Binance, the world’s largest crypto exchange by trading volume, has extended its spot market share across crypto exchanges for a fourth consecutive month.

The exchange market share increased from 59.4% in January to 61.8% in February, according to a report from crypto market data provider CryptoCompare. Binance had a 13.7% increase in its spot volumes to $504 billion, an all-time high market share for the exchange.

This comes as regulators in the U.S. and beyond have ratcheted up their scrutiny of the exchange in recent months. Most recently, a U.S. Securities and Exchange (SEC) official said that agency staff believe Binance.US may be operating an unregistered securities exchange in the U.S., an assertion to which Binance.US objected. Binance is a corporate entity that operates in US through Binance.US.

“Despite the recent criticism the exchange has received, market participants continue to take shelter on Binance under the premise that the largest exchange is seen as one of the safer trading venues,” said Jacob Joseph, a research analyst at CryptoCompare, in an interview with CoinDesk.

Joseph also attributes the exchange’s dominance to the vast amount of liquidity available on Binance, which means reduced slippage costs and spreads, an attractive benefit for traders. “It is one of the exchanges with the most trading pairs and services available,” Joseph said.

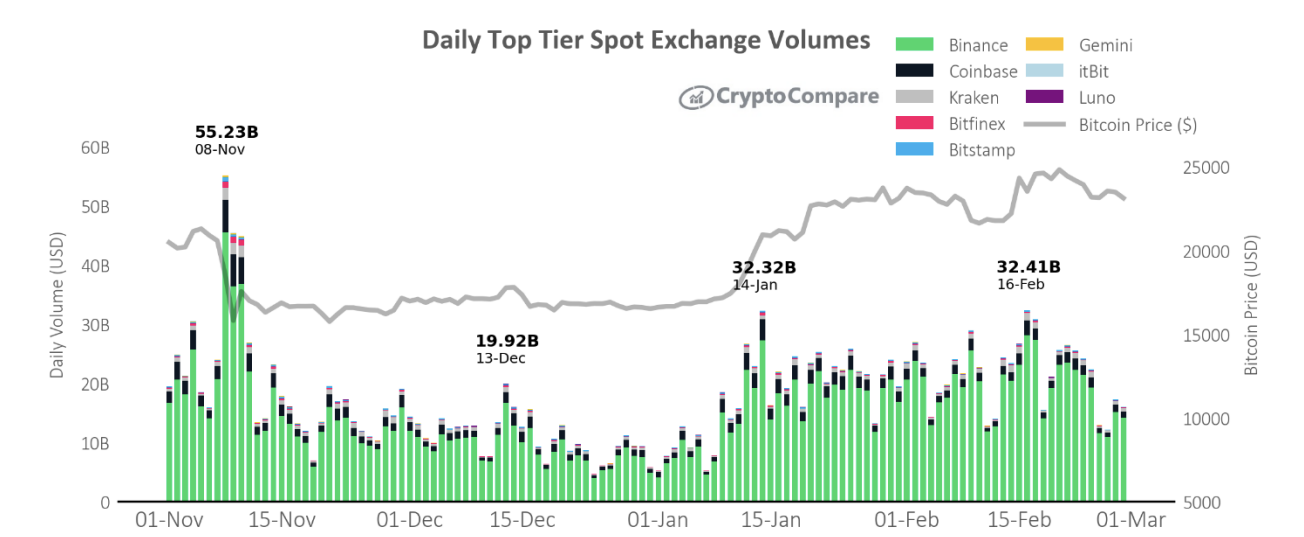

Coinbase is second to Binance in volume, trading $39.9 billion (down 29% from the previous month), followed by Kraken, which traded $19.3 billion (down 11%.)

(CryptoCompare)

In February, Binance’s market share across derivative exchanges also grew, climbing to 62.9%, its highest-ever recorded monthly market share, according to the report. Exchanges OKX and Bybit followed with 14% and 13.3% market share, respectively.