According to current reports, Binance is preparing to launch zero-commission trading opportunities in multiple countries starting tomorrow. The leading exchange had previously followed a similar method with TUSD and had seen a clear trend in transaction volumes.

Binance aims to attract new investors from these countries

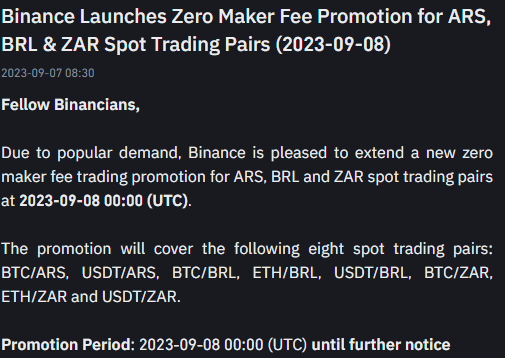

Crypto exchange Binance announced that it will expand its zero-fee trading promotion to include Argentinian, Brazilian and South African currency spot trading pairs starting Friday. According to the blog post, Binance users will be able to buy and sell Argentine peso, Brazilian real, and South African rand as well as Bitcoin (BTC), Ethereum (ETH), and USDT on the spot market without paying any fees. While makers create and wait for orders, buyers will provide liquidity by taking existing orders.

This move by Binance comes as the company faces legal and regulatory challenges in the US and Europe. The trading volume of the exchange is currently hovering at the lowest levels since 2019. Binance shut down crypto payment service Connect last month to focus on its core products. It has also decided not to issue branded debit cards in Latin America and the Middle East.

According to Chainalytic’s report, volume from developing countries is quite significant for crypto exchanges. This is because developing countries are more willing to adopt cryptocurrencies. Especially in countries with weak financial systems like Argentina, many people are turning to cryptocurrencies. People feel the need to store value or hedge against fluctuations in the local currency.

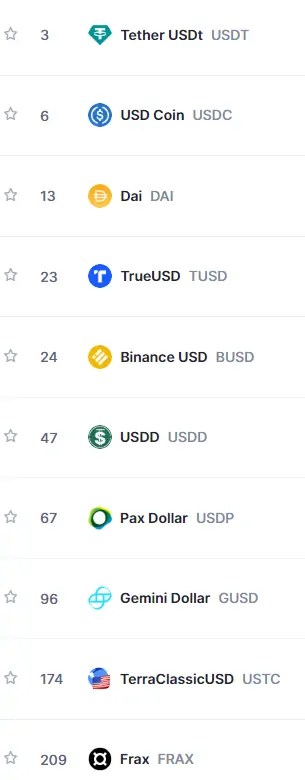

Additionally, Binance expanded its zero-fee promotion on trades earlier this year with offshore stablecoins TrueUSD (TUSD) and First Digital’s FDUSD. This step demonstrates the crypto exchange’s intention to promote access to different cryptocurrencies. These promotions significantly support e-global crypto trading.

FDUSD continues to gain volume

Previously, Binance launched zero-fee trading for First Digital FDUSD, the new stablecoin it supports. More specifically, all transaction fees for BTC/FDUSD are being canceled as part of Binance’s campaign. At the same time, maker fees for ETH/FDUSD will be 0% until further notice.

Binance has turned to new alternatives as BUSD issuer Paxos previously faced hurdles. Following this action, Binance encouraged trading with TrueUSD (TUSD) by waiving fees. TUSD trading volume has skyrocketed since then. Meanwhile, its market value rose to approximately $3 billion.

FDUSD is issued by a registered trust owned by First Digital under Hong Kong’s crypto rules. cryptocoin.comAs we reported, it recently broke a record with Binance support.