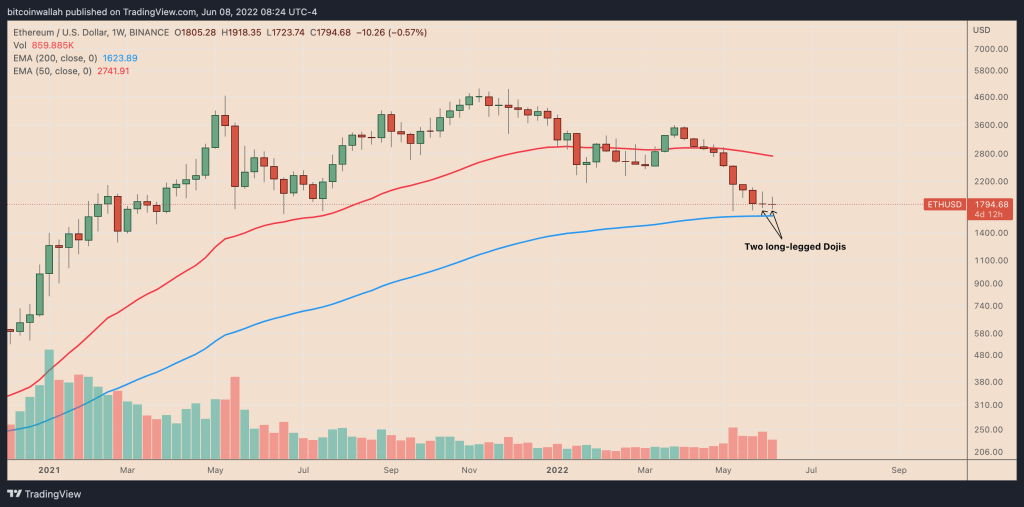

“Dual Doji” formation is forming on Ethereum chart. According to analyst Yashu Gola, a sharp rise can be seen in the coming weeks as this formation is accompanied by positive technical indicators. The leading altcoin is trading in the $1,800 region at the time of writing.

Strong support levels combined with Doji candles

Ethereum (ETH) is preparing for a rally due to the “binary Doji” formation on its chart. Doji; It is a candle formation that occurs when it opens and closes at the same level in hourly, daily or weekly timeframes. From a technical point of view, the Doji indicates that the market is dominated by indecision and the strength of the bears and bulls is balanced.

Therefore, if the market is falling at the time of the Doji pattern appearing, analysts interpret it as weakening selling. Therefore, investors also consider Doji as a signal to close short positions or open long positions.

Meanwhile, the binary Doji means that traders’ trends are conflicting and the price could break in either direction. The ETH/USD pair also formed a similar pattern on the weekly chart. Therefore, it seems ready to make sharp moves that will set the trend in the coming weeks.

