Uniswap, the decentralized cryptocurrency exchange behind popular altcoin UNI, has launched a governance vote for its integration into BNB Chain. However, major investment firm a16z showed in the voting process that it does not support this integration. The investment firm’s voting power also caught the attention of Binance CEO Changpeng Zhao. Here are the details…

Uniswap DAO vote messes up

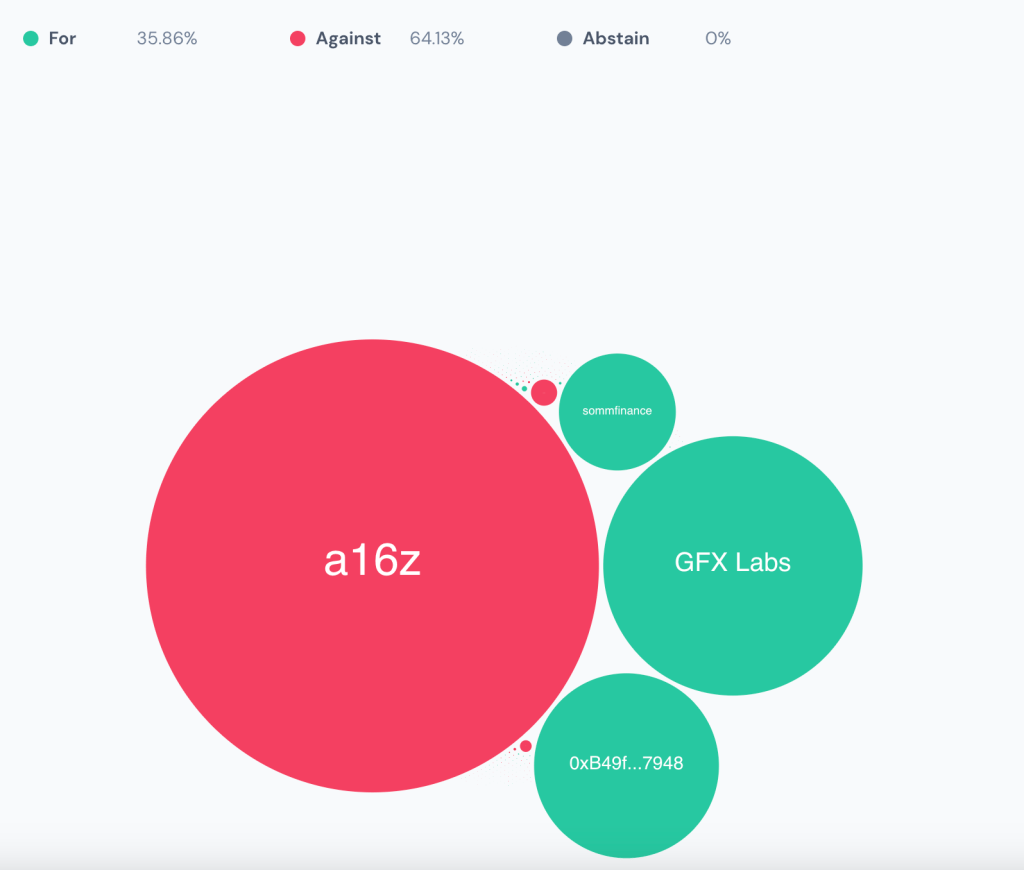

As the Uniswap DAO forum showed, venture capital firm Andreessen Horowitz (a16z) voted against a final proposal to deploy Uniswap v3 on BNB Chain using the Wormhole bridge. The governance proposal to deploy the latest Uniswap iteration on BNB Chain showed 20 million (80.28%) yes votes and 4.9 million (19.72 percent) no votes. But yesterday, venture capital firm a16z cast its 15 million UNIs to vote against the move. Moreover, the company voted with only 3 percent of UNI tokens, which marks 23.4 million votes. The voting period is scheduled to end on February 10.

Behind the conflict is the cross-chain bridge chosen for distribution. The proposal featuring BNB Chain uses the Wormhole bridge while a16z supports the use of LayerZero as an interoperability protocol. The venture firm’s partners have already expressed their intention to vote for LayerZero as the distribution bridge. Eddy Lazzarin, head of engineering at a16z, commented on the proposal discussion forum Jan.

To be perfectly clear, we would vote LayerZero 15 million tokens if we could technically do it in a16z. We’ll have a chance to do that in the next vote.

Wormhole hacked

In the proposal, 0xPlasma Labs states that stakeholders in the Uniswap ecosystem “express a desire to see trustless bridges used for governance for the new Uniswap v3 deployment on BNB Chain.” The proposal says, based on technical evaluations of the four bridges and “very complex discussion and voting on the snapshot, the community has chosen the Wormhole bridge for Uniswap v3 deployment on BNB Chain.” LayerZero team took the second place with 17 million votes.

cryptocoin.com As we reported, in 2022, the Wormhole protocol suffered one of the largest vulnerabilities targeting bridges, resulting in the loss of 120,000 Wrapped Ether (wETH) tokens, worth $321 million at the time. An attacker found a vulnerability in the protocol’s smart contract and managed to mint 120,000 wETH without collateral on Solana before exchanging it for ETH.

LayerZero is in a16z’s portfolio: Binance CEO reacts

Also, LayerZero Labs is part of the portfolio of the a16z initiative. In March, the protocol dedicated to Omnichain decentralized applications raised $135 million in a funding round led by a16z and Sequoia, among other investors, and gained “unicorn” status with a valuation of $1 billion.

Uniswap controlled by a16z? https://t.co/9QTi1KjVjG

— CZ 🔶 Binance (@cz_binance) February 5, 2023

This caught the attention of Binance CEO. Quoting a tweet referring to a16z’s LayerZero investment, “Is Uniswap controlled by a16z?” asked the question. He then tweeted, “Then on-chain voting means big whales control the blockchain. Just like the shareholders,” he said.

On chain voting just means the large whale(s) control the blockchain then. Just like shareholders. We were just discussing this at the conference yesterday.

— CZ 🔶 Binance (@cz_binance) February 5, 2023