Survival of the fittest – the old adage is playing out for crypto miners this year as a sell-off in the broader market is squeezing out some companies in the overcrowded industry.

In digital asset mining, particularly for bitcoin, competition has increased greatly in recent years as several new entrants joined the industry during the peak of 2021. However, with a price decline, survival of many new miners might be hanging on these companies being able to sell themselves or merge with another peer, according to industry participants.

“I think in the next six months or so we’ll probably see some M&A activity happen,” said Amanda Fabiano, head of mining at Galaxy Digital, “because some miners who got in the sector during the peak are just not going to be able to meet their requirements.”

Read more: How Does Bitcoin Mining Work?

During the 2021 bull run of the crypto market, margins of some bitcoin miners had been as high as 90%, which led to many new entrants and miners looking to grow at hyper speed. To do so, companies ordered mining rigs at high prices and deposited money upfront for their orders.

Fast forward to 2022, bitcoin prices have tumbled and margins have shrunk. Bitcoin network’s hashrate is hovering around all-time highs and operating costs are higher due to rise in energy prices – leaving miners in a very tight spot. “A falling bitcoin price means miner margins are compressing,” said Mason Jappa, co-founder and CEO of blockchain infrastructure and cryptocurrency mining company Blockware Solutions. “On top of that, margins have also been declining because Bitcoin’s network mining difficulty is increasing” as more miners are joining the network, he added.

Read more: The Future of Mining Finance: Time to Get Creative

A less profitable environment for bitcoin mining

Many of these companies that came into the mining sector in the last 12-18 months lacked a “sound balance sheet,” Mike Levitt, CEO of Core Scientific (CORZ), the largest publicly traded miner in terms of hashrate, told CoinDesk.

“These companies have found themselves in a position where they made plans and commitments that assumed external capital, whether from public or private markets, would always be readily available,” he said. “Now, the cost of capital, if available, just got more expensive, and some of these miners do not have sufficient capital to finish what they have started.”

Read more: 8 Trends That Will Shape Bitcoin Mining in 2022

Moreover, supply-chain issues and lack of access to capital are making matters worse for many miners. “The ability to secure large pre-orders of ASIC miners is no longer the major bottleneck to growth,” said Wall Street bank Jefferies analyst Jonathan Petersen in a recent research note. “Construction delays, caused by difficulties securing building materials and finalizing power purchase agreements, are a larger impediment to deploying new fleets.”

This perspective was echoed by crypto miner Hive Blockchain. “The crypto mining industry in general appears to find itself at a crossroads with a supply of very expensive ASIC chips and few places to plug them in,” according to a statement from the miner. “In our market intelligence, the company has noticed significant supply disruptions for electrical equipment needed to make data centers, such as transformers and switch gear.”

All these factors combined, and some of the newer and less capitalized miners are now in a limbo, as they are finding it hard to pay for their operations under the terms set out during the bull run.

“I think we’re going to see miners get humbled this year, in contrast to last year, when we saw the rise of public miners,” Fabiano said. Some of the miners who have signed some longer-term contracts will have to put up a lot of money in order to satisfy those obligations, she added.

On top of that, the ASIC markets are shifting downward, which means that miners are not going to be able to make the profit that they could have on the secondary market by just selling their machines if their operations aren’t up and running, according to Fabiano. In fact, with the slide in bitcoin prices, some of the older mining rigs, such as Bitmain’s Antminer S9s, are becoming less profitable, leading to miners shutting them down to avoid shouldering the costs.

This is likely to drive several miners to look for an exit strategy by selling their business or merging with other companies. “I think the ones [miners] that have no operational experience, no background in bitcoin mining, are probably the ones that will look for M&A, or they’ll have a distressed debt situation where they’re taking on [expensive] debt,” she said.

M&A opportunities

This tight market environment has already led to larger, more established miners, such as Core Scientific and Bitfarms (BITF), to lower their hashrate growth expectations for the year to a level that is more serviceable via capital they already have on their balance sheets. Meanwhile, Marathon Digital (MARA) remains “cautiously optimistic” about their hashrate growth outlook.

With larger miners reining in their growth outlook, the newer and smaller miners are likely to be in a tougher spot. This will probably lead to mergers fairly quickly given how long these newer entrants can actually withstand some of this market volatility in a bear market, according to Michael Ashe, head of investment banking at Galaxy Digital. “I think we’re going to see all different shapes and forms of M&A opportunities,” in this cycle, he said.

