Pantera Capital CEO Dan Morehead spoke out to criticize the Fed for causing a significant disaster for the cryptocurrency market. He stated that the Fed caused this disaster on its own. Famous CEO warns Bitcoin and altcoin investors.

Fed’s two decisions will further reduce Bitcoin and altcoin market

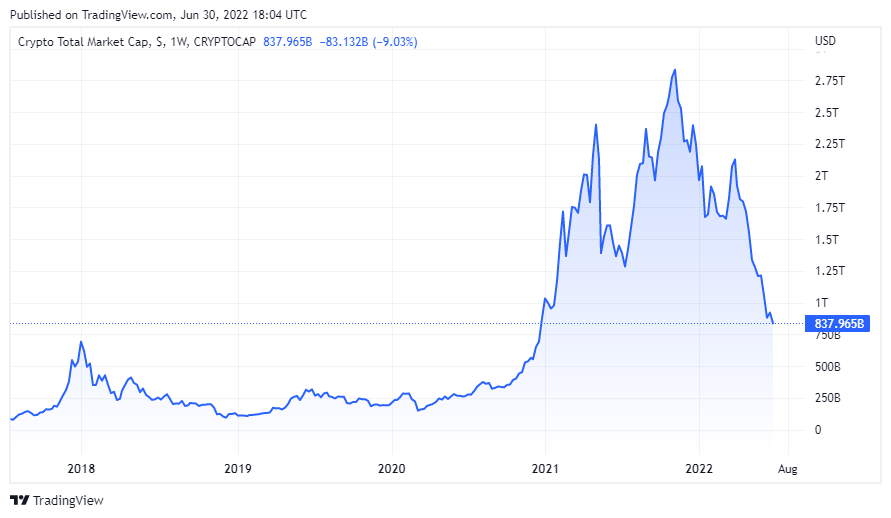

Extreme bear movements are felt in the cryptocurrency market. While the decline continued, 5% losses came to the previous day. Currently, its market cap is below $871.5 billion after peaking at $3 trillion.

Morehead claims that two major mistakes made by the Fed have cost the crypto market dearly. He said only one of the two authorities’ decisions was marginally correct. However, the Fed does not accept the big catastrophe, according to Morehead.

Morehead underlined that it has been shown that keeping overnight rates too low for too long has a significant impact on the market. Manipulating the bond market, meanwhile, has been the most egregious mistake. For the first time in 95 years, the central bank “never touched the interest rate beyond the overnight rate,” he said. Pantera Capital CEO predicts that this will be difficult to reverse. But the Fed still doesn’t seem to understand what it’s doing. The Fed has failed to reduce its bond holdings.

The correlation between BTC and stocks has grown

In his statements, Morehead also cites recent cryptocurrency market developments that highlight the system’s over-reliance on leverage. The bankruptcies of Terra LUNA, Celsius, and 3AC were the events that shook the cryptocurrency market. But Morehead predicts we’ll see a few more over the next few months.

Bitcoin (BTC) outperforms altcoins in times of significant selling pressure. The same thing happened in this cycle. Since reaching their ATH, most altcoins have lost more than BTC.

Meanwhile, Bitcoin’s correlation with stocks increased drastically during the S&P 500 declines. Association typically subsides after 71 days. However, this increase continued for a long time. It is believed that it may fall again soon. On the other hand, Bitcoin deepening below $20,000 again brought critical supports in the $16,000 region to the fore.

Bitcoin dropped to $18,872.32 today

We talked about the increasing correlation of the cryptocurrency market with the Nasdaq 100 and S&P 500. Meanwhile, the Fed interest rate expectation has affected the market in every way. Bank analysts are hinting that the S&P may recover to January levels by the end of this year. This move will bring Bitcoin along for the ride. At the time of writing, Bitcoin is trading at $19,113.34 after recovering from this support level.

cryptocoin.com As we covered in his analysis, on-chain analyst Ali Martinez shared 2 critical support levels for Bitcoin today. $19,100 followed by $16,000 are the regions with the highest concentration of Bitcoin buyers.