Bitcoin Bullish Surge Following Trump’s Crypto Reserve Announcement

In the past 24 hours, Bitcoin (BTC) and the wider cryptocurrency market have experienced a significant bullish reversal, spurred by former President Donald Trump’s announcement regarding the strategic crypto reserve he intends to establish. This revelation has rekindled investor enthusiasm, particularly for Deribit-listed call options, which represent bullish bets on BTC reaching the $100,000 mark, according to data from Amberdata.

As the leading cryptocurrency by market capitalization, BTC has surged nearly 10% in just a day, peaking at over $95,000 at one point, as reported by CoinDesk. Other cryptocurrencies mentioned by Trump—such as Ethereum (ETH), XRP, Solana (SOL), and Cardano (ADA)—have also recorded noteworthy gains. On Sunday, Trump took to Truth Social to announce that he has directed the Presidential Working Group to advance a crypto strategic reserve that prominently features XRP, SOL, and ADA, with Bitcoin and Ethereum at its core.

This announcement has been met with considerable optimism from the market, particularly given the previous frustrations among industry stakeholders over the lack of prompt action regarding the anticipated reserve since Trump’s inauguration on January 20. This development is now being interpreted as evidence of a “Trump put” on cryptocurrencies, suggesting that the Trump administration may step in to bolster the market during turbulent times, similar to how the Federal Reserve is known to act for the stock markets.

Market analyst Alex Kruger expressed his views on X, stating, “Today Trump signaled there is a Trump put on crypto. This is good enough for a trend change, particularly given how BTC blasted through resistance with sentiment among many at all-time lows.” He noted that BTC has re-established $89,000 and $92,000 as crucial support levels, advising traders to “long support confidently with clear invalidation levels below.”