In fact, Core Scientific has said that the company is already getting calls for M&A from miners who are feeling the squeeze. “There are a number of folks that have commitments that were dependent upon their being able to raise additional capital, and they’re finding it challenging to raise that capital,” said Core’s Levitt during a conference call, adding, “we’re starting already to have to be approached, frankly, with opportunities.”

Core Scientific will look at two types of potential M&A deals: One is cheap mining companies, and other is a business that helps the company grow, Levitt told CoinDesk. “Those are the two areas we’re looking for. It’s either value or growth, and if you’re really lucky, it’s a combination of both,” he said.

Moreover, he is also getting calls from other parts of the mining ecosystem, including companies with electrical equipment and power providers who now suddenly have a surplus of both and need buyers. “Companies that did not prepare for this downturn have very difficult strategic decisions to make. In terms of consolidation, we appreciate the current complexities in this industry, and we will continue to look into acquiring the best in class of our industry as we are presented with those deals,” Levitt added.

Read more: Marathon’s Thiel Says Company Not for Sale, as M&A Chatter Picks Up Among Crypto Miners

Miners who are more capitalized and have a solid strategy will likely find such a market an opportunistic one to pick up assets or companies at cheaper valuations. “This cycle is an interesting opportunity from an M&A perspective, because you do have some of these more established miners who have already weathered the past bear markets and will now look at this as an opportunity to go out and acquire equipment and real estate at attractive values,” said Galaxy’s Ashe.

Who will survive?

With publicly traded mining equities down, on average, more than 50% this year, investors’ confidence in the sector might be shaken. However, this could be an opportune time for longer-term investors to bottom-fish for attractive value. “Timing the exact bottom is not easy, but many on-chain and market indicators point to now being a good time to accumulate both bitcoin and bitcoin mining rigs,” said Blockware Solution’s Jappa. So then, what should the investors look for in a miner to sort out the winners?

One answer is look at the past downturns. “The miners that have survived the bear markets in the past are still going to be the ones that survive this next round,” said Galaxy’s Fabiano. “Being extremely opportunistic over the next six months with ASICs [as their prices drop] while also having a really strong strategy for growth on the infrastructure side will be an amazing way for miners to really separate themselves from the masses.”

Miners who are prepared and have the latest generation equipment with locked-in power rates will be able to benefit from current market conditions, said Zach Bradford, CEO of bitcoin miner CleanSpark (CLSK). “This stage in the business cycle will reward miners that have consistently delivered value to their shareholders and the Bitcoin ecosystem,” he added.

Another crucial factor to consider is the miners that are already sitting on cash and are still able to access the capital markets to finance their growth. “As the BTC mining industry funds more of its growth with debt, we expect the profitability of miners to continue to diverge with the larger public miners widening their cost of capital advantage,” wrote Wall Street investment bank BTIG’s analyst Gregory Lewis in a recent research note.

Read more: Battered Bitcoin Miners Increasingly Turn to Debt Financing

Digging deeper, Jefferies’ Petersen sees larger miners, such as Marathon Digital and Core Scientific, at a “relative advantage” compared to smaller miners when accessing debt financing. He also expects companies to start selling some of their mined bitcoins that they usually hold on their balance sheets in order to pay for operational expenses.

Recently, miner Argo Blockchain (ARBK) said during its first quarter conference call that it is raising debt and selling a portion of its mined bitcoin to cover some of its expenses. Meanwhile, Core Scientific said that it sold some of its mined bitcoins this year and will continue to do so.

Other miners such as Marathon also said they are considering selling some of their mined bitcoins, while peer Riot Blockchain (RIOT) has already started selling its mined digital assets.

Read more: Bitcoin Miners Are Selling Off Their BTC Holdings to Cope With Market Headwinds

Tying it all together, Arcane Research’s analyst Jaran Mellerud wrote in a recent report that “to gauge which miners are the best prepared to get through the bear market and even potentially capitalize on it by buying assets of distressed competitors, it’s essential to look at two factors: each company’s bitcoin production cost and the strength of their balance sheets.”

