Cryptocurrency exchange FTX has funded risky bets on CEO Sam Bankman-Fried’s (SBF) trading firm Alameda Research. It has lent billions of dollars’ worth of customer assets to it. Sources familiar with the matter said this move caused the stock market to explode and a liquidity crisis. SBF’s teams at FTX and Alameda have offered no satisfactory explanation of what really happened. On-chain research, verified and unconfirmed sources, and tweets by SBF, FTX, Alameda and related organizations reveal that the crisis was caused by Terra’s $41 billion collapse. Here is the comprehensive timeline for the FTX-Alameda events…

Timeline of the FTX-Alameda crisis

Samuel Bankman-Fried’s trading firm Alameda Research suffered huge losses after the explosion of Terraform Labs’ sister tokens LUNC (formerly LUNA) and UST. cryptocoin.com As we reported, Terra’s algorithmic stablecoin, UST, had a collateral-free design. This made it more susceptible to error and de-pegging than other stablecoins.

May 2022: Terra (LUNA) and UST explode, wiping out $41 billion

Some sources claim that Alameda Research suffered huge losses with the $41 billion Terra explosion. Informant and Terra community member FatManTerra claimed that Kanav Kariya, President of Jump Crypto, Do Kwon, CEO of Terraform Labs, and Samuel Bankman-Fried, CEO of the FTX exchange, were involved. FatManTerra said that SBF had a 30 percent Serum (SRM) deal with Jump Crypto, which is why FTX CEO was exposed to the Terra collapse.

June 2022: Samuel-Bankman Fried becomes prince Charming of crypto

In June 2022, SBF embarked on a buy/recovery spree. Crypto trading and storage service BlockFi and crypto asset broker Voyager Digital have offered approximately $750 million worth of emergency funds. FTX CEO bought BlockFi that same month.

@SBF_FTX I know about the 30% Serum handshake deal with Jump and what you did to retail investors after

— FatMan (@FatManTerra) May 23, 2022

Sources close to the matter claim that Alameda is trying to bail out bankrupt lending platforms to avoid collateral liquidation. The collateral for most loans was FTT, the native token of the FTX exchange. This was done to prevent a mass liquidation of the FTT which could cause the exchange to reduce selling pressure on the local token price. Some people close to the subject have explained a theory such as:

October 2022: Delphi Labs General Counsel Gabriel Shapiro leaks a copy of the DCCPA draft bill

SBF has ignited the ire of crypto influencers and big names through its “nail-in-the-coffin” regulatory scheme for the DeFi industry. The biggest issue was the Digital Commodity Consumer Protection Act (DCCPA) and how it became public knowledge. A copy of the still ongoing DCCPA, which outlines how the US Commodity Futures Trading Commission (CTFC) will regulate the crypto industry, has been uploaded to GitHub by Gabriel Shapiro. Shapiro serves as General Counsel for Delphi Labs, the research wing of investment firm Delphi Digital.

The DCCPA was introduced in August by Senators Debbie Stabenow and John Boozman. Sam Bankman-Fried, CEO of Coinbase and FTX, openly supported the bill. It gained momentum as it offered an alternative to the law, which the SEC described as an enforcement-by-regulation strategy. Jake Chervinsky, head of policy at crypto lobby group The Blockchain Alliance, said:

This bill can be interpreted as a DeFi ban.

November 6, 2022: FTX vs Binance war begins

SBF has been criticized by Binance CEO Changpeng Zhao and industry leaders for their views on DeFi regulation. CZ announced its decision to sell $584 million of FTT tokens, triggering FUD (fear, uncertainty and doubt) in the community. The FTT price soon fell from $22 to $3. SBF’s FTX exchange and Alameda Research did everything and failed to stop FTT’s collapse. FTX’s native token is currently around $3.

