With precious metals gaining momentum towards the end of the year, Main Street investors predict gold and silver will be the top performers in the new year, according to an online survey.

“The performance of gold, silver and platinum was remarkable”

While gold closed the year flat, silver finished 2022 with an increase of about 3%. Spot gold started 2022 at around $1,828 and finished just over $1,822. Spot silver opened last year at $23.28 and closed the year at $23.93. “Thanks to the impressive recovery in the last quarter, the gold price ended the year at the same level as it started,” says Commerzbank analyst Carsten Fritsch.

cryptocoin.com As you follow in 2022, the biggest macro hurdle for precious metals was the Federal Reserve’s historic tightening cycle, which saw its fastest rate of increase since the early 1980s. Overall, rates rose 425 basis points in 2022 to the range of 4.25%-4.5%. Carsten Fritsch comments:

The performance of gold, silver and platinum prices last year was therefore remarkable, given the significant headwind created by significant interest rate hikes by central banks, especially the Fed.

“Gold and silver will do well in the new year”

Looking into the new year, analysts predict gold and silver will do well as markets begin pricing a Fed pivot. Capital Economics expects the Fed to cut interest rates in the second half of 2023. In this context, he makes the following statement:

While the economy appears to have recovered in the fourth quarter, a recession is on the way that will help reduce inflationary pressures further. As a result, we expect interest rates to fall again by the end of 2023, despite the continued hawkishness of the Fed.

What do the survey results show?

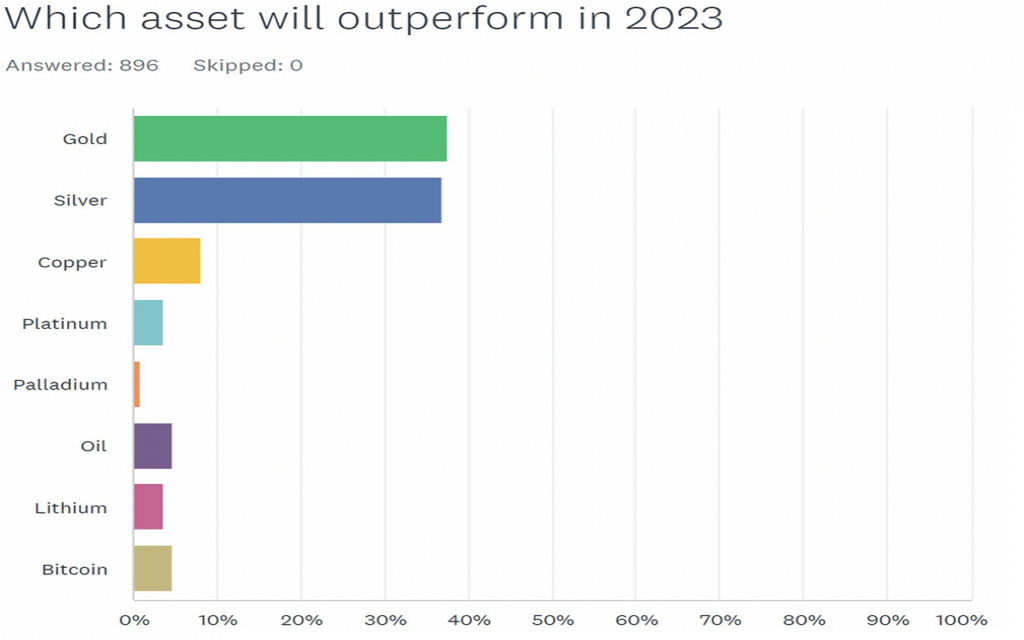

Kitco’s survey results show respondents almost evenly split between gold and silver as the top two choices for top-performing assets in 2023. 37.5% of the 896 respondents predicted that gold will perform best for 2023. 36.8% of the participants choose silver. The third most liked asset in the new year was copper, which received only 8% of the votes.

Also, respondents were split between oil and Bitcoin, with 4.7% of the votes for each asset. Something similar happened with platinum and lithium. Also, 3.7% of respondents voted for each. Palladium garnered only 0.9% of the vote, making it the least preferred choice for 2023.

“I look forward to a weaker dollar”

Wall Street side also expects a rise in gold and silver for 2023. Analysts say gold is in a good position to rally as the US economy slides into recession, the US dollar peaks and the Fed reverses monetary policy tightening. DoubleLine Capital CEO Jeffrey Gundlach thinks the Fed will move another 50 basis points in February, with rates potentially rising to 5% in 2023. However, he states that once the Fed reaches 5%, it cannot keep rates at this level any longer. Gundlach warns of multiple meetings.

The CEO of DoubleLine Capital points to the predictive behavior of gold when explaining why the precious metal is starting to rise. In this direction, “Maybe this is a prediction. I’m looking forward to a weaker dollar. The dollar has peaked,” he says.

“Market sentiment turned in favor of gold”

Daniel Hynes, senior commodity strategist at the Australia and New Zealand Banking Group (ANZ), also thinks market sentiment is turning in favor of gold. He explains his views on this matter as follows:

Gold prices tend to come under pressure before the recession. But then it outperforms other markets (like stocks).

“Gold may even rise above $1,900-2,000”

Wells Fargo’s head of real asset strategy, John LaForge, says gold began to price in with the Fed’s pause, followed by a final turnaround. LaForge further comments:

In the last few months, with all the talk about the Fed’s return, gold has started to rise. In 2023, both gold and silver will do well. Silver can do better.

Wells Fargo predicts that in 2023, gold will be between $1,900 and $2,000. “If we can achieve that, my priority will be to increase these goals,” LaForge says. Meanwhile, gold is still in proving mode, according to LaForge. This is because commodities have performed well over the past few years, but gold has been stuck. “I need confirmation via price that gold is starting to move,” LaForge said. If so, it is possible that it could even go above $1,900-2,000,” he says.

Analysts are even more optimistic about silver than gold.

Many analysts are even more optimistic about silver in the new year. “I’m a little more positive about silver as we’re back at $23,” LaForge said. This is high beta game. In a super cycle of over 10 years on a percentage basis, silver did better than gold. This is what happened in the last cycle between 1999 and 2011. This is typical,” he explains.

Gainesville Coins precious metals expert Everett Millman says silver has also been neglected by investors, so it has a lot of potential at current price levels. “Silver will outperform gold,” Millman said. This is the pattern that emerged during bull runs for precious metals. And his latest action is encouraging,” he says. Also, Millman said, “The current supply for silver investment products is quite limited. Sitting in safes that can be used for bullion and investment products, silver is getting tighter day by day. It is an important issue for 2023,” he explains.