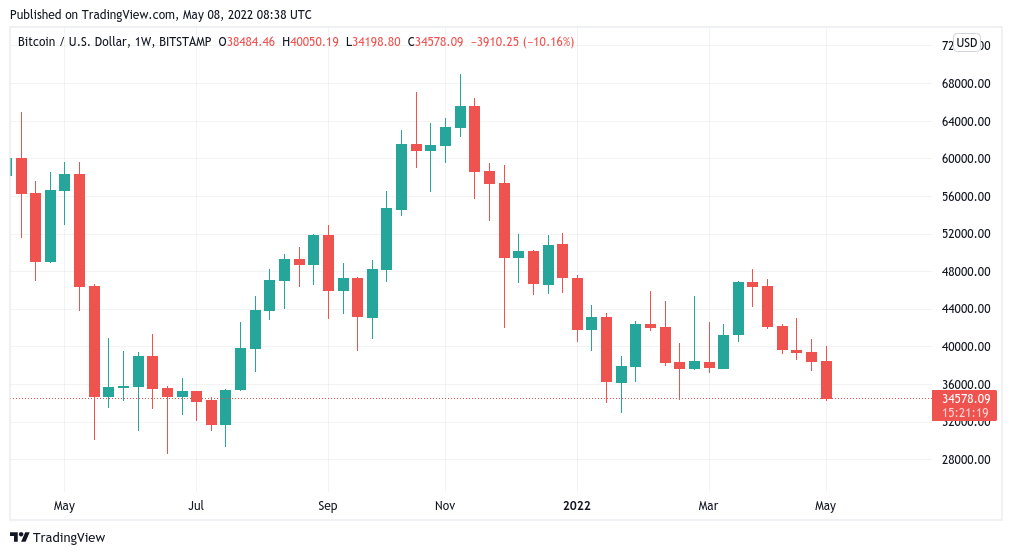

Bitcoin (BTC) is poised for a rare bearish feature to return on May 8 after overnight sell-off pushed the market closer to January lows.

Bitcoin surrounds $34,400 low

Data from TradingView shows that Bitcoin price dropped to $34,200 on Bitstamp and is trading around $500 higher at time of writing. It shows that he is recovering to see. On May 7, BTC found short support near $36,000, but this was lost as weak weekend liquidity added to volatility. However, data from on-chain data source Coinglass shows 24-hour liquidations worth around $80 million for both Bitcoin and Ethereum (ETH).

Updating its short-term price outlook, popular Twitter analyst Credible Crypto predicts a “collapse”, marking the new low of 2022, with Bitcoin price dropping as low as $29,000.

Lows at 34.4k almost taken, so eyes now on a flush into 29-32k along with filling that finex whale's bids. Dude doesn't miss. Not at my comp so no charts, this post is just so you guys don't blow up my phone asking what now lol. Still not expecting lows at 28k to be taken. $BTC https://t.co/K1uhD9n52X

— CrediBULL Crypto (@CredibleCrypto) May 8, 2022

Downward momentum on May 8, Blockchain protocol Accompanied by the news of trouble on Terra

The firm, which promised to buy unlimited amounts of BTC to support TerraUSD (UST), saw its first major test as a market participant selling UST worth approximately $300 million. While the outage was minimal, the UST rate briefly eroded 0.8%. Caetano Manfrini, legal officer at Brazilian crypto business forum GEMMA, says:

The attack on Terra-Luna-UST today was deliberate and coordinated. 285 million UST dumps on Curve and Binance by a single player, followed by massive shorts on Luna and hundreds of Twitter posts.

Now known for both Bitcoin purchases and social media engagement, Terra co-founder Do Kwon has evidently kept his cool.

So, is this $UST depeg in the room with us right now?

No?

I prescribe 24 hours of pegging over the next 7 days pic.twitter.com/GsBss7ACit

— Do Kwon 🌕 (@stablekwon) May 8, 2022

Weekly chart, threatening the bear model that has disappeared for eight years

On weekly timeframes, BTC/USD was close to completing its sixth consecutive red weekly candle – something that happened only once in its history in 2014.

In 2014, Bitcoin’s first halving cycle followed the peak and subsequent decline, and at that time major stock market Mt. It got worse after Gox was hacked. Micheal Van de Poppe, whose analysis we share as Cryptokoin.com , says:

Bitcoin has lost only 6 consecutive red candles so far.

#Bitcoin has only printed 6 weekly red candles in a row ever.

That was May 2014.

Eight years ago!

— Michaël van de Poppe (@CryptoMichNL) May 7, 2022