As part of Binance’s exit from FTX equity last year, Binance received roughly $2.1 billion USD equivalent in cash (BUSD and FTT). Due to recent revelations that have came to light, we have decided to liquidate any remaining FTT on our books. 1/4

— CZ

Binance (@cz_binance) November 6, 2022

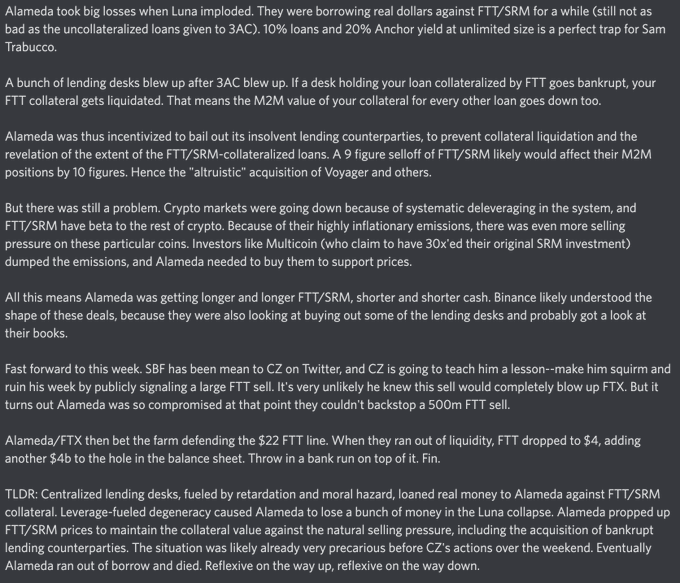

Unconfirmed sources and crypto analyst Hsaka Trades claimed that SBF is trying to de-peg USDT as rival exchange Binance holds 17.6 million worth of Tether on its books. Tether remained stable and rebounded to $0.99 after temporarily falling from $1 to $0.97.

November 8, 2022: FTX reaches out to Binance to save the exchange

CZ told his 7.5 million followers on Twitter that FTX had asked Binance for help. To support traders and protect the crypto community, Binance signed a Letter of Intent (LOI) to acquire FTX and began due diligence on the exchange.

This afternoon, FTX asked for our help. There is a significant liquidity crunch. To protect users, we signed a non-binding LOI, intending to fully acquire https://t.co/BGtFlCmLXB and help cover the liquidity crunch. We will be conducting a full DD in the coming days.

— CZ

Binance (@cz_binance) November 8, 2022

November 10, 2022: CZ pulls out of deal, USDD leaves stable, Justin Sun reveals bailout plan

Just a day after they said they would buy FTX, Binance expressed concern about the state of the troubled exchange. He withdrew the bailout offer, stating that the business’ situation was beyond “what they would help”. Hours after Binance’s announcement, USDD, the stablecoin of the Tron ecosystem, suffered a slump. It dropped from $1 to $0.98. The reason was thought to be related to Alameda selling its holdings in USDD to protect itself from bankruptcy.

Then, Tron founder Justin Sun tweeted that he is on the side of Tron (TRX), BitTorrent (BTT), Just (JST), Sun Token (SUN) and Huobi Token (HT) holders. For the protection of token holders in the Tron ecosystem, Justin Sun and his team met with FTX for a plan to save the exchange.

The ongoing liquidity crunch, despite short term in nature, is harmful to the industry development and investors alike.

— H.E. Justin Sun

(@justinsuntron) November 10, 2022

November 10, 2022: FTX signs with Sun, receives Tron loan

FTX exchange; TRX announced that they have reached an agreement with Tron to set up a proprietary system that will allow BTT, JST, SUN and HT holders to move their assets from FTX to external wallets. This functionality would be activated on November 10, 2022 at 6:30 PM. The exact capacity of Tron’s token facility will be determined weekly. The amount to be deposited would depend on a number of factors, such as the withdrawal request and the funding capacity to be provided by Tron.

