Bitcoin, which held psychological resistance levels throughout July, dropped to $25,000 this week. While many analysts are speculating for $20,000, TechDev takes a different view.

According to the famous analyst, the latest drop has laid the groundwork for a new expansion

The crypto analyst known as TechDev revealed the positive aspects of the current Bitcoin price correction. According to the analyst, the drop was the last downside correction before a major bull run is coming. In his analysis, he interpreted Bitcoin’s fall to the $25,000 level as a preliminary for a new growth period. cryptocoin.comAs we reported, Bitcoin lost $27,000 for the first time during SpaceX news.

“Either the coming months will surprise the market once again or it will be really different this time,” TechDev writes.

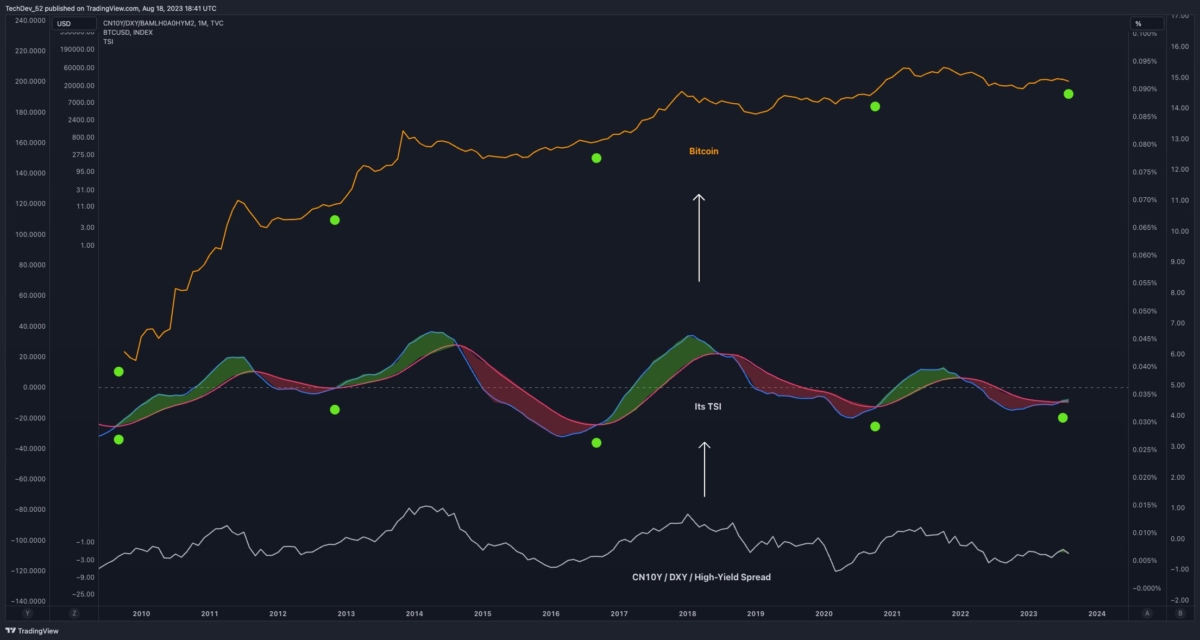

TechDev is famous for monitoring Chinese 10-year bonds against DXY to track global liquidity cycles. In his technical analysis, he uses the real power indicator (TSI) to measure the momentum of CN10Y against DXY. Accordingly, the TSI exhibits a bullish technical reading, which was also observed at the start of previous Bitcoin bull markets.

What’s next for Bitcoin price, according to TechDev?

