a nominal value of $ 421.97 million. Put/Call ratio of these contracts with a period of time 0.48. In addition, the maximum pain point for crypto currency is $ 2,700.

Ethereum options that have survived. Source: Deribit

Ethereum options that have survived. Source: DeribitWhat does the maturity filling of options mean to crypto currencies?

During the article, Bitcoin is traded for $ 98.284 with an increase of 1.03 %on a daily basis. Ethereum is traded for $ 2,752 with a 0.682 %increase. In the context of the option trade, the Put/Call ratio below 1 for BTC and ETH shows that purchase options (Calls) are more common than sales options (PUTs).

However, according to the maximum pain theory, Bitcoin and Ethereum prices may turn towards their use prices as the end of the maturity approaches. To do this will cause most options to endless and therefore “maximum pain .. This means that BTC and ETH prices can record a small correction as the options end.

Concerns continue between trades and investors!

He explains why there is a cautious fall in the market, as the analysts in Greex.live disappoint the trader of low volatility. They argue that traders and investors are continuing concerns about Bitcoin, especially Bitcoin, and traders closely monitor the key price points. In this context, analysts make the following assessment:

Group sensitivity tends to decline cautiously with low volatility that disappoints traders. While the participants watched the $ 96,500 level with suspicion of upward acceleration, the volatility discusses the possibility of clustering at a low level of low levels.

Deribit, low volatility makes you feel safe, because the markets tend not to wait for a long time, it warns that this sense of security is only instant.