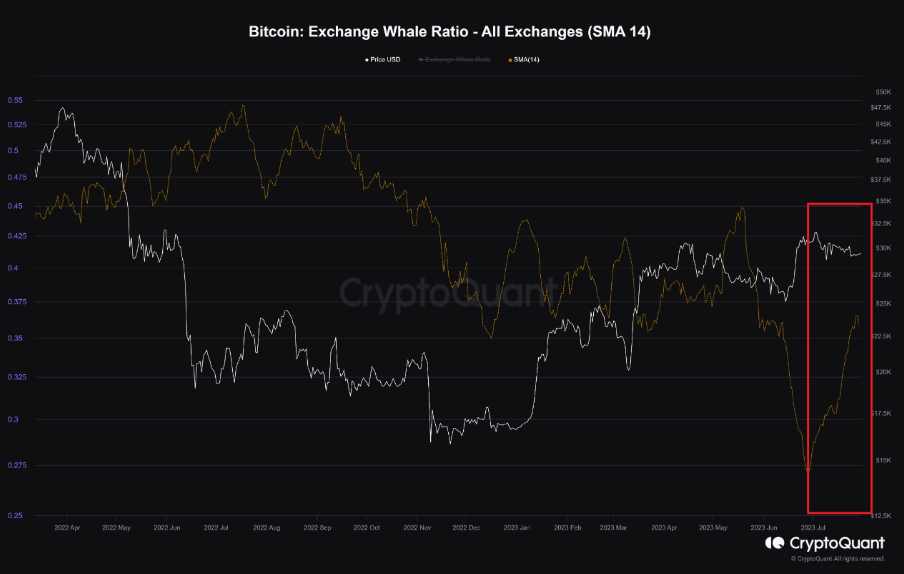

According to data provided by CryptoQuant, the cryptocurrency market has seen a surge in whale activity in recent weeks, especially in the derivatives market. The Stock Whale Ratio, a key metric used to measure the participation of major players in the market, has seen a significant increase of over 30 percent since the beginning of July. This increase is heavily linked to the derivatives sector, raising eyebrows among on-chain analysts who suspect that Binance whales may be behind the increased selling pressure. Here are the details…

Binance whales take action

Calculated by dividing the top 10 listings by the overall listings of a particular exchange, the Stock Whale Ratio is an important indicator for assessing the impact of major players in the cryptocurrency market. A significant increase in this ratio indicates that large investors, commonly known as whales, are actively participating in the trading activities of the stock market. Upon closer examination of the data, on-chain analysts concluded that the Binance exchange could be the driving force behind this notable increase in Whale Rate. It has been reported that whales have deposited a significant amount of Bitcoin (BTC) on the Binance platform, leading to speculation that these whales may be responsible for the observed fluctuations in the metric.

The increase in selling pressure from Binance whales is being watched closely by experts and investors alike, as it has the potential to significantly impact market dynamics. Large-scale trading by whales can trigger volatility. It can even affect the overall sentiment among individual traders and institutional investors. Cryptocurrency markets have long been known for their proneness to large price fluctuations. The participation of whales in the derivatives market could exacerbate these volatility. An increase in the Stock Whale Ratio signals a bullish outlook for some investors, while others may perceive it as a sign of potential market manipulation.

Market metrics are critical for cryptocurrencies

It is important to remember that while whale activity is important, it is not always indicative of bearish or uptrends. Sometimes whales can use complex trading strategies to hedge their positions or manage risks more effectively. However, the spike in whale activity calls for caution from both market participants and regulators. CryptoQuant’s findings have sparked a dialogue between experts and enthusiasts about the consequences of increased whale activity in the derivatives market. It highlights the need for sound risk management strategies and continuous monitoring of market metrics to ensure market stability and investor confidence.

As a result, the recent surge in whale activity in the cryptocurrency market, particularly in the derivatives sector, has created both excitement and anxiety among investors and analysts. The significant increase in the Stock Whale Ratio indicates the active participation of major players, possibly due to the Binance whales investing significant amounts of Bitcoin in the exchange. While this increased activity points to a bullish outlook for some, others remain cautious, seeing potential market manipulation. Since the cryptocurrency market is always open to price fluctuations, the inclusion of whales in the derivatives market can exacerbate these fluctuations, affecting overall market sentiment and stability.