Some altcoin projects have been driven by developments recently, both macroeconomically and technically. However, according to some analysts, these mostly bullish moves are coming to an end. Here’s what experts are waiting for for the two altcoins…

Altcoin ARB transactions were quite volatile

cryptocoin.com As we have also reported, on June 2, the US Senate voted to raise the debt limit. After that, Arbitrum’s price jumped along with the top-ranked cryptocurrencies. The price of Arbitrum (ARB) rose 9 percent yesterday to its intraday high of $1.25. It outperformed the crypto market’s overall gain of 1.5 percent over the same period. Arbitrum’s outstanding performance coincided with some strange buying activity associated with popular trader Andrew Kang’s crypto addresses.

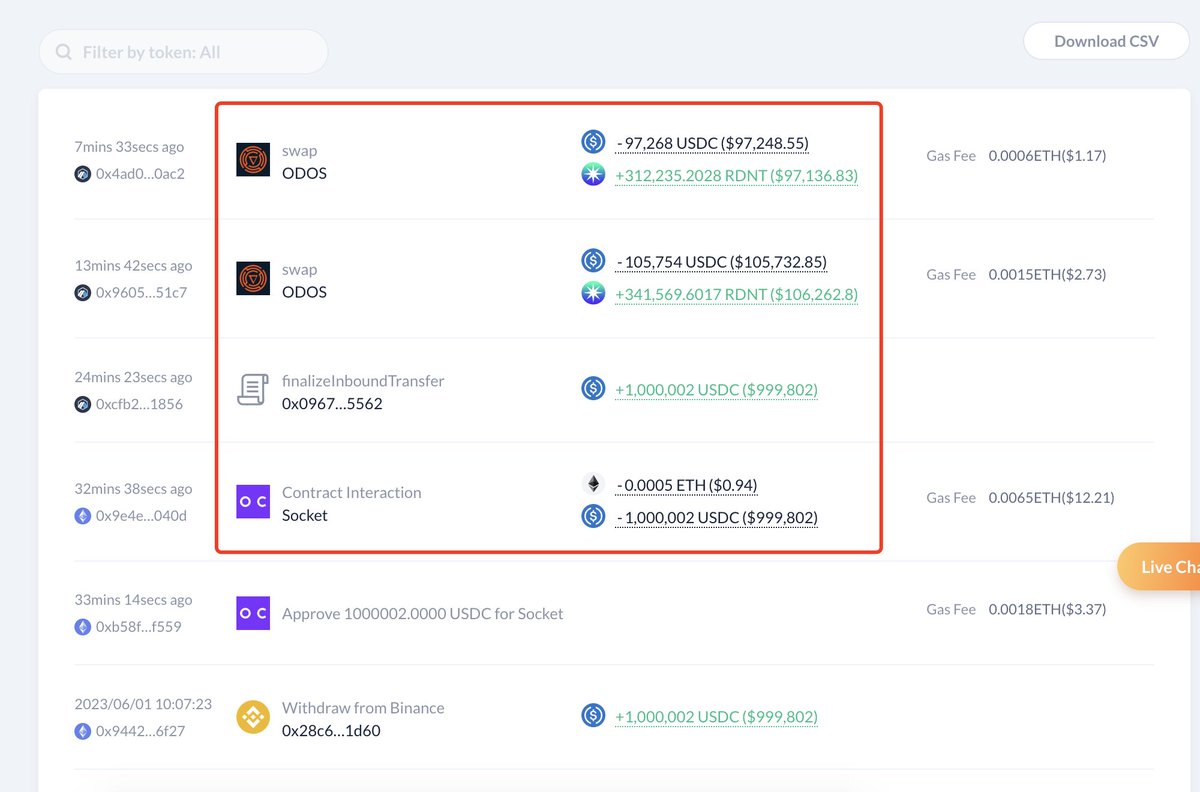

Specifically, on June 2, Mechanism Capital co-founder invested $1 million worth of stablecoins into Arbitrum pools. More than 20 percent of that was spent on purchasing RDNT, the native token of decentralized finance lending platform Radiant Capital. Later, Kang replaced his newly purchased and existing RDNT reserves with $867,000 worth of ARB. He then invested the proceeds to borrow Circle’s USD Coin into Radiant Capital, according to data source Lookonchain. The platform noted:

Andrew Kang appears to be using leverage to trade long to ARB at RDNT Capital. Buy ARB → deposit ARB → borrow USDC → buy ARB.

Is the ARB rally sustainable?

Lookonchain has revealed that an anonymous whale deposited $1.5 million in ARBs on the OKX exchange simultaneously with Kang’s aforementioned transfers. Investors often deposit tokens on crypto exchanges for sale. This raises the possibility of ARB’s pullback in the coming days if demand falls. Interestingly, the technical pattern of the token on the daily chart shows the same thing.

Whale"0xf59b" finally waited for the rise of $ARB and deposited 1.2M $ARB ($1.5M) into #OKX 30 minutes ago.

He withdrew 1.2M $ARB from #OKX on May 8th, and the buying price may be around $1.2.https://t.co/cJReZfg007 pic.twitter.com/jFwBRtPUpK

— Lookonchain (@lookonchain) June 2, 2023

Specifically, according to analyst Yashu Gola, the ARB has formed what appears to be a bear flag, which is confirmed by the price consolidating between two ascending, parallel trendlines following a strong downward move. A bear flag is resolved after the price drops below the lower trendline and falls by as much as the increase of the previous downtrend. That puts ARB on its way to $0.95 in June, down nearly 20 percent from current price levels. Conversely, a decisive break above the flag’s upper trendline will likely invalidate the bearish view.

Accumulation of SHIB whales did not positively affect the price

On the other hand, Shiba Inu (SHIB) price has been supporting the bulls for a week. It has also increased its gains in two consecutive sessions. This has come as sentiment in the crypto market initiated by Bitcoin (BTC) continues to improve. Shiba Inu (SHIB) whales have purchased around 100 billion SHIB tokens. IntoTheBlock shows that wallet addresses of major SHIB holders do this in less than five days. However, about 60 percent of these tokens are held in dead wallet addresses. This means that the coins are ready to be burned. According to the latest data from Shibburn, around 4 billion SHIB tokens have been burned in the last 24 hours.

However, the outlook for the SHIB/USDT four-hour chart is bearish, according to analyst Lockridge Okoth. The chart shows that the meme-coin has been following a descending channel since April 18. The upper band of the descending channel is currently acting as resistance. The 0.00000874 level is a very important resistance as it is the high of the previous day. Currently, the Shiba Inu is testing its resistance at $0.00000861 which is the same level where the 50-Moving-Average is located. Failure to break above this level will cause the coin to extend its decline. The selling pressure from here will push prices towards the June 1 low of around $0.00000831.