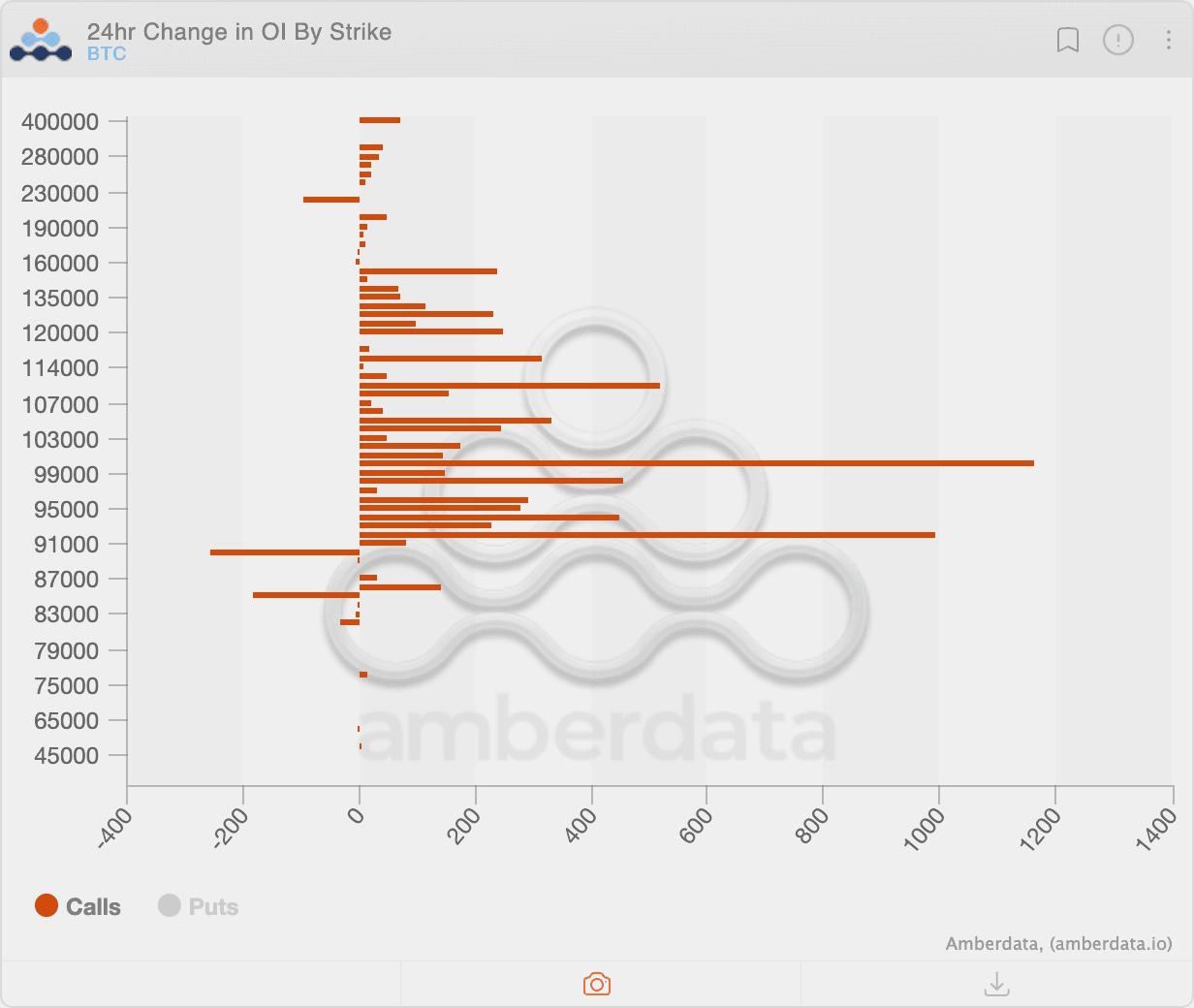

Josh Gilbert, a market analyst at eToro, echoed similar sentiments in an email to CoinDesk, stating, “Given the President’s vested interests, it feels like this is something investors may need to get used to; sell-offs of this nature could continue to be supported moving forward.” In light of these developments, there has been a resurgence of activity surrounding the $100K strike call, indicating that traders are optimistic about further price increases despite the ongoing volatility. A call option allows the purchaser the right to buy the underlying asset at a predetermined price on or before a specific date, providing them with asymmetric upside exposure.

According to data tracked by Amberdata, open interest—the number of active positions—regarding the $100K call has surged by 1,163 contracts, amounting to over $100 million, making it the most active option listed on Deribit. “$100K will be the level everyone is looking at intra-week,” stated Greg Magadini, the director of derivatives at Amberdata, in an email. “This upcoming week will have interesting ‘Buy the rumor / Sell the news’ dynamics around the March 7th crypto summit.”