As part of the deal between FTX and Tron, the exchange disabled all Tron deposits for users. The only deposit would be pre-announced deposits made weekly by the Tron team. Initially, $13,000,000 in assets would be distributed to facilitate swaps, and information on future capital injections would be shared weekly. The announcement indicated that TRX, BTT, JST, SUN and HT are likely to experience high levels of volatility.

November 10, 2022: FTX exchange opens withdrawals for Bahamian users

Crypto experts at Twitter have determined that withdrawals from FTX have begun. The exchange told traders that withdrawals are now open for users in accordance with Bahamian regulations. The amount withdrawn is a small fraction of the assets FTX currently holds, and they are working on additional ways to secure withdrawals for the remaining users. Sam Bankman-Fried apologized to international users of FTX on Twitter.

2) The amounts withdrawn comprise a small fraction of the assets we currently hold on hand and we are actively working on additional routes to enable withdrawals for the rest of our userbase. We are also actively investigating what we can and should do across the world.

— FTX (@FTX_Official) November 10, 2022

The stock market experienced a major “bank rush”: Whales survived the event

Last week, the FTX exchange processed over $8.7 billion in withdrawals versus $7.7 billion in deposits. This translates to a net outflow of approximately $1 billion. Unsurprisingly, this was the biggest outflow compared to other cryptocurrency exchanges in the same period.

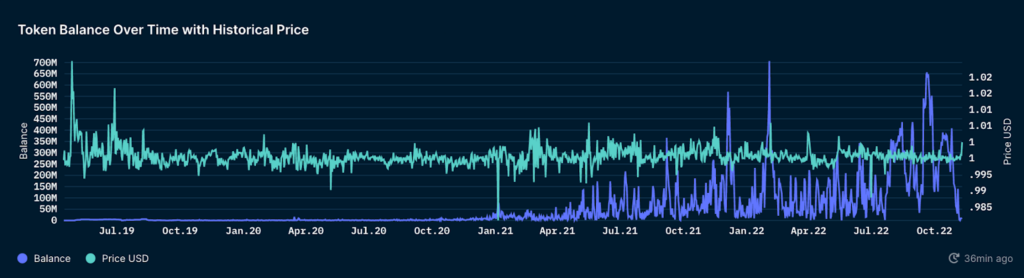

On-chain data reveals that the balance of USD Coin (USDC) in FTX’s primary Ethereum hot wallet peaked at $408.3 million on Oct. Most withdrawals initiated during this period were from trading firm Alameda Research. This raises the question of whether the firm is withdrawing funds to meet its liquidity requirements elsewhere.

FTX’s stablecoin liquidity was in free fall, and the exchange wallet lost $137 million in USDC within 48 hours. After CZ’s tweet informing users about the $584 million FTT token sale and risk management concerns at FTX, he began to look forward to the “bank rush.” A bank run refers to a simultaneous attempt by depositors to withdraw money from a bank that is expected to fail.

About half a billion dollars worth of Ethereum was withdrawn from FTX between 5-7 November 2022. 358,000 ETH was withdrawn from SBF’s exchange and allegedly a bank run.

