The widening effects of the FTX bankruptcy are massively disrupting the flow of money. Bitcoin and Ethereum are about to break the volume-deprived $16,000 and $1,200 supports. Let’s take a quick look at what analysts are saying in this environment.

Analyst who knows Bitcoin crash says “new bottoms are coming soon”

Twitter analyst Capo, who accurately predicted this year’s Bitcoin crash, says the downward momentum will continue. The crypto analyst said we are probably heading towards new bear market lows. “The $14-12,000 range is a matter of time,” he wrote on Twitter on November 18. He predicted a 40-50% drop in the altcoin market.

Good morning!$BTC to $12,000-14,000 is a matter of time. Altcoins much lower (40-50% drop on average) pic.twitter.com/DEByAUUHQH

— il Capo Of Crypto (@CryptoCapo_) November 18, 2022

Capo also said that the current rally in the market is aimed at trapping the bulls. He says that after that, Bitcoin will drop to lower levels in the short term. In a tweet, he shared how BTC turned $17,600 support into resistance.

A chart is worth a thousand words.

— il Capo Of Crypto (@CryptoCapo_) November 16, 2022

Capo predicts that Bitcoin will start to recover after reaching this target. On November 15, he said that doing FUD was unnecessary as BTC approached $17,000. The analyst says that Bitcoin will rise after testing lower levels.

What I see:

-Technicals looking bad (price below June's low, indicators bearish, funding reset…)

-Same bull traps as always, but even weaker. People falling for them.

-Comments like ''you are going to miss the train''. Really?This is not over. Final capitulation is likely.

— il Capo Of Crypto (@CryptoCapo_) November 15, 2022

Analysts will prefer to wait a little longer to take positions.

Another Twitter analyst, Cred, said that Bitcoin is relatively strong despite the collapse of FTX. However, he adds that it is too early for a solid bullish position for Bitcoin. “Given the enormity of what happened, I understand the relatively strong argument to be based on,” Cred said. But if you’re going to make a bullish argument, it should be that.” “We got the worst news, understandable and incomprehensible. But the market is still some kind of range bound on the daily chart. So someone is willing to exploit it,” he added.

Benjamin Cowen says on-chain indicators for Bitcoin signal a bottom

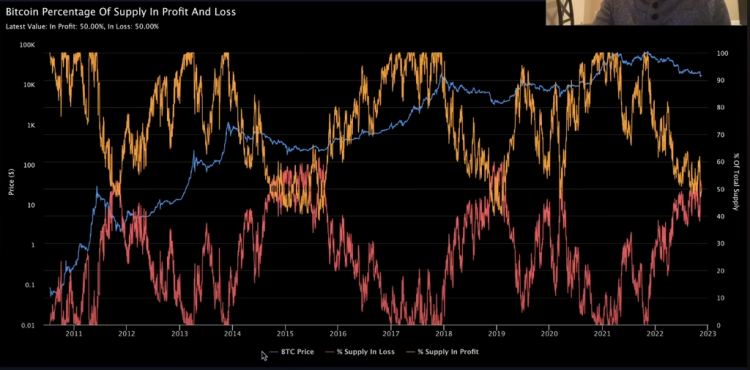

Benjamin Cowen said in a recent YouTube post that Bitcoin’s percentage of supply in the profit and loss metric shows a historic bottom. This indicator shows what percentage of BTC amount has made profit or loss to its holders. Cowen says this signals a bottom for historical data:

…What you might notice is that they tend to intersect at a certain point during a bear market, and in fact, the percentage supply of Bitcoin in profit and loss intersects in every single bear market. Here in 2011, in 2014, in 2015, in 2018 and in 2019, and in late 2022 they begin to pass through again.

Cowen goes on to say that when applying the 30-day moving average to Bitcoin’s percentage of supply in profit and loss, he shows a historical pattern that is often the harbinger of a price floor:

If you apply the 30-day moving average to Bitcoin’s percentage of supply in profit and loss, what you’ll notice is that historically, they always intersect before bottoming out.

Michael van de Poppe was optimistic compared to other analysts

cryptocoin.com As you follow, Bitcoin price approached the $16,000 support in the last days as the FTX crisis cooled. Renowned crypto analyst Van de Poppe says a bear market rally is coming soon:

I can’t wait to start sharing the charts and setup gains as we approach the bear market rally.