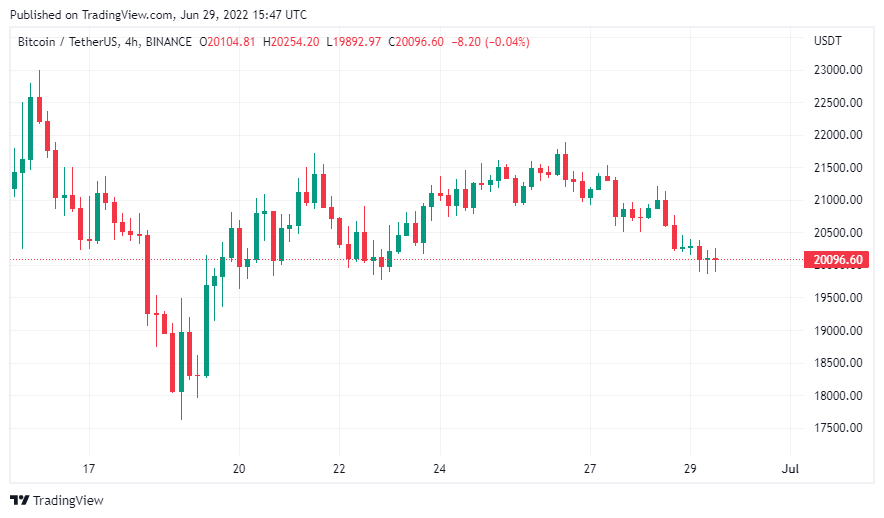

Bitcoin is about to break $20,000 despite all the efforts in recent days. But that doesn’t mean that money doesn’t move behind the scenes. Big money in the market these days is flowing into these altcoin projects instead of SHIB…

Where is the big money flowing in SHIB and the crypto market

Bitcoin has fallen hard this week. This momentum is due to the bankruptcy of a number of macroeconomic and crypto lending companies. Yesterday’s Wall Street Journal bulletin explained the situation as follows:

While short transactions are almost exclusively handled by traditional hedge funds in the US and Europe, crypto firms – particularly those based in Asia – have been happy to facilitate the other side of the transaction.

Tether is still the largest stablecoin by market capitalization today. It was also initially a safe haven for capital fleeing its failed algorithmic rival TerraUSD (UST) in May. But stablecoin watchers have long complained that Tether doesn’t have enough funds to support it. The USD Coin (USDC), which has much more, is rising rapidly. USDC reached a market cap of $55 billion and Tether fell to $66 billion.

FTX and Goldman Sachs seek opportunity in altcoin market

Goldman Sachs said in a statement on Friday:

Web3 crypto funds want to broker a deal in which traditional financial institutions with funds specializing in distressed assets and ample cash will purchase $2 billion worth of assets from Celsius Network.

To remember, cryptocoin.com As we reported, Celsius had 12 billion dollars under management as of May. But it turned out to be too leveraged in the event of a crypto crash. Knowing that its customers are there for returns, Celsius claims customers are still reaping rewards from their savings.

Sam Bankman-Fried, CEO of FTX, already owns a 7.6% personal stake in Robinhood. But he told Bloomberg:

There are no active M&A talks with Robinhood. We’re already excited about Robinhood’s business prospects and the potential ways we can partner with them.

Cryptocurrency market poised to bounce from lows

At the May/June crash, the cryptocurrency market seemed to have gained a low total of around $775 billion (on June 18). Now, the crypto market cap is back to $1 trillion.

As a result, the trajectory we see in the quarterly chart above is strongly correlated with BTC prices. So it’s not just BTC that’s been at its lowest level lately. Bloomberg attributes this to the “Ethereum update” as ETH has increased by about +14% in the last five days. The approach of PoS transition triggers excitement among investments. This comes with a +16% jump for Polygon (MATIC) and +20% for Avalanche (AVAX).

Finally, the total crypto market cap was $2 trillion by April. But in 2021 it exceeded $1 for the first time and then reached $3 trillion for the year. For comparison, the 2018 high was a market cap of $690 billion.