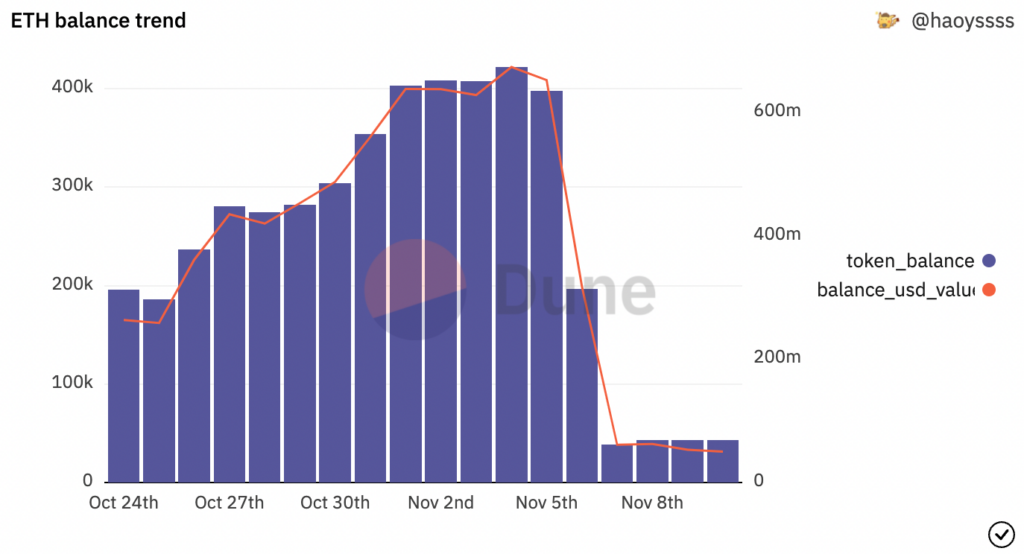

About $1 billion worth of non-Ethereum ERC-20 tokens were withdrawn from the FTX exchange between November 5 and 10. Onchain analysis reveals that users retain tokens with higher market capitalization and liquidity before withdrawing smaller, less liquid tokens.

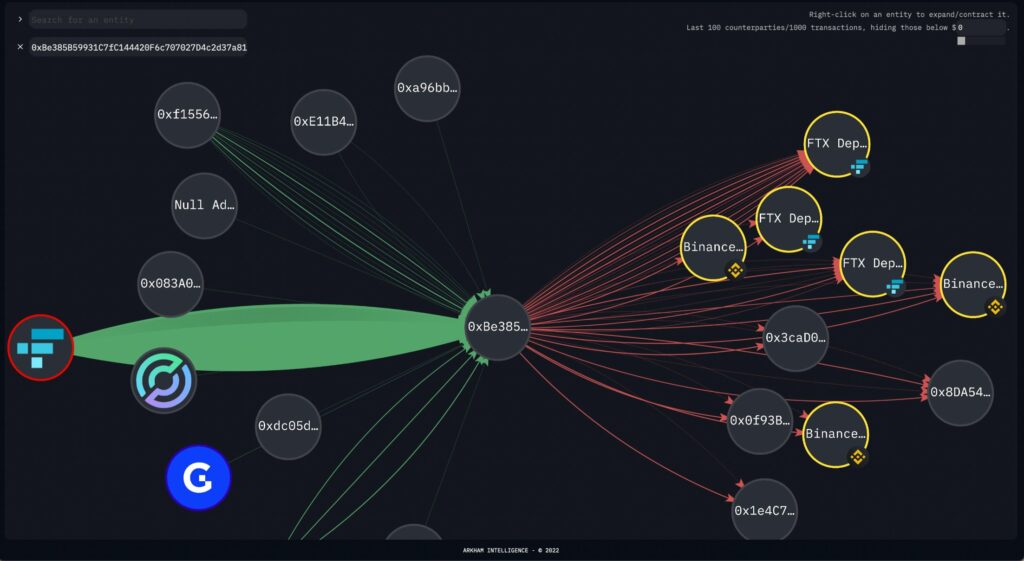

Hsaka Trades, an analyst, believes that large wallet investors can exit on time. Whales withdrew all or some of their funds from FTX before the liquidity crisis unfolded by November 8. It was able to withdraw $269 million USDC and USDT from FTX with a wallet address 0xbe385b59931c7fc144420f6c707027d4c2d37a81 and moved approximately $33 million to Binance.

