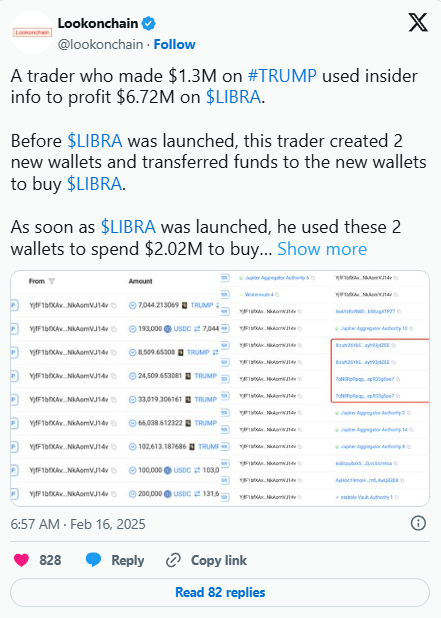

A Memecoin Trader is accused of earning $ 6,72 million on LIBRA transactions using information from inside. According to the report of Blockchain Analysis, Lookonchain’s report, the same trader had earned $ 1.3 million from the process with Trump Token. This re -raised concerns about the use of information in the crypto market.

6.72 million dollars profit from LIBRA transaction

Trader created two new digital wallets just before the LIBRA launch, and transferred large amounts of funds to these wallets. As soon as $ LIBRA was released, 5.08 million LIBRAKEN TOKEN from these wallets. Trader spent a total of $ 2.02 million for this purchase.

Trader, who immediately disposed of the tokens he bought, earned 8.74 million dollars of revenue from this process. Thus, the net provided $ 6,72 million profit. The crypto community suspects that he may have used information from inside by looking at the timing of Trader’s operations. Especially the history of Trump Token increases these doubts.

Investors want a tight regulation

This incident drew attention to the dangers of the use of information from inside in the crypto market. Many investors demand more strict arrangements in the market to provide fair competition and trust. Transparency is critical for the growth of the sector.

According to Lookonchain’s report, traders, who have access to information from inside, can make big gains in a short time with this advantage. The authorities closely examine this situation and investigate whether there is a contrary to the law.

Trust problem in the market and possible future arrangements

Such events for the use of information from inside can cause reliability problems in the crypto world. In particular, individual investors may be adversely affected by such manipulative transactions. When fair market conditions are not met, the confidence of investors is shaken and this can damage the overall growth of the market. For this reason, regulators may work on new measures to increase market transparency and prevent internal use. Making technological control systems more effective and strictly complying with the principles of transparency of crypto exchanges may play an important role in solving this problem.

On the other hand, investors should also make risk management more carefully and be cautious against such speculative movements. In the long run, such arrangements can provide a healthier and more sustainable structure of the crypto market.