UST, an algorithmic stablecoin pegged to the US dollar belonging to the Terra ecosystem, fell by 40 percent against the dollar to $0.60 today. Normally, the value of this coin was supposed to be stable at $1. Terra (LUNA) also experienced a 60 percent drop. Following these developments, Binance, the world’s largest cryptocurrency exchange by trading volume, temporarily suspended the withdrawals of LUNA and UST. Here are the details…

Binance halts LUNA and UST withdrawals

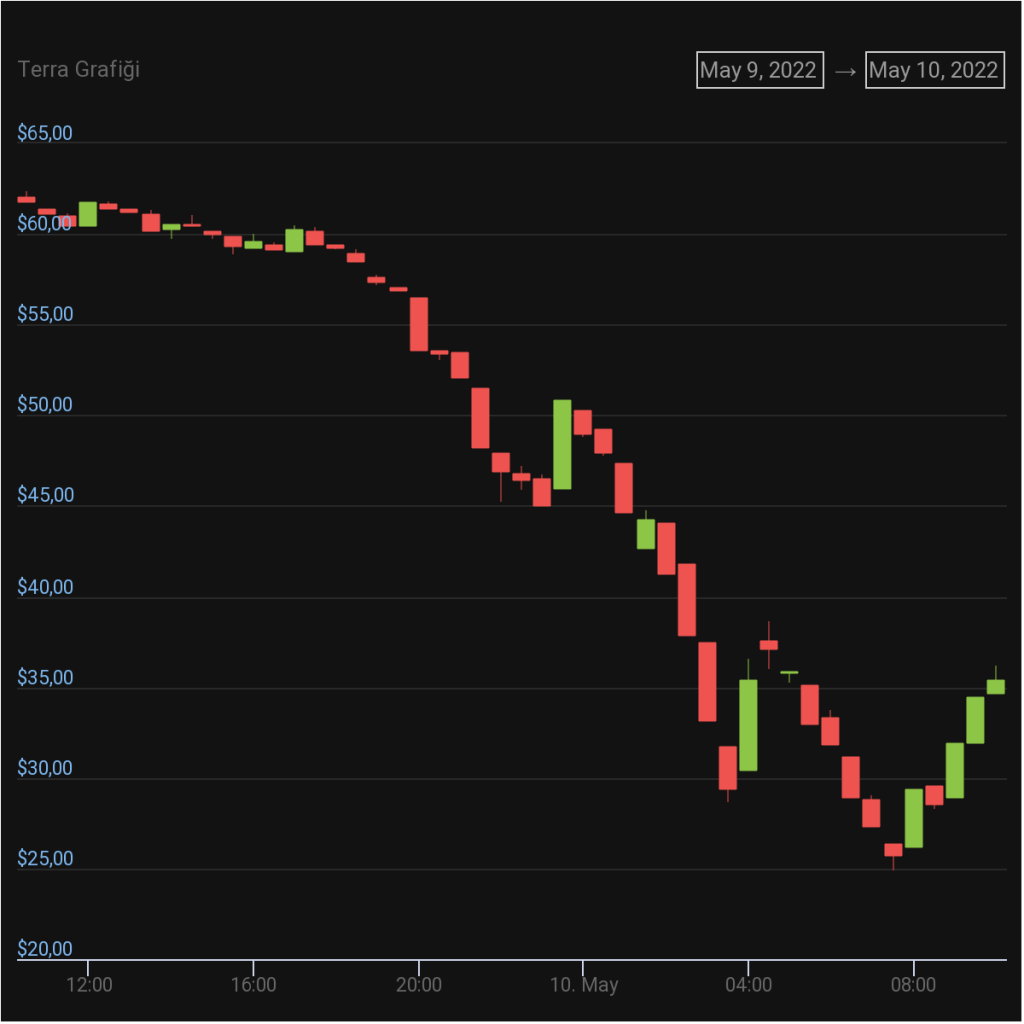

Terra’s algorithmic stablecoin UST’s price dropped a staggering 40 percent against the dollar at 0.60 fell to the dollar. This resulted in the massive liquidation of Terra’s native cryptocurrency LUNA, as well as UST. LUNA dropped from $62.34 to $24.85 in the 24-hour range. At the time of writing, it is changing hands at $ 35.84. Following these developments, crypto exchange Binance announced that it is temporarily suspending withdrawals on its LUNA and UST stablecoin. The official announcement is as follows:

Withdrawals for LUNA and UST tokens on the Terra (LUNA) network are temporarily suspended as of 05:20 on May 10, 2022 due to large pending withdrawals. This is due to network slowness and congestion. Binance will restart withdrawals for these tokens once we detect that the network is stable and pending withdrawal volume is decreasing. We will not notify users with any further announcement. We apologize for any inconvenience.

24h LUNA chart

24h LUNA chart Luna Foundation Guard start liquidating BTCs? As

Kriptokoin.com , the Luna Foundation Guard, known to hold large amounts of Bitcoin (BTC) in its reserves, is seeking Bitcoin to buy UST and stabilize the troubled UST stablecoin. began to liquidate its reserves. According to available data, LFG’s BTC address transferred 28,205 BTC to Binance. Previously, he transferred 42,530 BTC.

However, the latest update by Luna Foundation Guard shows that Bitcoin reserves are loaned to market makers (MM). It is stated that a certain part of the most recently withdrawn amount of 37,000 BTC was loaned to MMs, while a certain part was used to purchase UST.