Binance CEO Changpeng Zhao (CZ) expressed his skepticism about the revival plan for the Terra ecosystem and the launch of the new LUNA token. He also pointed out that the LUNA events are a lesson to other altcoins. Here are the details…

Binance CEO Terra (LUNA) talked about the events

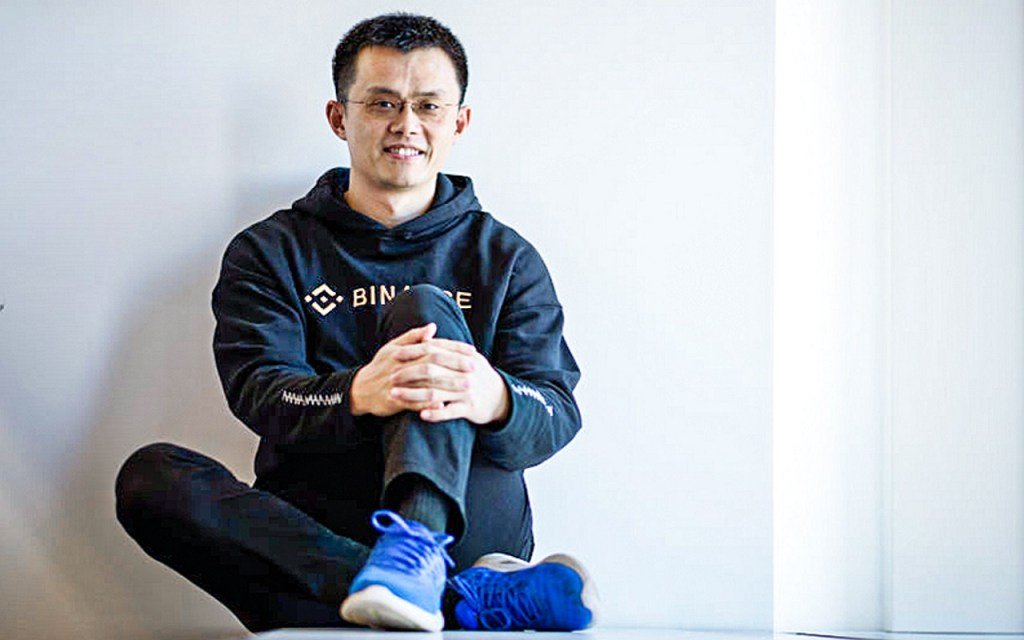

Co-founder and CEO of Binance, the largest cryptocurrency exchange in terms of daily trading volume. Su Changpeng Zhao said in an interview that he was skeptical of plans to revive Terra. CZ used the following statements:

I try not to guess what the community will do. […] Many are skeptical. I am one of them.

Following the collapse of TerraUSD (USD), the Terra ecosystem stablecoin, CZ criticized his team for not properly handling the crisis, pointing to the project’s flaws that led to its collapse. However, as we have reported at Kriptokoin.com , Binance is actively participating in Terra’s revival plan by hosting an airdrop of the new LUNA token. As CZ points out, despite widespread skepticism about the Terra reboot, Binance has a responsibility to help users affected by LUNA’s collapse. “We still need to ensure people’s continued access to liquidity. We should support the revival plan, hoping it will work,” he explained.

CZ: Warning to other altcoins

According to CZ, the Terra debacle should serve as a warning to altcoin projects based on unsustainable business models based on “aggressive incentives” . As he points out, crypto projects like Terra offer high returns to attract people in hopes that they will become profitable once there are enough users. “We have to look at projects in a really fundamental way, […] more than just an incentive payment,” Changpeng Zhao said.

LUNA Classic and its stablecoin TerraUSD (UST) crashed last month. The stablecoin crashed in early May and lost $40 billion in market cap. This led to a significant loss in the entire crypto space. The incident has caused concern among regulatory authorities over the alleged risks that stablecoins pose to the financial system. In the UK, for example, the collapse of the IHR is also briefly mentioned in the new advisory.