According to crypto analyst Filip L, ATOM price is giving the bears a knee-jerk reaction. Meanwhile, the analyst says AVAX is heading towards a 15 percent decline. Also, according to the analyst, the DOGE price is in the process of forming a bear trap. Analyst Ekta Mourya evaluates the outlook for the leading altcoin Ethereum.

ATOM price may turn flat this week!

Cosmos price made a significant gain in the ASIA PAC session on Thursday. Thus, the bulls were finally able to trigger a significant rise. With this move, it broke the highs earlier this week. It also triggered quite a few stops of bears in the process. This opens up more room to the upside, with less resistance from short sellers. Because it’s possible that a two-stage reversal could easily set the ATOM back to $12. This means that it erases all the losses of the week.

ATOM will first face $11.40, which hits the green ascending trendline. Breaking above this level means that the bulls re-enter the pennant pattern that appeared on the chart in the long run. Once it rises above this level, the moving averages will be around $11.60. This will remain the last challenge before the bulls mark $12 on the penn’s upper red trendline and gain 10% in the process.

ATOM 4-hour chart

ATOM 4-hour chartThe downside risk comes in the form of a false bounce followed by a larger drop with a 10% drop. ATOM will still climb as high as $11.40. Thus, the green will receive a rejection against the rising trendline. In addition, he will perform his next landing. If this story happens, it is possible to test this week’s low of $10.80 and quickly break through last week’s low of $10.20 as the end of the bearish line for now.

The AVAX price has the last chance to save the situation!

Avalanche price may or may not be at a critical point already. But the chart paints a clear picture that the AVAX bulls are playing their last game with either a successful outcome or a hangover variety. AVAX is seeing its losses increase as Bitcoin price pulls back in the late European session this Wednesday, dragging other cryptos and altcoins down with it. The real question is: how long will the bulls withstand the pressure?

AVAX will see the pressure rise brutally further at $16 with the 200-day Simple Moving Average (SMA) in sight. This 200-day SMA has been significant on previous occasions in February and March. Once the bears pull their legs out from under the bulls, AVAX price will quickly free fall towards $14.50. Thus, it will form a double bottom with the April low of $13.80. This means a 15% loss.

AVAX 4-hour chart

AVAX 4-hour chartThe result of a test above this 200-day SMA could be very binary in the sense that the bulls regain control and push the AVAX price action to $18.50. Regarding positioning, this would make sense as the Relative Strength Index (RSI) supports this situation. It is already subdued and fairly close to reaching the oversold mark. With a one-day close preferably above the monthly pivot at $17.50, and the next turn above the 55-day SMA at $18.50, a quick bounce is possible.

DOGE price, a you trap a? che is he eating?

Dogecoin price saw a sudden reaction in both the RSI and price action this morning as the bulls said enough is enough. A 2,5 snowy candle erased Wednesday’s low. It also broke the 55-day SMA, which hangs as a cap above the price action. Currently, bears trying to re-enter their short positions with the 55-day SMA going down will trigger a few stops.

DOGE sets itself up for the perfect bear trap here. Because the re-entering of the bears that was stopped earlier means that the bulls will soon force price action above the 55-day SMA. A squeeze will occur as the bears exit their positions and see DOGE rise towards $0.084. The 200-day SMA has already proven to be a major hurdle in the past. So, don’t expect much action from there.

DOGE 4-hour chart

DOGE 4-hour chartA downside threat is based on a rejection against the 55-day SMA as the bulls avoid keeping the price action above it. In this case, if more cryptos start to participate in the sale, the rate of fading is likely to start to increase. This means that the bulls will get caught in a bull trap this time and get stuck towards $0.076.

