Things have turned around for CyberConnect (CYBER), which debuted on Binance Launchpad and led the week’s gains. After the liquidity crisis, Binance struggled with the double-digit falling price.

CyberConnect (CYBER) started wiping all earnings after recent developments

Things turned around in just 24 hours for CYBER, a Binance-backed project. The altcoin, which made ATH on September 1, fell in double digits after a sudden liquidity crisis today. cryptocoin.comWe have included the reasons behind the decline in this article.

Just a day ago, CYBER recorded its new high of $15 on Upbit. As seen in the chart below, its price is currently down 18% and trading in the $8 region. Binance, on the other hand, reduced the leverage rates for CYBER in its first move…

Binance lowers CYBER’s leverage

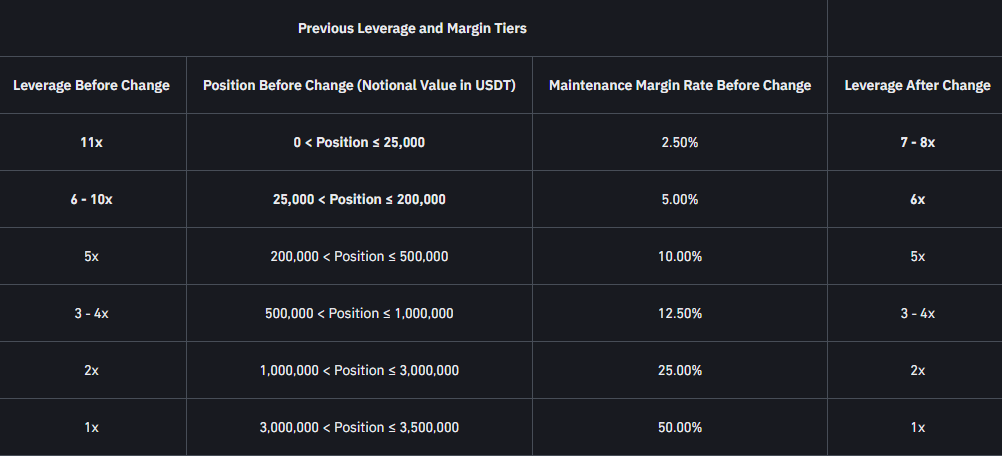

Recently, Binance Futures announced that it will update the CYBERUSDT U leverage ratios. The exchange is lowering the leverage rates for CYBER tonight at 23:30. Open positions must be closed before this date. Binance reported that any remaining open positions will be automatically closed.

#Binance Futures will adjust the leverage and margin tiers of the USDⓈ-M CYBERUSDT Perpetual Contract at

🗓 Sep 2 2023, 10:30 (UTC)

Read more ⤵️https://t.co/EIVLVyNzD5

— Binance Futures (@BinanceFutures) September 2, 2023

Leveraged positions allow users to take positions with a multiplier at a determined rate against collateral. These include odds like 10x, 7x or 5x. With the latest announcement, Binance is updating its leverage rates for CYBER with the following rates. Accordingly, the 11x leverage was updated to 7-8x. This decision will provide more stability for the altcoin.

Why is the CYBER price falling? Will the Binance move be enough?

CyberConnect announced today that its much-anticipated proposal, CP-1, has been rejected. CyberConnect’s official Twitter account @CyberConnectHQ said:

The CP-1 snapshot offer had an error and was therefore rejected. The intended use of Community Treasury to provide liquidity was 1,088,000 CYBERs, which was already unlocked.

There was a mistake in the snapshot proposal CP-1 and so it was rejected. The intended usage of Community Treasury for providing liquidity was 1,088,000 CYBER which was unlocked already.

— CyberConnect (@CyberConnectHQ) September 2, 2023

The main objective of the CP-1 proposal was to increase the liquidity of the CYBER token on the Ethereum (ETH), Binance Smart Chain (BSC) and Optimism networks. According to the announcement:

To optimize CYBER liquidity in ETH, BSC, Optimism networks, we propose a set of active balancing strategies for CYBER token in these networks.

New asset balancing strategy

The proposal outlined a number of active balancing strategies, including:

- Deploying Bridges: The plan was to deploy CYBER-ETH, CYBER-BSC and CYBER-OP bridges powered by LayerZero’s ProxyOFT. This will allow users to bridge CYBER from any network to another via Stargate.

- Use of Community Treasury: The CyberConnect foundation aimed to use 1,088,000 unlocked CYBER tokens from the Community Treasury to provide liquidity to these bridges. The foundation aimed to have 25,000 CYBERs on each of the CYBER-ETH, CYBER-BSC and CYBER-OP bridges.

- Supply Maintenance: In case of liquidity problems in any of the networks, the foundation will burn and mint cross-chain CYBER tokens to ensure a balanced supply. The total supply of CYBER tokens across all networks will remain stable at 100,000,000.