Binance, the largest cryptocurrency exchange by trading volume, has made a delisting announcement for certain altcoin pairs. The announcement specifically covers spot trading pairs. Here are the details…

Binance delists 5 altcoins

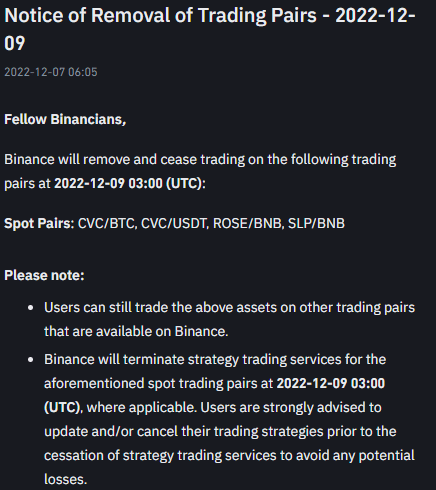

The leading exchange announced in a delisting announcement recently that it will delist BTS/BTC, KEY/ETH, AION/BTC, ATOM/BRL and OKI/ETH trading pairs. Transactions will end on January 27 at 06:00. In the official announcement, the exchange warns users to terminate their positions and close their open orders before this date:

Binance will terminate its strategy trading services for these spot trading pairs as of 01/27/2023 06:00 (UTC), where appropriate. Users are strongly advised to update and/or cancel their trading strategies prior to the expiration of strategy trading services to avoid any potential loss.

Leading exchange allegedly trading for confiscated Bitzlato

Binance has been on the agenda recently with money laundering charges from the USA. A Reuters report dated January 24 suggested that there were Binance transactions on Bitzlato, which was shut down last week. Bitcoin traded by transaction volume, Reuters reported on Tuesday, citing data from blockchain research firm Chainalysis. cryptocoin.comWe have included the details in this article.

According to Reuters, Binance processed 205,000 transactions on behalf of Bitzlato between May 2018, when Bizlato was shut down after the US Department of Justice accused it and its founder of money laundering. The report also suggests that around $90 million worth of Bitcoin transfers were made after August 2021, when Binance said it would begin requiring stricter background checks from customers to combat financial crime.

Binance was named one of Bitzlato’s top three counter companies by the US Treasury Department’s Financial Crimes Enforcement Network. To date, neither Binance nor Chainalysis has commented on the allegations. The exchange has also come under pressure from regulators around the world in recent months, who have been concerned about the potential for cryptocurrencies to be used for money laundering and the risks to consumers from volatile crypto trading.

Binance, whose holding company is registered in the Cayman Islands, said it was reducing its product offerings, including leveraged trading and equity-linked tokens, and wanted to improve relations with regulators. However, a suspicious transaction that surfaced on January 24 shows that Binance has broken its promises. It has emerged that some client funds are held in the same wallets as internal collateral, although Binance has previously said it keeps corporate and client funds in separate accounts.