Binance drew attention to an important point today. Accordingly, the issue of tokenization has gradually started to take place on the agenda. Despite being in the early stages of development, there is enthusiasm. Accordingly, the tokenization of real-world assets (RWA) has received significant attention in recent years. It has also attracted both users and large corporate players. Let’s take a look at Binance’s report.

Binance and the rise of real-world asset tokenization

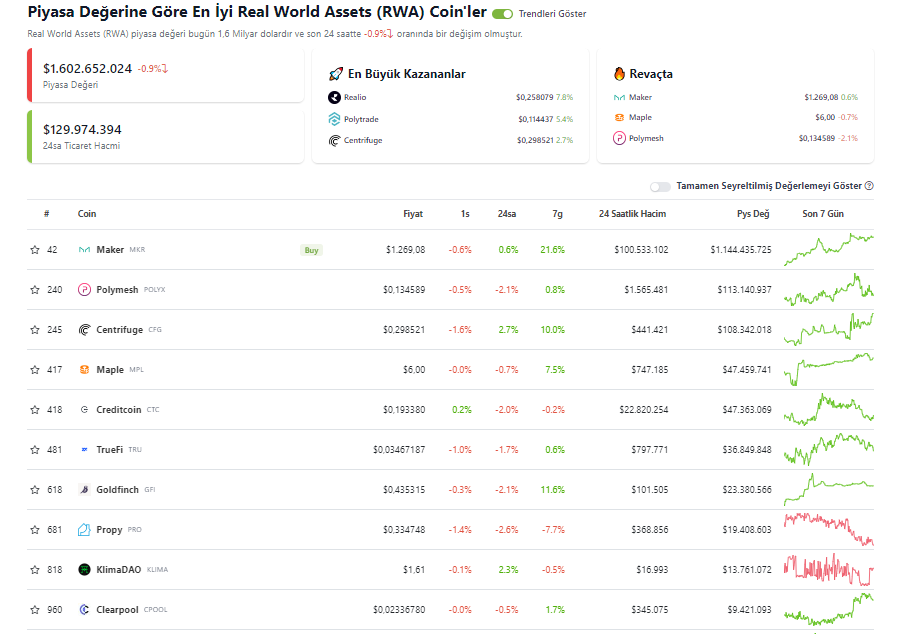

A new study reveals interesting results. It shows that RWAs have emerged as the 10th largest industry in DeFi, according to protocols followed by DeFi Llama. It also points out that it was ranked 13th about a month ago. The latest report from Binance Research also has a different emphasis. Binance emphasizes that “The rise in the rankings of RWAs as an industry is a testament to the increasing adoption of RWA protocols.” Moreover, the newly announced stUSDT has become an important trend-catalyzing factor.

The data compiled by Binance Research is interesting. There are currently over 41,300 RWA token holders on the Ethereum blockchain. In addition, this number represents a 130% increase compared to the 17,900 recorded at the beginning of the year. Tokenized US Treasuries are another highlight in the RWA industry lately.

RWA and US Treasury term in Binance report

In the Binance report, the term “US Treasury” refers to debt issued by the US government, which is known for its role in traditional financial markets as a benchmark for risk-free assets. As interest rates rose, yields on these Treasuries gradually climbed, significantly outpacing DeFi yields.

Intuitively, all else being equal, capital goes where returns are most competitive. US Treasuries come to the fore here. According to the Binance report, investors who have seen the benefits of RWAs can now enjoy real-world returns by investing in tokenized treasury bonds without leaving the blockchain. According to the report, the tokenized treasury market is worth approximately $603 million. This means that investors lent this amount to the US government at about 4.2% APY.

$16 trillion market by 2030

There are estimates in a study conducted by the Boston Consulting Group. It is estimated that tokenized assets will be a $16 trillion market by 2030. By the end of the decade, this projected growth will result in the tokenization of assets equivalent to 10% of global GDP.

This estimate takes into account both on-chain asset tokenization, which is particularly relevant to the blockchain industry. It is also in line with the Binance report. It also takes into account traditional asset fragmentation such as exchange-traded funds (ETFs) and real estate investment trusts.

Supporting the adoption of real-world asset tokenization

Other than the Binance report, according to some experts, the adoption of RWA will have a different dimension. He believes that Central Bank Digital Currencies (CBDCs) will be powered by the emergence of tokenized assets in games and blockchain-based payments on social media. Others view that “partial ownership is the key premise” for the adoption of the RWA.

Tokenization of real world assets is proving to be a transformative trend with enormous growth potential. According to this cryptocoin.com As the market expands and technological advances continue, a different situation will emerge. Investors and institutions will see the benefits of tokenizing real-world assets within the blockchain ecosystem. They will also increasingly accept RWAs.