Cryptocurrency exchange Binance will list Arbitrum (ARB) in USD and USDT pairs. Meanwhile, an Arbitrum whale sold its tokens. Ethereum scaling solution Arbitrum begins distributing 113 million ARB tokens to DAOs in its ecosystem

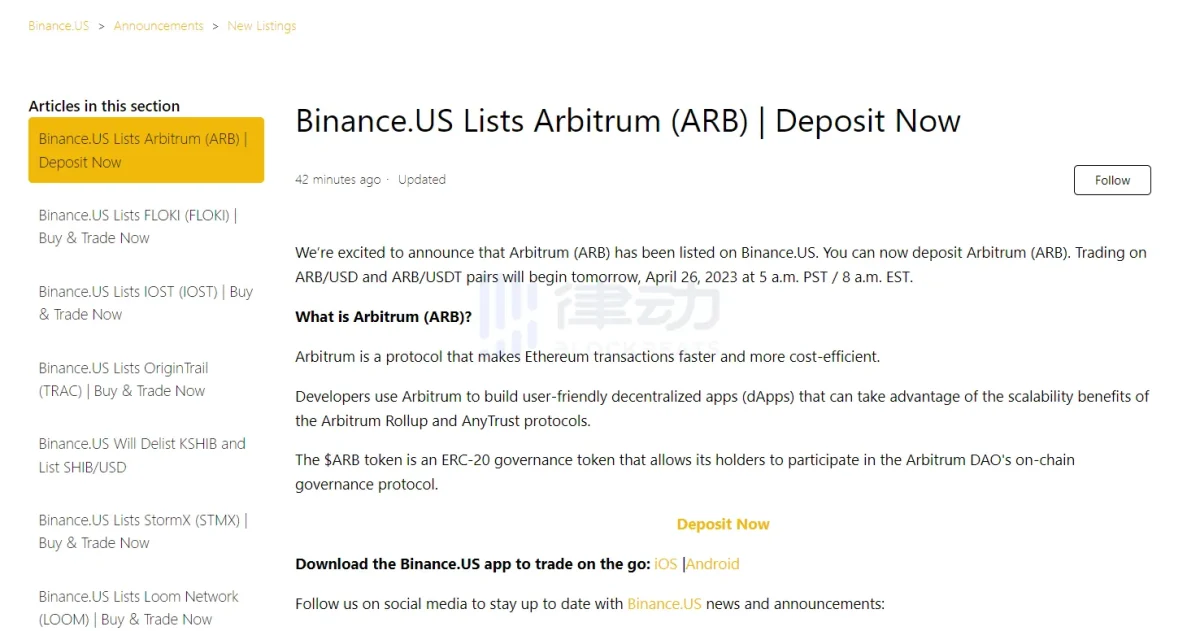

Binance will go live with US Arbitrum Token (ARB)

Binance US, the ADD arm of Binance, will start trading on ARB/USD and ARB/USDT pairs on April 26. In this context, Binance announced that it will list with Arbitrum Token (ARB) once ARB deposits are opened.

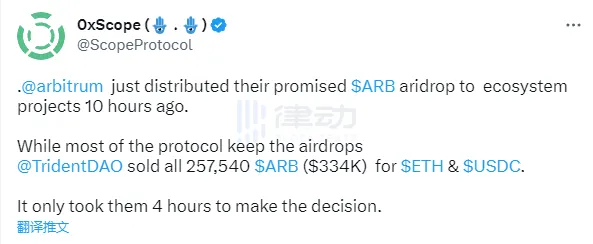

Chain Trident sold all ARBs allocated from Arbitrum

Meanwhile, according to monitoring 0xScope, Arbitrum ecosystem fund Trident has sold all 257,540 ARBs allocated for ETH and USDC after Arbitrum completed the distribution of the first ARB allocation to its eco-DAO.

Arbitrum airdrop provides $120M ARBs to DAOs

Ethereum scaling solution Arbitrum has distributed $120 million worth of ARB tokens allocated to DAOs in its ecosystem. Leading Ethereum analysis firms such as Nansen, Arkham and LookOnChain reported that approximately 100 million ARB transfers were made to addresses of suitable protocols. The amount initially allocated to 125 DAOs corresponds to 113 million ARB tokens. This is worth approximately $148 million at current prices. According to Spotonchain, about 90 million ARBs worth about $120 million at current prices have been distributed so far.

Leading buyers include Treasure DAO, SushiSwap, Dopex, Radiant and Balancer. TreasureDAO and GMX will receive the highest amount allocated with 8 million ARBs each. Subsequently, SushiSwap, Balance, Uniswap, Curve and Dopex will each receive 3 to 5 million ARBs.

cryptocoin.com As you followed, the DAO Distribution of the Arbitrum airdrop took place last night. About 120 million ARBs have been sent to Arbitrum protocols. But not all projects have received their allocations yet.

gm

The DAO Distribution of the Arbitrum airdrop occurred last night.

Around $120M of $ARB was sent to Arbitrum protocols – although not all projects have received their allocation yet.

As of right now the top recipients include @Treasure_DAO, @SushiSwap and @dopex_io. pic.twitter.com/Pe2qfSUfah

— Arkham (@ArkhamIntel) April 25, 2023

Alongside the projects mentioned above, 118 other ecosystem protocols will also receive varying amounts of ARB airdrops. The Arbitrum team expects the token distribution to be completed by the end of this week.

Airdrop will support the growth of the ecosystem

DAOs will have the independence to choose how to distribute their share of the ARB airdrop. It is possible for users to receive rewards retroactively. Or they can promote liquidity and utilization by offering new ARB incentives. In a blog post, the Arbitrum team explained that the purpose of the airdrop to DAO treasures is to “localize community governance.” For example, PlutusDAO has pledged to “make Plutus stronger than ever before” using the additional funds.

Mechanism Capital co-founder Andrew Kang stated that the additional $130 million transferred to the Arbitrum ecosystem could help increase liquidity in Arbitrum DeFi projects. He also pointed out that on Layer-1 platforms, such incentives provide the “fly wheel giving 100%+ APY to the L1 token” in these ecosystems. Recently, Optimism has also launched similar programs to increase liquidity and usage.

Meanwhile, on-chain data analyst The Data Nerd suggested that protocols with smaller market caps would likely benefit most from ARB incentives.

$ARB is being airdropped to projects by @arbitrum.

We calculate the most rewarding ones using $ARB in dollar terms divided by Marketcap.

Here are our results:

1. @HundredFinance $HND

2. @vestafinance $VSTA

3. @y2kfinance $Y2K

4. @saddlefinance $SDL

5. @PlutusDAO_io $PLS pic.twitter.com/r1yWGaiRmm— The Data Nerd (@OnchainDataNerd) April 25, 2023

In addition, the analyst matched the ratio of ARB incentives to each protocol with the market value and found that ecosystems such as Vesta Finance, PlutusDAO and Yin Finance receive incentives several times their current market value, which can help the ecosystem grow.