The Bitcoin accumulation trend score shows that shrimps are buying and whales are selling. According to crypto analyst Andjela Radmilac, macro uncertainty is pushing whales to sell their cryptocurrencies and avoid risk. However, the analyst says it has little impact on short-term holders who continue to accumulate. We have prepared Andjela Radmilac’s analysis and reviews for our readers.

An important indicator: the tendency to accumulate score

The hoarding propensity score is an on-chain indicator used to determine whether assets are actively accumulating cryptocurrencies. It can be applied to any cohort (group) to determine the behavior of any group. So it’s a much better indicator of overall market sentiment for buying and selling.

The indicator consists of two metrics, a business’s engagement score and a balance change score. A business’s engagement score represents its overall cryptocurrency balance. The balance change score represents the number of new coins bought or sold during a month.

An accumulation trend score close to 1 indicates that the largest portion of the network has accumulated. On the other hand, a score close to 0 indicates that the network is essentially distributing their coins. Applied to Bitcoin, the accumulation trend score gives great insight into the balance size and behavior of market participants over the course of a month. Meanwhile, exchanges and miners are excluded from the measurement to better represent market conditions.

What does the propensity to accumulate score show for Bitcoin?

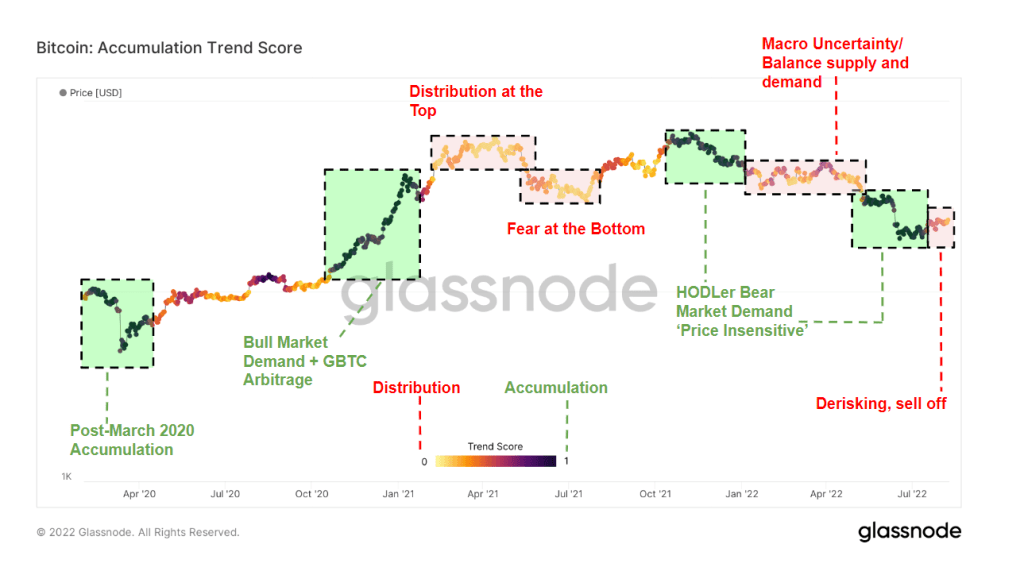

Bitcoin’s accumulation trend score from April 2020 to August 2022 shows four different accumulation periods. The accumulation periods highlighted in green in the chart below occurred in March 2020, early 2021, early 2022, and late May 2022. The most significant accumulation rate was seen in March 2020, when the Covid-19 pandemic crushed global markets. The massive sell-off we saw following the Terra (LUNA) crash in late May and early July triggered a massive saving spree.

Cryptocurrency distribution periods highlighted in red and yellow followed all accumulation periods. Some of the highest cryptocurrency distribution rates were seen during the exit of miners from China in the summer of 2021 and the start of the Russian invasion of Ukraine in February 2022. Macro uncertainty pushed more investors. That’s why he also sold his BTC this summer to avoid risking the portfolios of many addresses.

