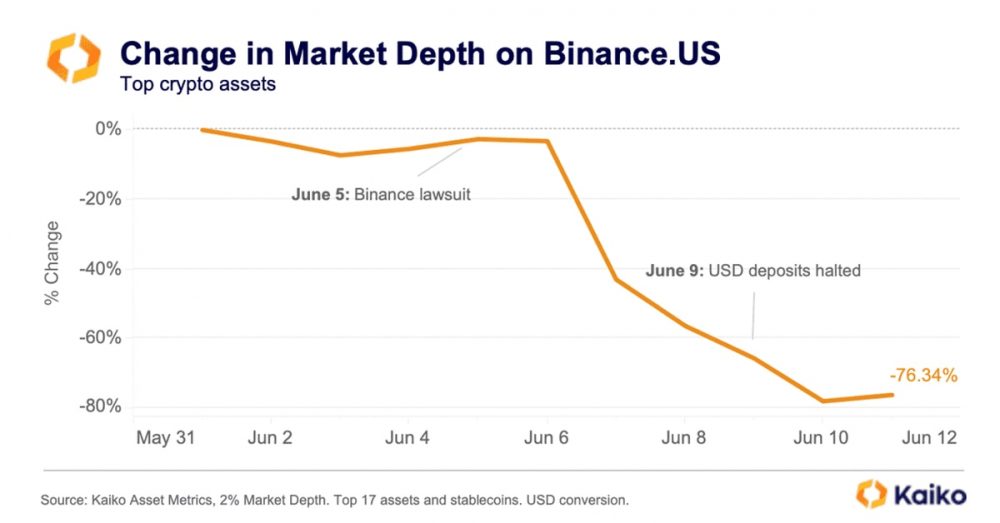

Binance.US is witnessing market makers and traders flee the exchange en masse following last week’s U.S. Securities and Exchange Commission lawsuit against it, alleging multiple securities violations.

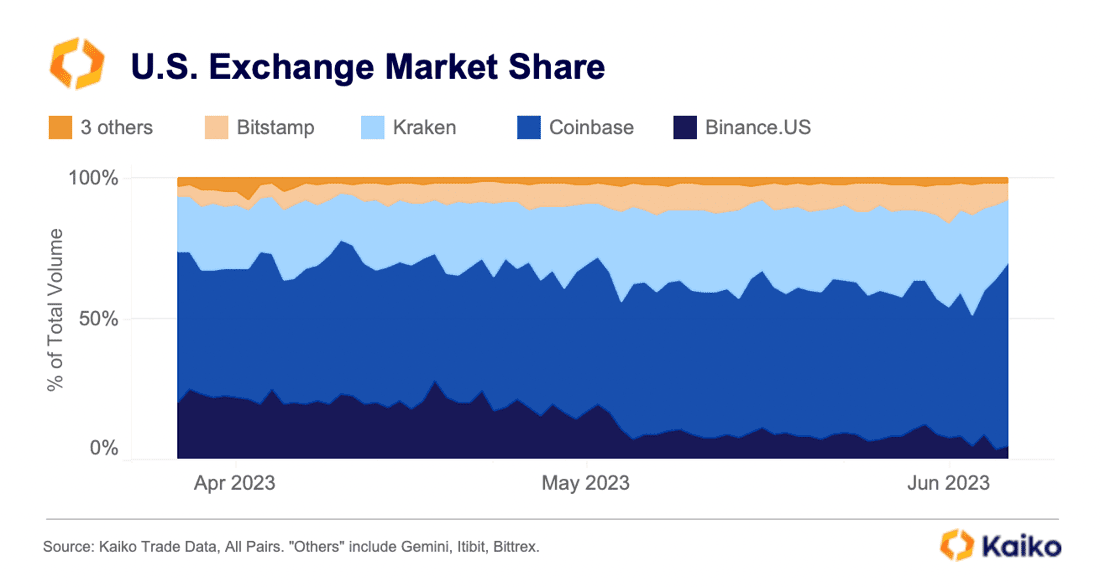

Just one week after the lawsuit, liquidity, which is measured by aggregated market depth for 17 tokens on Binance.US, has dropped 76%, according to a report by Kaiko. The U.S. arm of Binance also saw its U.S. market share drop to 4.8% from 20% in April.

The day before the lawsuit, June 4, market depth was at $34 million, whereas on Monday, market depth was at $7 million, according to the report.

The SEC sued Binance, the operating company for Binance.US and founder and CEO Changpeng “CZ” Zhao. Binance global also witnessed a drop in market depth, dropping 7% since the start of June.

“Binance’s market depth initially held steady, even increasing in the immediate aftermath of the lawsuit, but over the weekend fell as altcoin markets sold off,” said the Kaiko report.

Binance isn’t the only exchange suffering from a drop in market depth. U.S.-based Coinbase, which was also sued by the SEC last week, saw its liquidity drop by 16% over the same time period.

“The sharp drop in liquidity suggests market makers are nervous and want to avoid volatility-induced losses and the non-negligible possibility that their assets could get stuck on an exchange à la FTX collapse,” said the Kaiko report.

The report noted that although Binance.US’s market share dropped to 4.8% in June, Coinbase’s market share increased over the past week from 46% to 64%, for reasons that are unclear, said Kaiko.