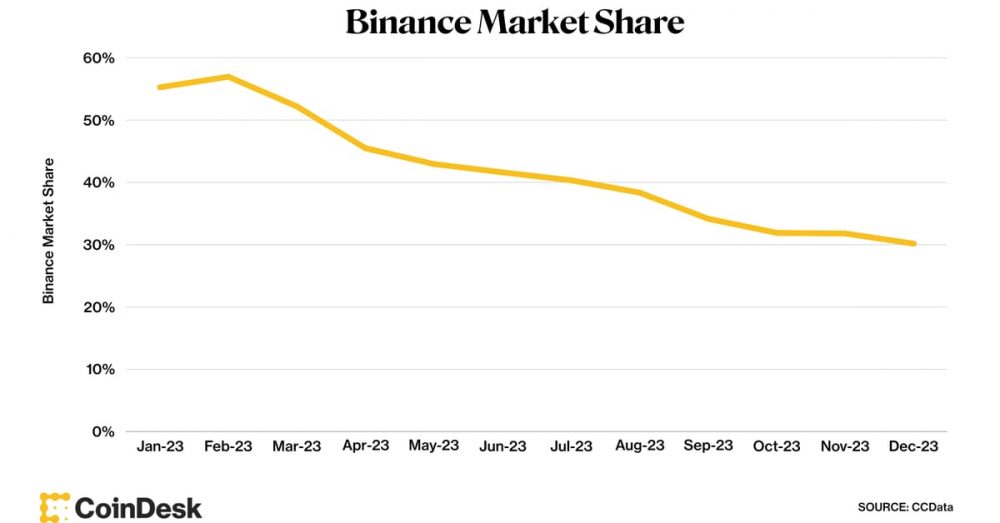

Binance, the world’s largest cryptocurrency exchange by market volume, has seen its spot market share gradually decline over the year as the company faced an array of charges from regulators that eventually claimed its founder and CEO Changpeng “CZ” Zhao.

According to numbers provided by CCData, Binance’s market share so far in December was just 30.1% versus 55% at the start of the year. From January to September, the exchange’s monthly spot volumes declined by over 70% from $474 billion to $114 billion. CCData does note that Binance has begun to see a boost in monthly trading volumes since September even as its market share continued to slide.

The company in November and its now former CEO CZ agreed to pay nearly $3 billion to settle a U.S. Commodity Futures Trading Commission lawsuit. This came alongside separate settlements with the U.S. Department of Justice and Treasury Department.

In addition to the exit of its CEO, the company also witnessed a large number of executive departures this year, including its Chief Strategy Officer Patrick Hillmann, Senior Director of Investigations Matthew Price and U.K. chief Jonathan Farnell.

Despite Binance’s decline in spot trading market share over the year, it still remains the largest cryptocurrency exchange by a wide margin. In second place to Binance’s 30% is Seychelles-based OKX, which has seen its market share grow to 8% in December from around 4% to start the year, according to CCData.

The numbers are similar when looking at combined spot and derivatives trading, where Binance saw a decline in market share to 42% from 60% while OKX’s grew to 21% from 9%.