Whales sell, shrimps buy

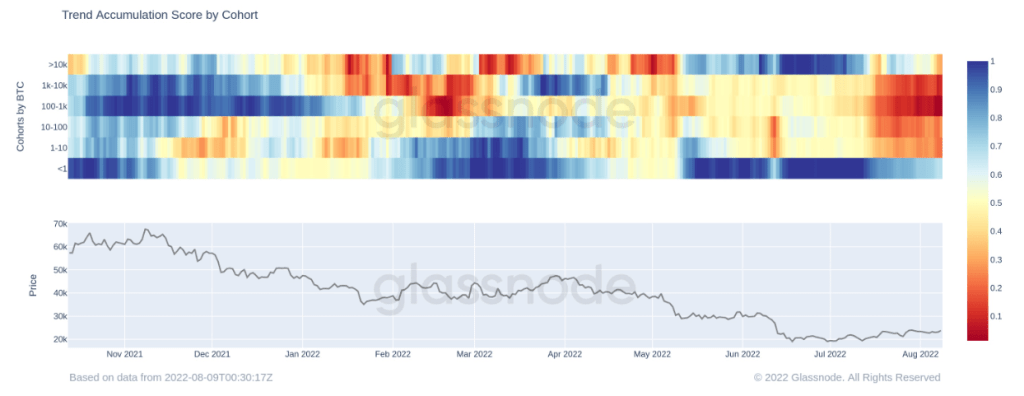

Breaking down the aggregation trend score by group reveals the behavior of the two main groups in the Bitcoin network. These groups are whales and shrimps. Whales are defined as addresses with more than 1,000 BTC. Shrimps, on the other hand, are addresses with less than 1 BTC. During the month of July, both whales and shrimps are aggressively accumulating BTC. The chart below shows the group’s accumulation rate for the entire month, with whales, shrimp, and everyone in between.

However, as August progresses, the rate of accumulation among whales begins to decline. The general macro uncertainty has driven many large investors to sell their BTC holdings. Many investors are expecting a tough winter. So it wants to get as much liquidity as possible.

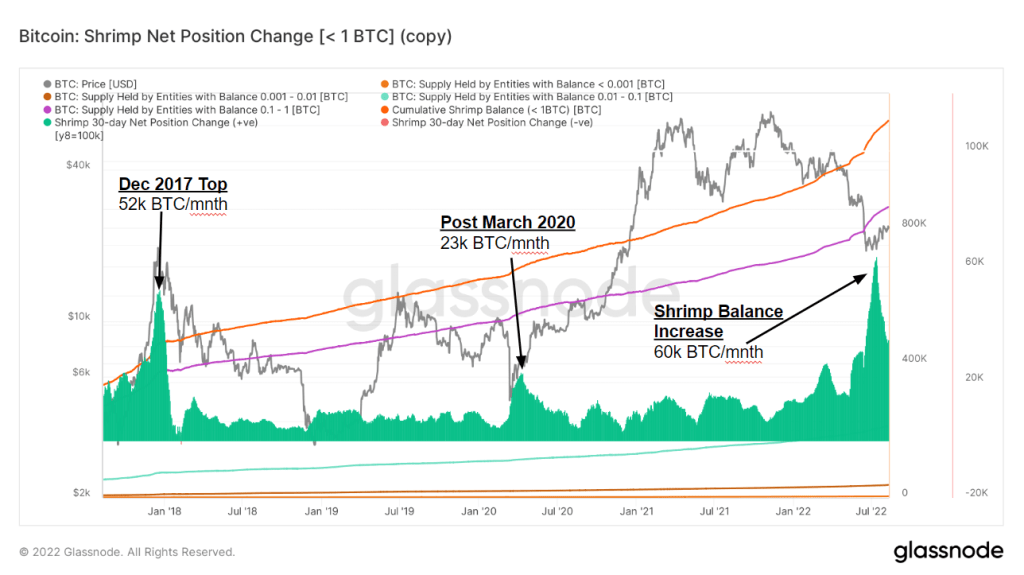

Assets that are still accumulating BTC are shrimp that keep accumulating even when the majority of major holders start selling. July was the most important savings month for small property owners since 2018. Shrimps increased their balance by more than 60,000 BTC in a single month. The second largest accumulation was in December 2017. Prawns have accumulated 52,000 BTC in one month. It was during this period that Bitcoin reached an all-time high.

This is a sign that small holders find the nearly $20,000 price of Bitcoin very attractive. It also shows that it continues to buy cryptocurrencies for long-term investment even if its price remains stable.