The movements of large investors (whales) in the cryptocurrency world carry important signals that can cause fluctuations in the market. Particularly high volume transfers not only cause sudden fluctuations in market prices, but also become important signals for other investors. In recent days, major Binance transactions regarding Aave (AAVE), Pepe (PEPE), and MANTRA (OM) tokens have attracted attention.

AAVE, PEPE whales made large transfers to the Binance exchange

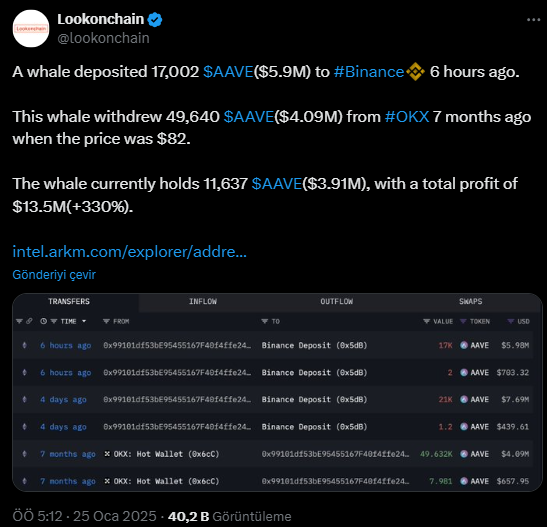

In a notable transaction in the Aave (AAVE) ecosystem, a whale transferred a total of 17,002 AAVE (approximately $5.9 million) to the Binance exchange. According to on-chain data, this whale purchased 49,640 AAVE seven months ago at approximately $82 per token, for a total of $4.09 million. AAVE’s current price stands at $328, which represents a 272% increase compared to last year. However, the token is still 50% below its peak of $666 four years ago. This whale made a total profit of $13.5 million with its previous transactions, giving a return of 330%.

On January 26, a whale wallet named “marketparticipant.eth” transferred 325.48 billion PEPE tokens (approximately $4.9 million) to the Binance exchange, according to data from Ember Monitor. This whale has made many transactions with PEPE in the last 10 months and made a total profit of $1 million. PEPE continues to be one of the popular meme tokens, especially attracting the attention of small investors.

Strategic decision from OM whale

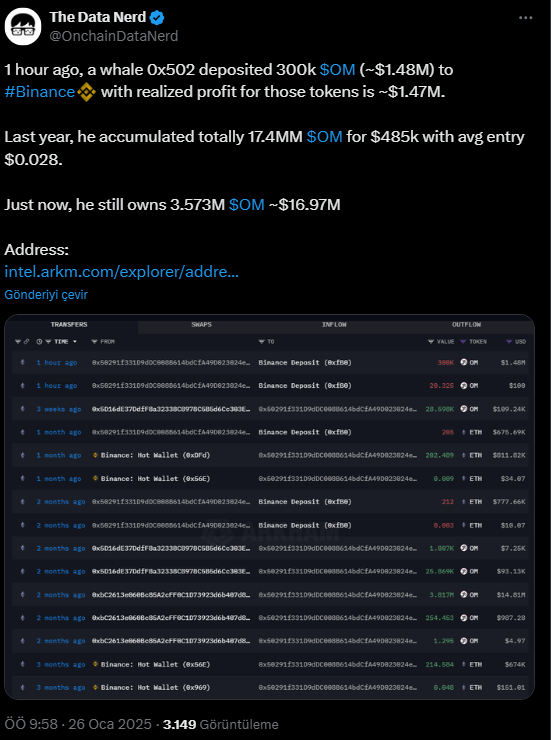

According to information provided by The Data Nerd, on January 26, a wallet named Whale 0x502 deposited 300,000 OM tokens (approximately $1.48 million) to Binance. The total profit from these transactions was recorded as 1.47 million dollars. This whale invested $485,000 in the last year, purchasing a total of 17.4 million OM tokens at an average price of $0.028. The total value of these assets held by the whale, which currently owns 3.573 million OM tokens, is approximately $16.97 million.

The movements of whales in the crypto market can have significant effects on both prices and investor perception due to large transaction volumes. These transactions, which take place in different tokens such as AAVE, PEPE and OM, are carefully monitored by investors. Because these strategic moves of whales have the potential to trigger fluctuations in the market.