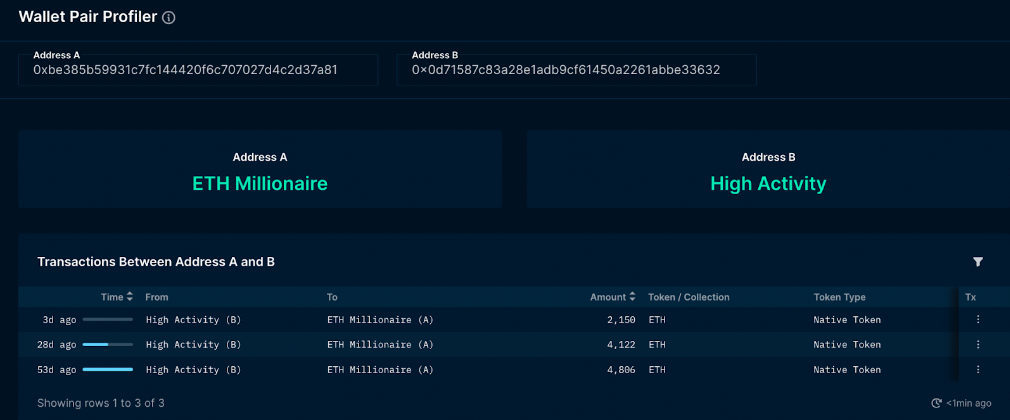

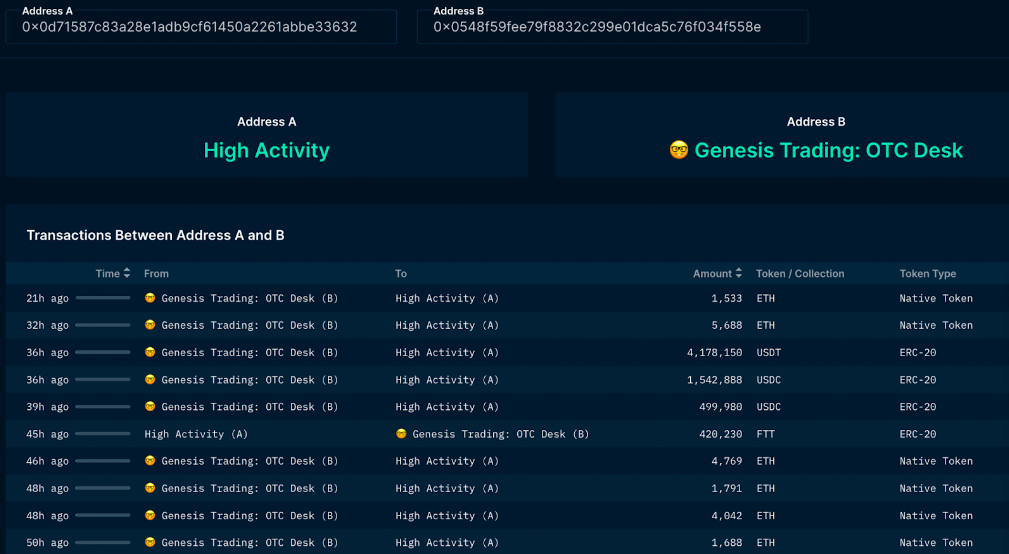

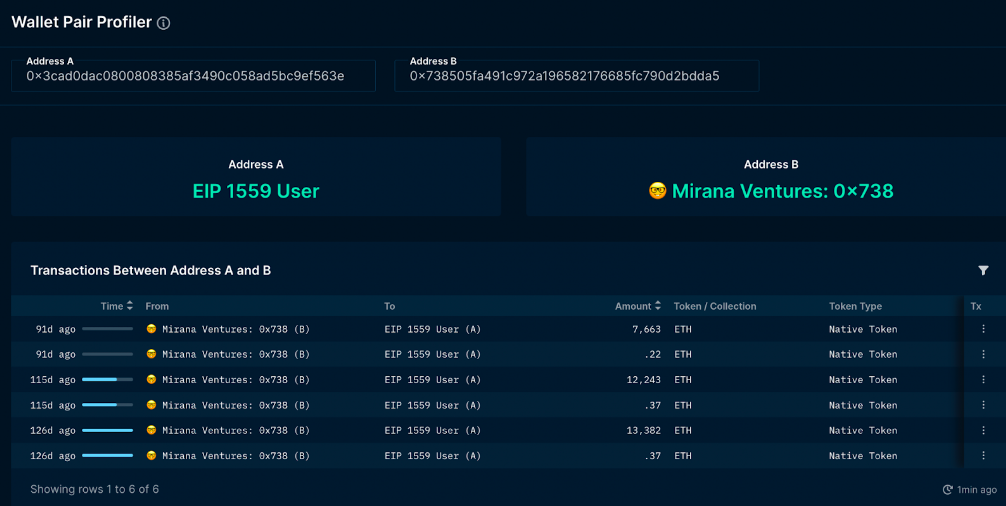

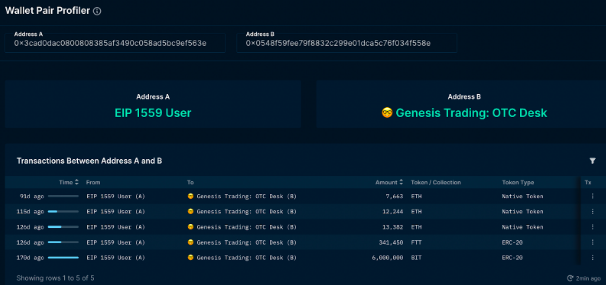

The chart above shows a series of transactions where wallet A pulled $269 million from FTX, of which about 12.2 percent moved to Binance. The major wallet investor remains anonymous, but its transaction history points to industry insiders. Standing out is node A (0xbe385b59931c7fc144420f6c707027d4c2d37a81), which interacts with B (0x0d71587c83a28e1adb9cf61450a2261abbe33632), which has a history of transactions with Genesis OTC and Three Arrows Capitals. These are the big names that have emerged in connection with Terra’s $41 billion boom.

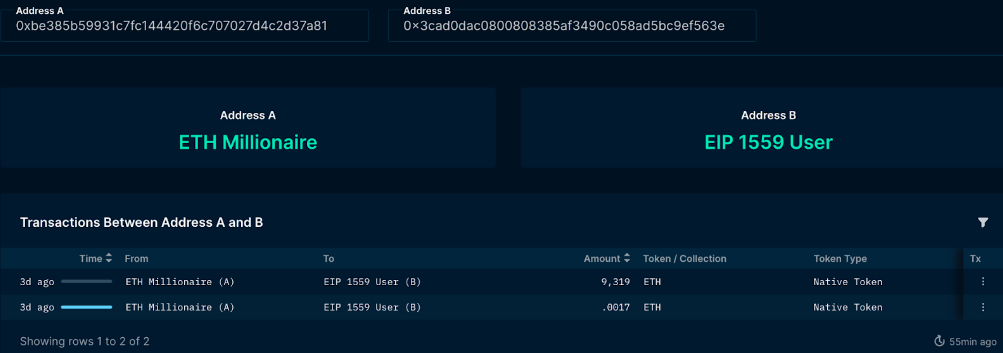

A also interacted with C (0x3cad0dac0800808385af3490c058ad5bc9ef563e), which received funding from Mirana Ventures, the early stage investment arm of centralized exchange Bybit.

C has a history of transfers to the same Genesis OTC wallet B has interacted with in the past.

Data reveals exchange and Alameda funds mingling

An examination of transactions between FTX and Alameda revealed that the trading firm is attempting to close the liquidity issue the exchange faced between November 5 and 7. After receiving tens of millions of dollars from FTX in the last week of October 2022 and the first week of November 2022, Alameda moved approximately $360.9 million back to SBF’s exchange to combat the impending liquidity crisis.

This information supports the idea that FTX’s funds were mixed with Alameda. No rational trading firm will deposit money in a bank-run stock market. The $360.9 million entry into FTX from Alameda was an attempt to bridge a gap and failed.

