Crypto markets have been in a bloodbath over the past few hours. Major cryptocurrencies, including Bitcoin and Ethereum, witnessed a sudden crash. This relentless drop comes just after a week marked by shocking regulatory actions targeting leading crypto companies and leaving the industry in limbo. Here are the price movements and possible reasons for the decline…

Bitcoin and altcoins collapsed

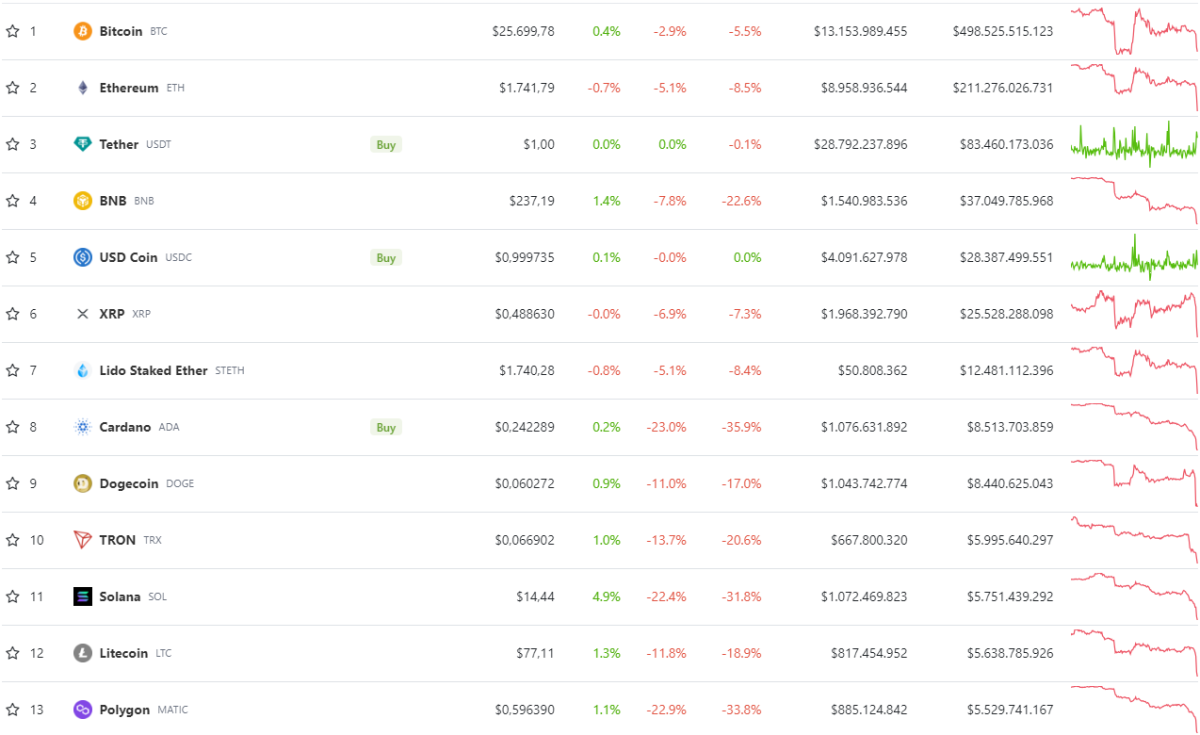

Bitcoin, the largest cryptocurrency by market capitalization, fell to about $25,000, a 5% decline. It reached its lowest level since March. Ethereum, the second largest cryptocurrency, also followed suit, reflecting the bearish trend. However, for other leading cryptocurrencies such as BNB, XRP, Cardano, Matic, Dogecoin and Solana, the collapse was even more severe. These coins have experienced staggering losses ranging from 10 percent to 25 percent in just a few hours.

Described as an “absolute bloodbath” by cryptocurrency traders on Twitter, the value of the crypto market has dropped to nearly $1 trillion. This sad situation came about when Moody’s, one of the top global credit rating agencies, downgraded its outlook on Coinbase from stable to negative. Moody’s analysts expressed concern over the “uncertain magnitude” of recent events during the week that led to Coinbase’s downgrade.

As a result, the price outlook for Coinbase has been labeled “negative” for the next 12 to 18 months. cryptocoin.com As we reported, during the week, the US Securities and Exchange Commission (SEC) intensified its regulatory pressure on the crypto industry, accusing Coinbase of illegal transactions. The SEC has previously sued Binance, the world’s largest crypto trading platform, for a number of violations, including misuse of funds, inflated trading volume, and evasion of legislation.

Cryptocurrency platforms withdraw from the USA

Binance’s US subsidiary has suspended dollar deposits, implying that it cannot facilitate dollar withdrawals. Robinhood, a popular trading app, announced that it is cutting support for three major cryptocurrencies (Cardano, Polygon and Solana) after the SEC classified these tokens as unregistered securities. Also, Crypto.com, a Singapore-based cryptocurrency exchange, has further unsettled the market by announcing its intention to discontinue its services for US-based institutional traders later this month.

Gordon Grant, co-head of trade at Genesis Trading, suggested that the regulatory developments of the week are affecting the prices of cryptocurrencies. This series of events created confusion and confusion among market participants, underlining the inherent sensitivity of the asset class to sudden and sharp price fluctuations.

Did the sale of Scimitar Capital affect the markets?

Rumors circulated during the crypto market turmoil suggested that a leading fund, Scimitar Capital, liquidated $2 billion worth of altcoins in a massive sale. These rumors were later confirmed in a statement made by the fund that pointed to a strategic decision to liquidate its crypto assets and return the capital to its valuable LPs (limited partners). The Fund believes this move will encourage more stability and opportunity in the long run.

https://twitter.com/ScimitarCapital/status/16674222106017996804

As the dust dissipates in this disastrous hour in the crypto markets, industry participants and investors grapple with uncertainty and anxiously await further developments in the regulatory environment. The resulting bloodbath highlights the need for robust regulatory frameworks and risk management strategies to ensure their long-term sustainability, with the inherent volatility of cryptocurrencies.