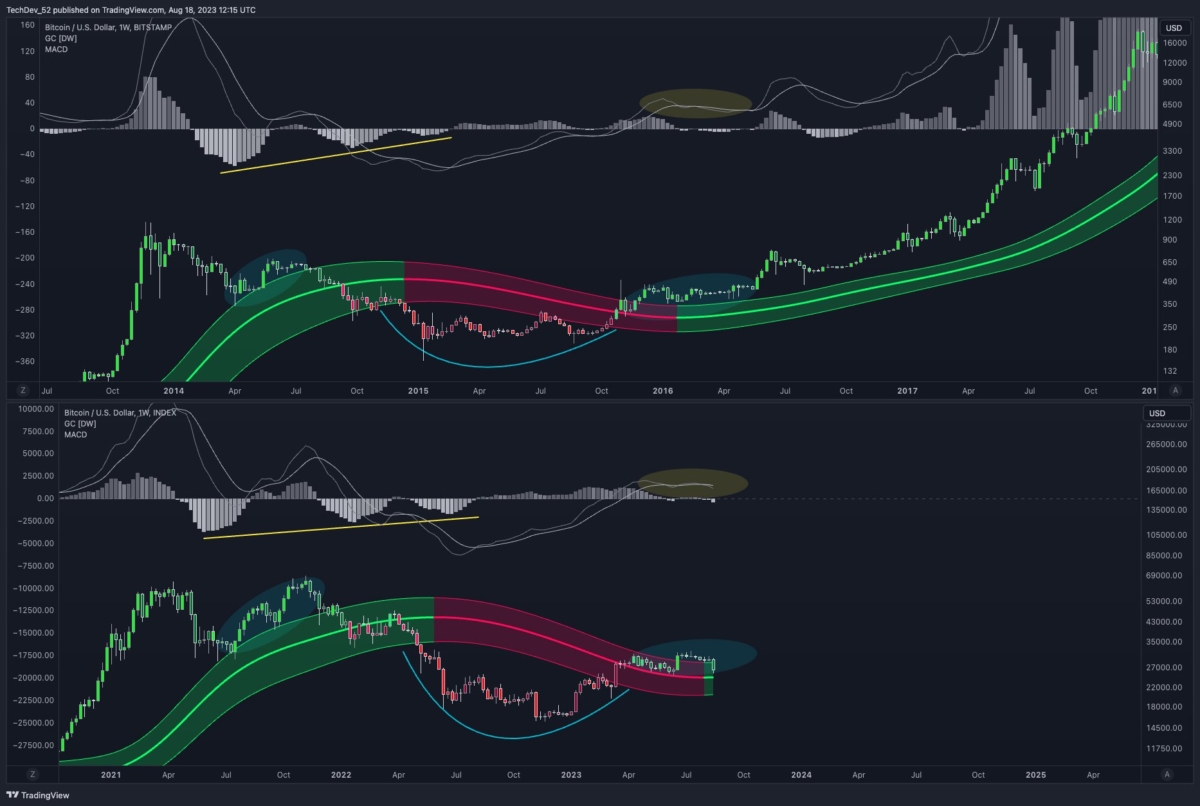

The crypto analyst says that the optimal scenario for Bitcoin would be a rise to the two-month supertrend level of around $50,000, represented by the red line on the chart, before testing support around $30,000.

According to TechDev, this move could trigger Bitcoin’s bi-monthly chart to drop into the support zone of the Bollinger Bandwidth (BBW) indicator, which marks the start of the 2017 and 2020 bull markets. BBW is used to measure asset volatility. At this point, TechDev says, “Expect to see a move up to the two-month supertrend. In addition, I want to retest to complete the two months of compression,” he says.

The analyst also compares 2016 to today, when BTC spent several months above the Gaussian Channel and tested it as support while consolidating before moving into a clear uptrend.

Accordingly, BTC consolidated just above the Gaussian Channel for a long time before reaching ATH levels. Therefore, there is a possibility that it is currently repeating its 2016 recovery. At this point, TechDev says, “Stay above the Gaussian Channel center.”

DonAlt says recent Bitcoin correction hands control over to bears

Another crypto analyst, DonAlt, said that the latest Bitcoin correction, which pulled BTC below $26,000, is a sign that bears are taking control of the market. According to the analyst, his time on the sidelines will be shortened if Bitcoin manages to regain $30,000 or drop as low as $18,950. According to his current analysis, which also covers ETF developments:

From a trading perspective, looking at this week’s candles, I see we’re following the ETF BlackRock story. After my surge to the $16,000 level, things got complicated with the collapse of FTX, the steep drop in price, and then the negative news. However, the price slowly recovered.

At the moment, we have a situation where the price has pulled back despite the positive news over the last few weeks and months. This can be seen as a signal of weakness in terms of trading. Considering our current trading position, I don’t think it makes much sense to take a bullish position right now. I think we should stay away from the levels we are trading.

The crypto strategist also takes a look at investor sentiment after the latest correction. He states that investors are bullish on altcoins. This means that it is not yet time to return to the crypto market.