Firms make statements, deny affiliation with Alameda and FTX

News of the alleged bank run of the FTX exchange and its mixing of funds with Alameda has become common knowledge in the past few days. Several crypto platforms, exchanges, and organizations have come to the fore by denying SBF’s affiliation with the FTX exchange and Alameda Research. However, the denials of these third-party individuals are reminiscent of the $41 billion Terra explosion, in which crypto hedge funds halted withdrawals and filed for bankruptcy within a month, despite initially denying that they were involved in the boom.

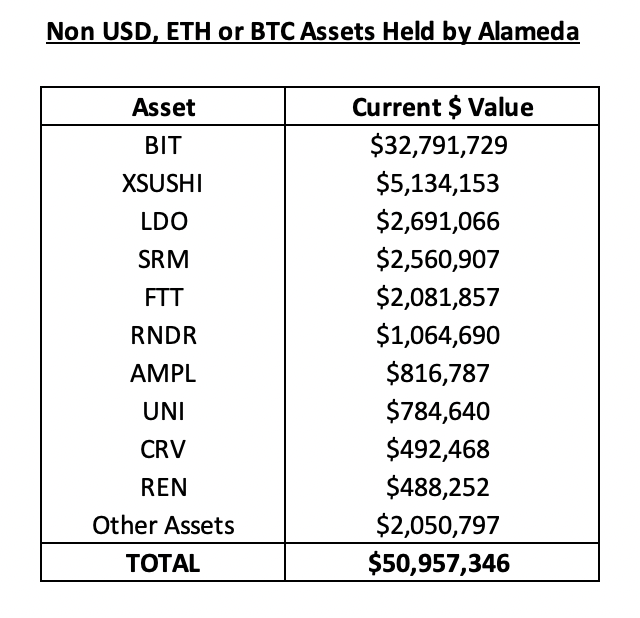

Rumor has it that Alameda is sinking after FTX’s collapse, but data on ten chains suggests otherwise. Larry Cermak of The Block highlighted a number of questionable Alameda wallets currently holding $50.9 million in USD, ETH and non-BTC assets. Among all cryptocurrencies held by these wallets, the largest position is in BIT, the token of the centralized exchange Bybit. Alameda acquired BIT through a token trade for FTT. Alameda currently holds 100 million tokens worth approximately $32 million at current prices.

Alameda’s largest non-SBF positions are xSUSHI and LDO with a combined value of $5.8 million. If the trading firm liquidates its position in these tokens, it could result in a small increase in supply in the increasingly illiquid market.

Did FTX and Alameda crash the crypto industry?

The exchange of funds between SBF’s two entities, FTX exchange and Alameda Research, before and during the exchange supports the idea that the two are more closely linked financially. A huge asset, wallet A, managed to attract hundreds of millions of stablecoins during the run, and the whale likely protected its assets from the bank run. Suspicious Alameda wallets are thought to still have more than $50 million in tokens at risk of liquidation on the open market. Alameda has over $12 million in outstanding loans at a very high risk of default.

The collapse of FTX also caused chaos across DeFi as liquidity dried up for both MIM and USDT. Since Alameda is a key user of Abracadabra, it used the native token FTT as collateral to issue Magic Internet Money (MIM). As of November 3, more than 35 percent of the outstanding MIM supply was backed by FTT.

The stablecoins USD Tether (USDT), USD Coin (USDC) and USDD (the stablecoin of the Tron ecosystem) have dropped or temporarily dropped below the $1 pair. Stablecoins are crumbling under selling pressure as traders pull their fiat money from the crypto market.

FTX files for bankruptcy and Sam Bankman-Fried resigns

FTX, which includes FTX US, Alameda Research and approximately 130 related organizations, filed for bankruptcy, and CEO SBF resigned from his position at the exchange.

Press Release pic.twitter.com/rgxq3QSBqm

— FTX (@FTX_Official) November 11, 2022