Crypto assets that are limited in number or tradable in expectation of profit may count as investment instruments that have to publish a prospectus for potential investors, the Belgian financial regulator has said in a consultation published Wednesday.

While the European Union is finalizing its landmark Markets in Crypto Assets Regulation (MiCA), issuers in the meantime need to know if cryptocurrencies are subject to existing securities laws, Belgium’s Financial Services and Markets Authority (FSMA) said.

“While awaiting a harmonized European approach, the FSMA wishes to provide clarity about when crypto-assets may be considered to be securities, investment instruments or financial instruments and may therefore fall within the scope of the prospectus legislation and/or the MiFID conduct of business rules,” said the regulator.

Read more: Brussels’ Fledgling Crypto Industry Flexes Its Muscles

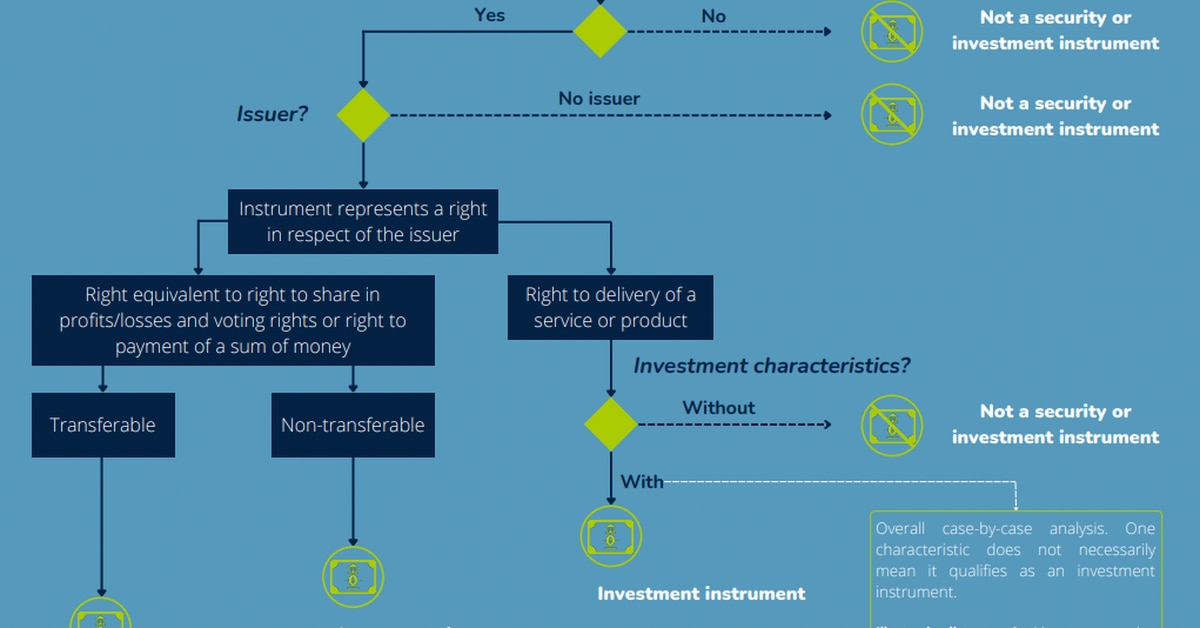

MiCA will oblige crypto issuers to issue a White Paper of information for investors. Until that takes effect – expected sometime in 2024 – regulators will use a bundle of illustrative characteristics to figure out if a cryptoasset falls under the existing prospectus law which applies to stocks and bonds, according to the report.

The EU’s Markets in Financial instruments Directive (MiFID) requires financiers to be clear and honest when approaching potential investors, and not to have conflicts of interest. Assets like bitcoin (BTC) and ether (ETH) wouldn’t be subject to either prospectus or MiFID rules because they have no issuer, but are instead created by computer code, the document said.

Read more: EU Agrees on Landmark Crypto Authorization Law, MiCA