Binance, the world’s leading cryptocurrency exchange, has announced a number of exciting updates to its platform, including the addition of new loanable assets on Cross Margin and Isolated Margin. In addition, Binance has expanded its loanable assets and collateral assets in Flexible Credit and VIP Credit, giving users more flexibility and borrowing options. Here are the details…

Binance adds two new margin pairs

Binance users now have access to two new borrowable assets on cross and isolated margin. The newly added cross margin pairs are QUICK/USDT and WLD/USDT, while the isolated margin pair is QUICK/USDT. This addition expands the range of assets available for trading and borrowing on the Binance platform, meeting the needs of different traders and investors.

New altcoins available in flexible and VIP credit

The Flexible Credit and VIP Credit services on Binance have been enhanced with a variety of new lending and collateral assets. Users can now take advantage of the following loaned assets:

- Flexible Credit:SHIB, WLD, PROM, SFP, KDA, BAT, BAND

- VIP Credit:WLD, ORN, QI, OXT, SYS, ARDR, MOVR

In addition, collateral assets in both Flexible Loan and VIP Loan have been expanded to include:

- Flexible Credit:GRT, PROM, PEPE, ENS, SFP

FUSD trading will begin on Binance

cryptocoin.com As we reported, in another important announcement, Binance is preparing to list its new stablecoin First Digital USD (FDUSD) for spot trading. The trading pairs for FDUSD will be BNB/FDUSD, FDUSD/BUSD and FDUSD/USDT. Deposits for FDUSD have already started, allowing users to prepare to trade when it opens at 11:00 CEST on 26 July 2023. Withdrawals for FDUSD will begin at 11:00 AM on July 27, 2023.

Dual Investment products have been renewed

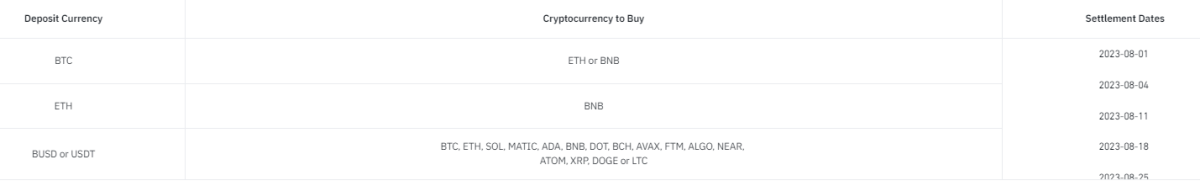

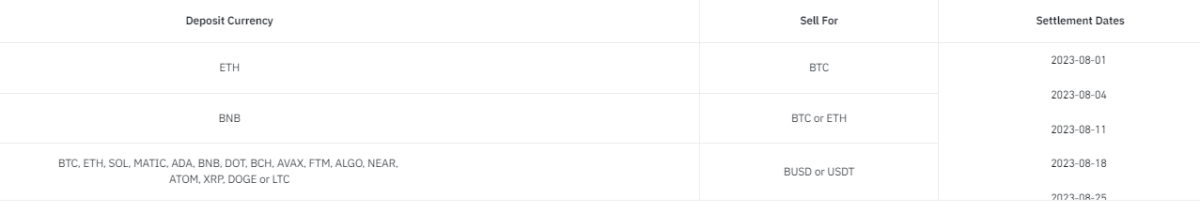

Binance has also launched a new suite of Dual Investment products with updated target prices and settlement dates. Dual Investment allows users to choose certain prices and dates in the future to buy or sell cryptocurrencies without any fees. Subscription for Binary Investment products will be on a first come, first served basis. High sell products are designed for users who want to accumulate high rewards on their cryptocurrency holdings or sell their deposited currency at a higher price in the future compared to the market price at the subscription date.

Bottom buying products, on the other hand, appeal to users who want to accumulate rewards in stablecoin holdings or purchase cryptocurrencies in the future at a lower price than the market price at the subscription date. Available deposit currencies include BTC, ETH, and BNB, with payout dates spread throughout the year.