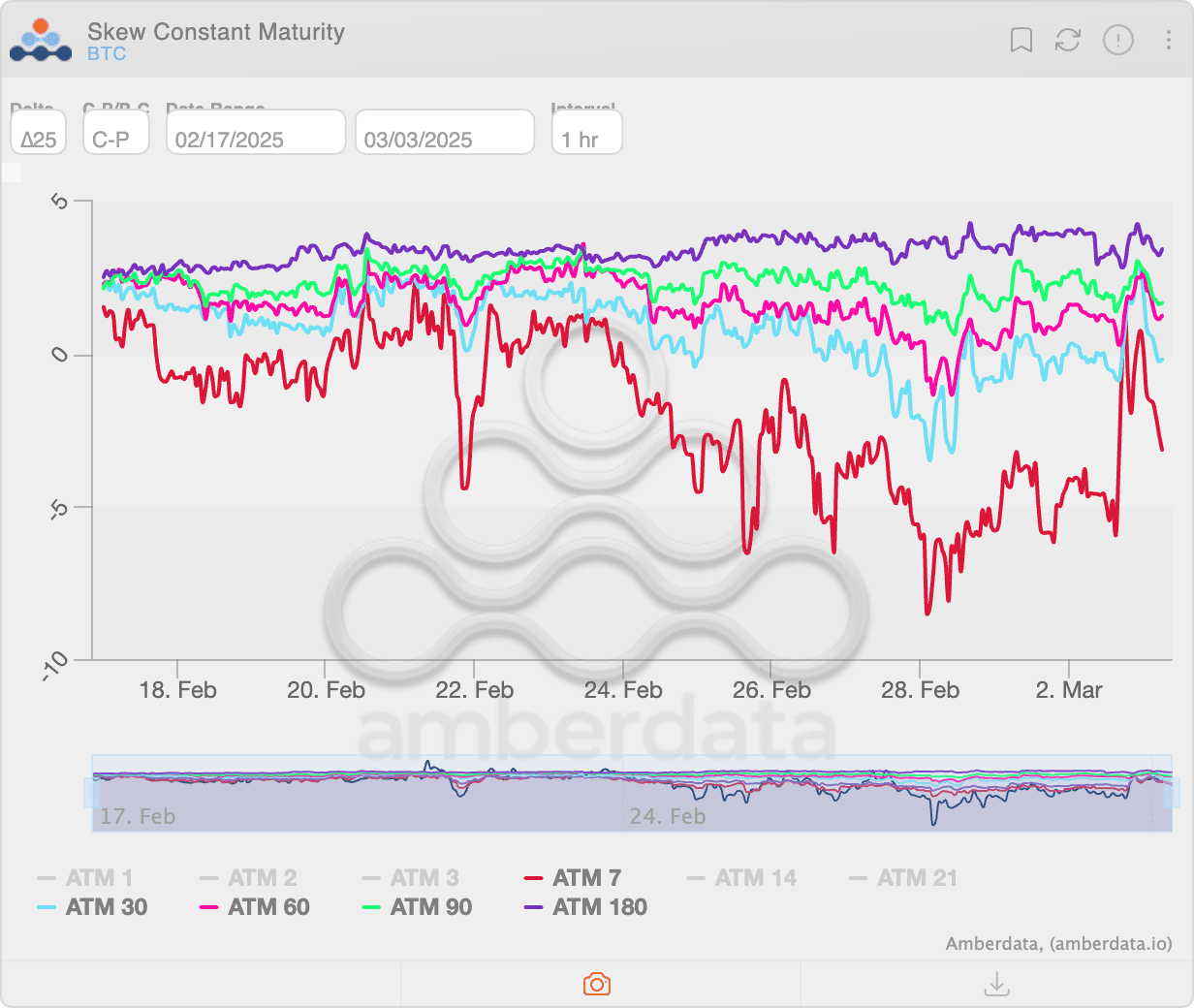

The renewed appetite for call options is also reflected in the recovery of short-term skews, which measure the implied volatility premium (demand) for calls relative to puts. The seven-, 30-, and 60-day skews have bounced back to zero and beyond, a significant improvement from the deep negative readings observed since Friday when traders primarily sought protective put options. “People like to buy calls and sell puts when the market bounces,” remarked Lin Chen, Deribit’s Head of Asia Business Development, in an interview with CoinDesk.

Challenges Ahead

Despite the positive market sentiment, some observers are cautious about the potential for slow progress regarding the crypto reserve. Arthur Hayes, chief investment officer and co-founder of Maelstrom Fund, reacted to Trump’s announcement on X, stating, “Nothing new here. Just words. Let me know when they get congressional approval to borrow money or revalue the gold price higher. Without that, they have no money to buy Bitcoin and shitcoins.” This skepticism is echoed by others, including Bybit’s CEO, Ben Zhou.

Mark Hiriart, Head of Sales at digital asset trading firm Zerocap, expressed a similar viewpoint in an email to CoinDesk, noting, “The sentiment we’re seeing in the wake of the U.S. federal crypto reserve announcement is largely bullish, with expectations of institutional inflows and global competition for crypto reserves. Skepticism remains, however, with specific concerns over execution, Congressional approval, and potential long-term risks like government intervention.” He added that while institutions may rush in, unclear regulations and macroeconomic conditions could dictate whether this rally can sustain momentum.

As the market braces for developments, all eyes will be on the White House Crypto Summit scheduled for March 7, which promises to deliver more insights into the details surrounding the proposed crypto reserve.