The US Securities and Exchange Commission (SEC) said that 3 altcoin projects on the investment giant Grayscale’s list may have security status.

SEC warns Grayscale for these 3 altcoins

First, according to recent regulatory filings by Grayscale, the company is currently responding to questions from the SEC regarding three Bitcoin Trust products. The SEC also said that 3 altcoins on Grayscale’s list may have security status. The disclosures address Grayscale funds, which include cryptocurrencies of the following Blockchains.

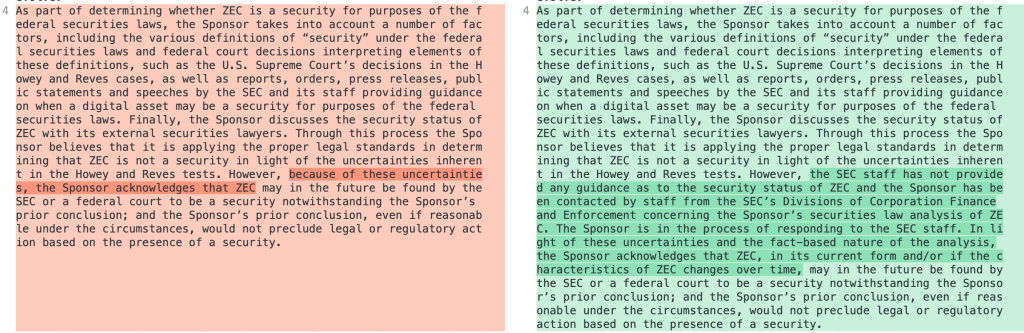

- Zcash (ZEC)

- Stellar (XLM)

- Horizon (ZEN)

The SEC’s questions highlight uncertainty for Grayscale’s line of brokerage-friendly crypto Trust products. He’s also talking to a more aggressive regulator than ever before, determined to crack down on tokens he believes should be subject to US securities law.

Grayscale offers crypto trusts to traditional investors as an easy way to invest in crypto tokens alongside stocks and bonds. Grayscale, a subsidiary of the Digital Currency Group, has billions of dollars’ worth of assets in these products. The most popular are Bitcoin (BTC) and Etehhreum (ETH).

ZEC, ZEN and XLM what’s next?

ZEC, ZEN and XLM have combined just $40 million of Grayscale’s roughly $18.7 billion assets managed by funds and tursts, turning them into small principalities in a formerly much larger empire. Grayscale held around $60 billion in the middle of last November’s market peak before the value plummeted along with the rest of the crypto markets.

While they are relatively small trust products, any uncertainty surrounding the legal status of this trio – namely whether they are securities – underscores the risks of Grayscale’s regulatory gamble. Trust products assume that these cryptos are not securities. If the SEC decides otherwise, Grayscale may have to unplug the trust products from BTC and ETH to these 3 altcoins.