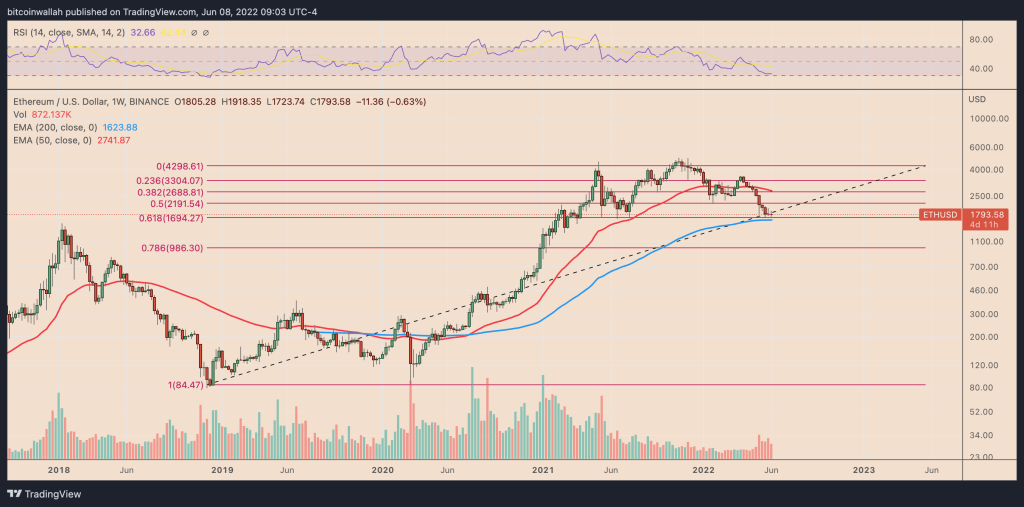

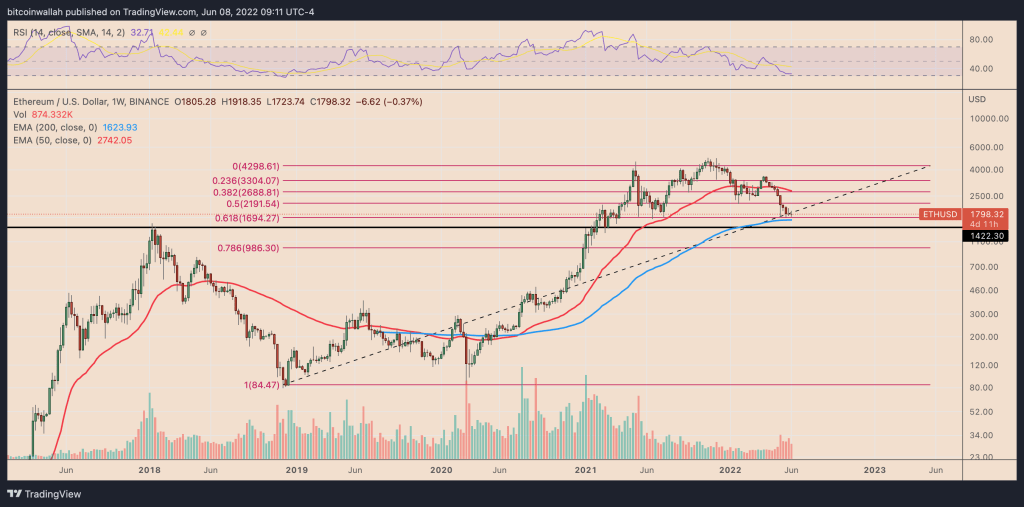

Ethereum’s strong support level, some technical indicators such as the 200 EMA (blue wave) near $1,625, point to the upside momentum. ETH’s 1,500-1,700 band, which limits bearish movements from February to July 2021, also acts as a solid support. According to analysts, all these indicators signal that there is a rally ahead of us.

Is 50% rally possible for the leading altcoin?

If ETH price breaks to the upside as mentioned, the next target is at the 0.5 Fibonacci retracement level. This level coincides with around $2,120.

This represents a 20 percent increase. If the said level is also exceeded, investors will target $2,700 by September 2022. This level, which intersects at the 50-week EMA, represents an increase of around 50 percent. If the breakout occurs in the opposite direction, the downside target is $1,400.

Meanwhile, ETH price was bullish today with the Ropsten testnet. As Kriptokoin.com we have covered the details in this article. It looks like whales are heading back to Ethereum with ETH 2.0.

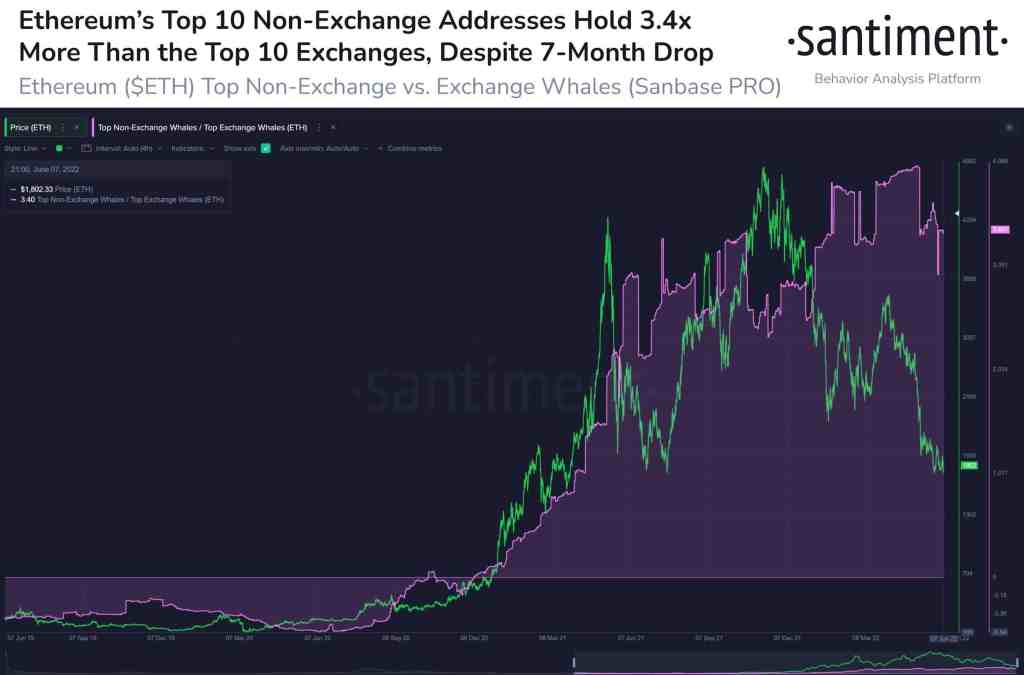

Altcoin whales back on Etehreum, switch to PoS effective

Ropsten testnet completed successfully. On the other hand, positive on-chain data, increasing whale stocks and other positive factors are reflected in the ETH price. The Ethereum team completed the Ropsten test on June 8 without any errors or difficulties during the merge phase. Glassnode data shows that the value of staked ETH has risen to over $22.78 billion. At the same time, it reveals that it is ready for the upcoming PoS transition.

Also, according to on-chain analytics platform Santiment, the top 10 Ethereum whales hold more ETH than the top 10 crypto exchanges, despite the drop in Ethereum prices. Thus, it indicates that whales’ confidence in the Ethereum (ETH) price may stabilize at current levels.