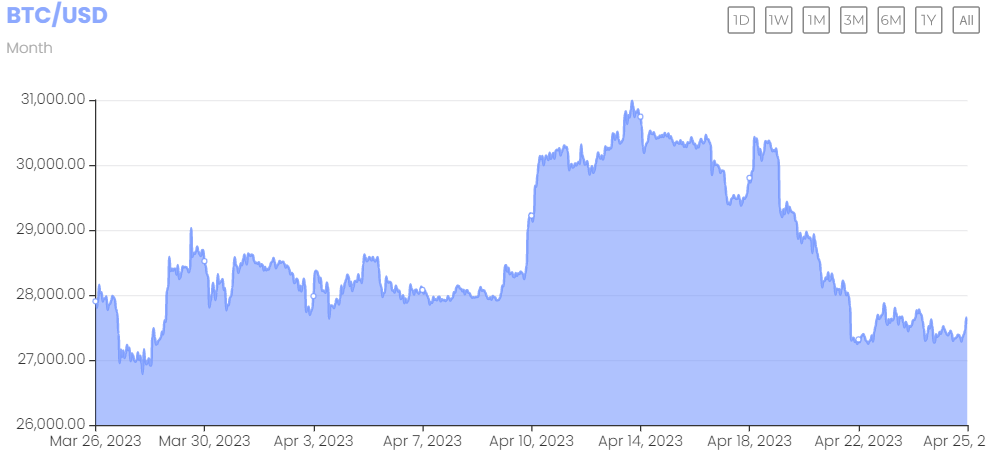

The leading crypto Bitcoin price has entered a bearish trajectory after some strong moves earlier this month. However, BTC managed to hold the $27,000 shadow. So, what’s next for crypto’s route? Analysts are looking for an answer to this question.

What’s next for Bitcoin price by the end of the week?

Bitcoin (BTC) has come under significant selling pressure recently and has lost around 10% on the weekly chart. At press time, Bitcoin is trading at $27,387 with a market cap of $530 billion.

The recent Bitcoin price drop follows the broader market correction, which analysts call a period of consolidation and healthy correction. So, after a staggering 80% gain in 2023, it is highly likely that Bitcoin will go through a period of some cooling before the next rally. Sam Callahan, an analyst at Bitcoin financial services firm Swan Bitcoin, shared:

Market participants appear to be somewhat cautious in light of various economic metrics that point to weakness in the economy, as well as the increased likelihood that the Federal Reserve will keep interest rates higher for longer.

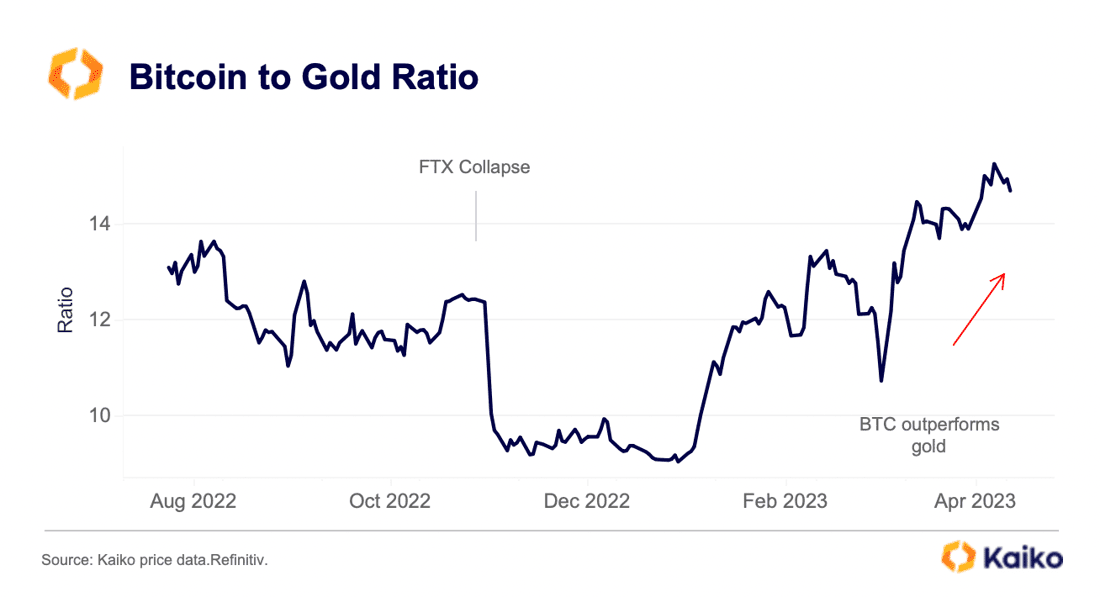

However, despite the current price drop, the Bitcoin-Gold ratio continued to move upwards, according to crypto data firm Kaiko. At the beginning of the year, one BTC was equal to 9 ounces of gold. However, the same rate is currently at 14 ounces of gold.

Source: Kaiko

Source: KaikoKaiko states that the Bitcoin-Gold ratio fell to the lowest levels during the collapse of crypto exchange FTX in November 2022. It also adds:

A rising rate means that BTC is outperforming safe-haven gold despite continued macro uncertainty. This is also a bullish signal.

Bull scenario for bitcoin price

This recent pullback in Bitcoin price has not deterred investors from staying bullish on Bitcoin. BTC has managed to show strong resilience to macro events such as the banking crisis and rising interest rates. That’s why investors are looking at the next big event. So the Bitcoin halving is in focus, which can play an important role in determining the next price increase.

Bitcoin halving basically reduces the number of tokens Bitcoin miners receive as part of their work. As the BTC halving reduces the tokens in circulation, it helps push the price upwards. cryptocoin.com As you follow, Bitcoin’s next halving event will occur in mid-2024 next year. Therefore, analysts give different price targets for Bitcoin. Bloomberg Intelligence analyst Jamie Douglas Coutts expects BTC to reach $50,000 by the 2024 Bitcoin halving. In this context, the analyst makes the following statement:

Bitcoin cycles bottom about 12-18 months before halving. Also, this loop structure is similar to the ones in the past. However, many things have changed. The network is much stronger. However, Bitcoin has never faced a serious long-term economic contraction.

On the other hand, banking giant Standard Chartered recently stated that the BTC price could reach $100,000 by the end of 2024.

The 2023 rally of the leading cryptocurrency is not over yet!

Popular analyst Michaël van de Poppe believes that Bitcoin’s comeback this year will continue despite the recent correction in the broader crypto markets. However, the analyst predicts that Bitcoin will decline to $ 26,600 before continuing its uptrend. The analyst expresses his views on this issue as follows:

Bitcoin will look at a level that we need to maintain. In this case, we need to look at anything between $26,600 and $28,000 as potential entry zones. They have to support themselves. If we do this, it is possible for us to continue (the uptrend). Meanwhile, it takes time for the markets to bounce back.

Source: Michaël van de Poppe/Twitter

Source: Michaël van de Poppe/TwitterAccording to the analyst, Bitcoin bulls need to surpass a key resistance level to end the corrective move. In this context, the analyst shares the following assessment:

Same bowl, same bath for Bitcoin. It cannot exceed $27,800 as the resistance point. We’ll be watching for a sweep at the lower levels until we make a splash. However, $27,800 is crucial for a trend reversal, not $28,800.