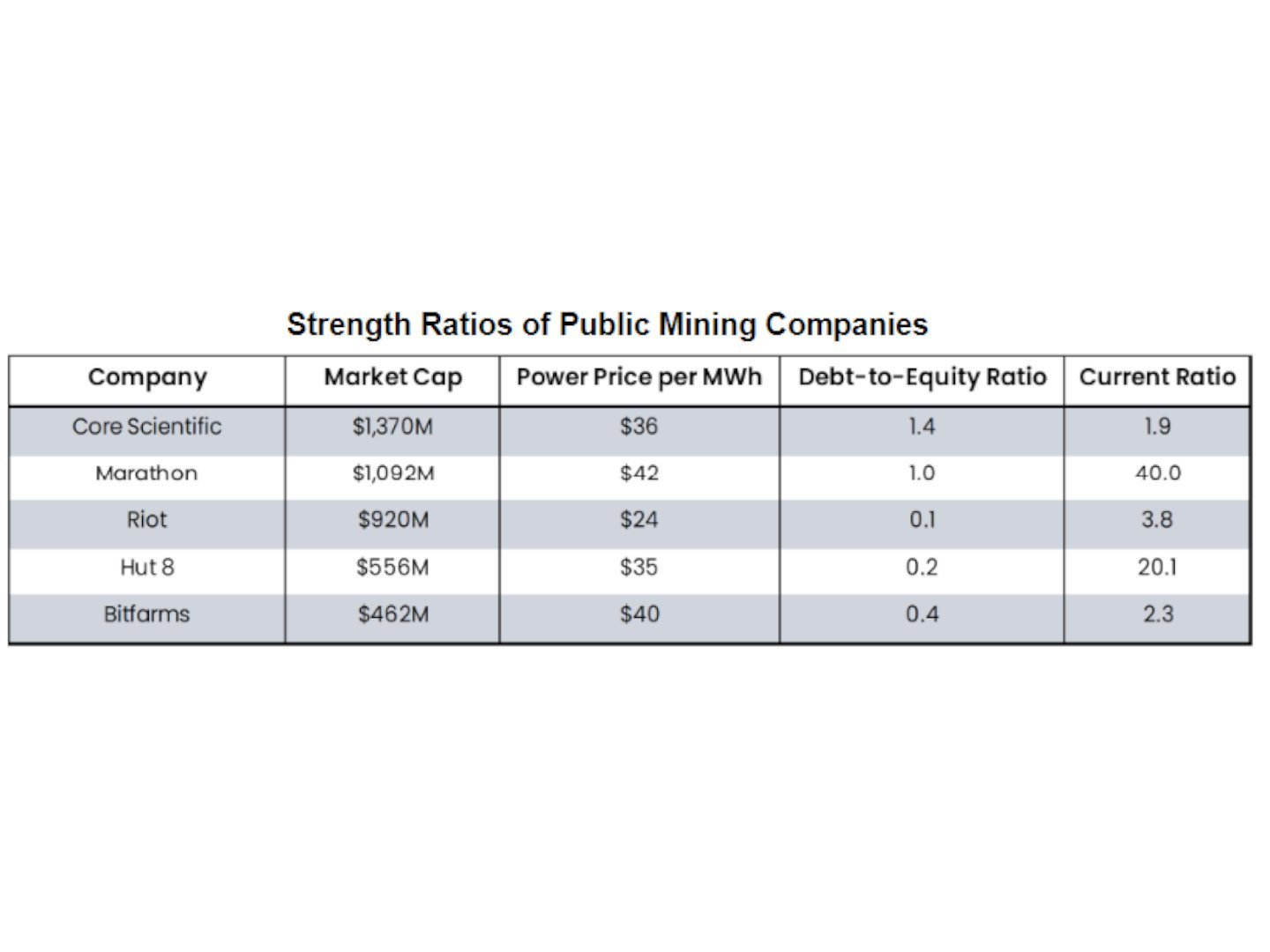

Based on the most recent information, Riot Blockchain has the lowest power prices among the top five miners by market cap, only paying $24 per megawatt per hour (2.4 cents per kilowatt per hour), Mellerud wrote. He also noted that power prices have likely increased for all mining companies in recent months.

Comparable metrics of top five mining companies, based on market cap (Arcane Research)

“Overall, based solely on its low power cost and healthy balance sheet, Riot seems to currently be in the strongest position of the five biggest public miners by market cap,” Mellerud said.

The bottom line is that investors trying to pick winners in a down market should look for miners with traits that include proven operational track records, lower costs, and good treasury management strategies and hedging options.

Read more about

Save a Seat Now

BTC$29,477.30

BTC$29,477.30

6.97%

ETH$1,776.81

ETH$1,776.81

8.51%

BNB$298.15

BNB$298.15

6.57%

LUNA$0.006486

LUNA$0.006486

48.75%

XRP$0.392190

XRP$0.392190

5.91%

View All Prices

Sign up for The Node, our daily newsletter bringing you the biggest crypto news and ideas.