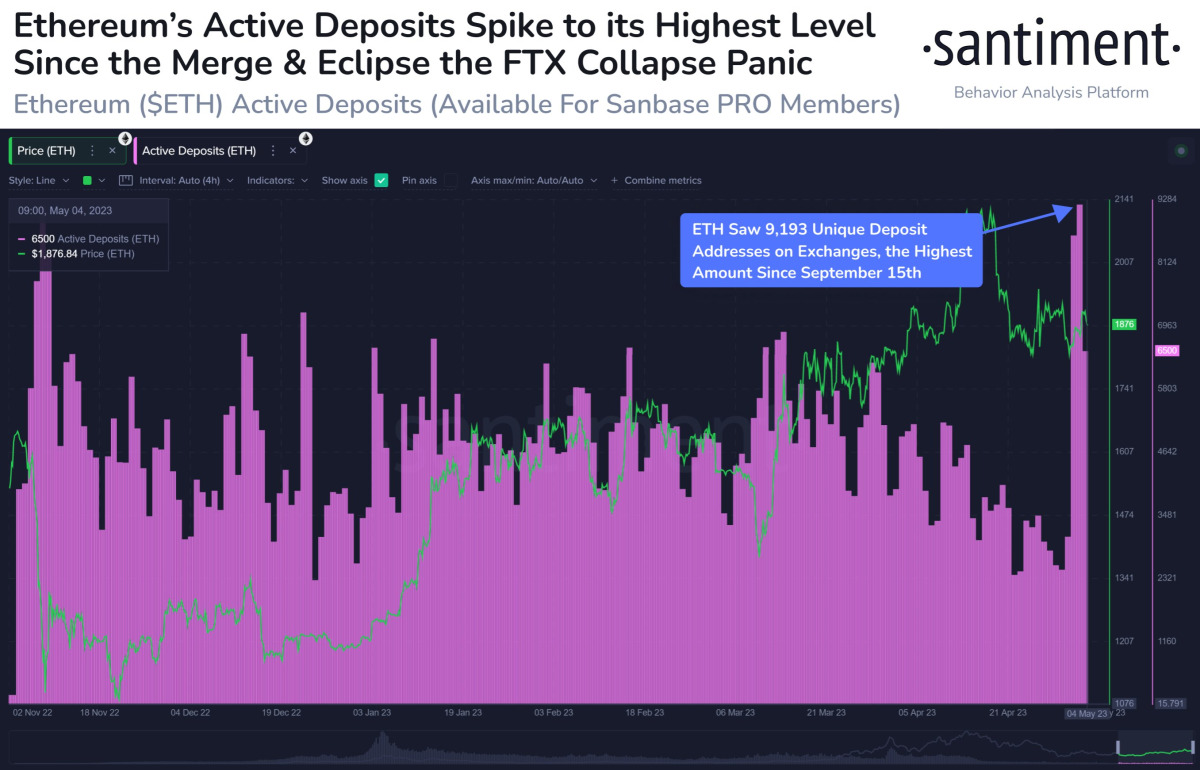

Ethereum active deposits at eight-month high

The volume of active deposits on the Ethereum Blockchain exploded, reaching an eight-month high. Thus, deposits to ETH’s Beacon Chain contract reached the peak of eight months. Experts at crypto intelligence tracker Santiment are investigating the cause of the peak and conclude that an increase in deposits could overshadow Ethereum price volatility.

Ethereum active deposits

Ethereum active depositsThe surge in Ethereum deposits came at a time of macroeconomic uncertainty. cryptocoin.com As you follow, the US Federal Reserve increased interest rates by 25 basis points. Typically, an increase in Ethereum deposits is indicative of a decrease in the circulating supply of ETH. As the circulating supply of ETH decreases, there is a decrease in selling pressure on the asset. Thus, it supports the bullish thesis for ETH price.

Ethereum price is currently in an ascending parallel channel. The altcoin is currently in an uptrend that started on November 22, 2022. While ETH price continues above the midpoint of the channel, the altcoin is closer to the upper trendline of the parallel channel. The altcoin price broke above the parallel channel in mid-April 2023 before retreating inside the channel.

ETH 1-day price chart

ETH 1-day price chartThe altcoin is on its way out of the upward parallel channel. A close resistance is at $2,134. The bullish target for Ethereum is $2,320. A drop below the lower trendline to $1,678.5 will invalidate the bullish thesis for Ethereum.