According to the analyst, Bitcoin is forming a bearish trend that will push the price further down if this condition is met. Another analyst says the dire macroeconomic conditions of 2022 are ‘unlikely to continue’ next year. Popular analyst Michaël van de Poppe updates his views on Ripple (XRP) and VeChain (VET).

“Bitcoin creates super bear formation”

According to crypto analyst nicknamed RektCapital, a Bearish Engulfing (BE) candlestick has started forming on Bitcoin’s annual chart. However, certain conditions must be met for this BE formation to be fully confirmed. Accordingly, BTC would need to close below $14,000 annually to confirm a crash. A bearish candlestick cannot be formed before this point.

#BTC is forming a Bearish Engulfing candlestick formation on the Yearly chart

But for this BE formation to fully validate, $BTC would need to perform a Yearly Close below ~$14k (black) to confirm a breakdown

Until then, the bearish candlestick is not confirmed#Crypto #Bitcoin pic.twitter.com/uZYBkcw3Yz

— Rekt Capital (@rektcapital) December 31, 2022

In another important development, extensive research into the net flow and historical indicators of the crypto exchange points to a number of prominent hypotheses. According to the data, net flow will eventually turn positive as it approaches zero. This results in fewer buyers and more sellers. At the same time that it turns positive, a local peak is likely to form. Also, the selling pressure on the future market is likely to increase afterwards. It is possible that this will cause the bearish trend to continue and the support already present to disappear.

Will this year’s horrific conditions continue?

Tom Lee, managing partner at Fundstrat Global Advisors, says the dire macroeconomic conditions of 2022 are ‘unlikely to continue’ next year. In a recent Twitter thread, Lee notes that inflation is falling faster than markets and the Federal Reserve expected. The CNBC writer also notes that the Fed likes to see a strong labor market. In this context, Lee makes the following statement:

Many inflation factors literally exploded for 2022 after rising mid-year. You don’t need to look far to see progress. While wages are important, the Fed doesn’t want to crush the economy. It also does not want to destroy employment.

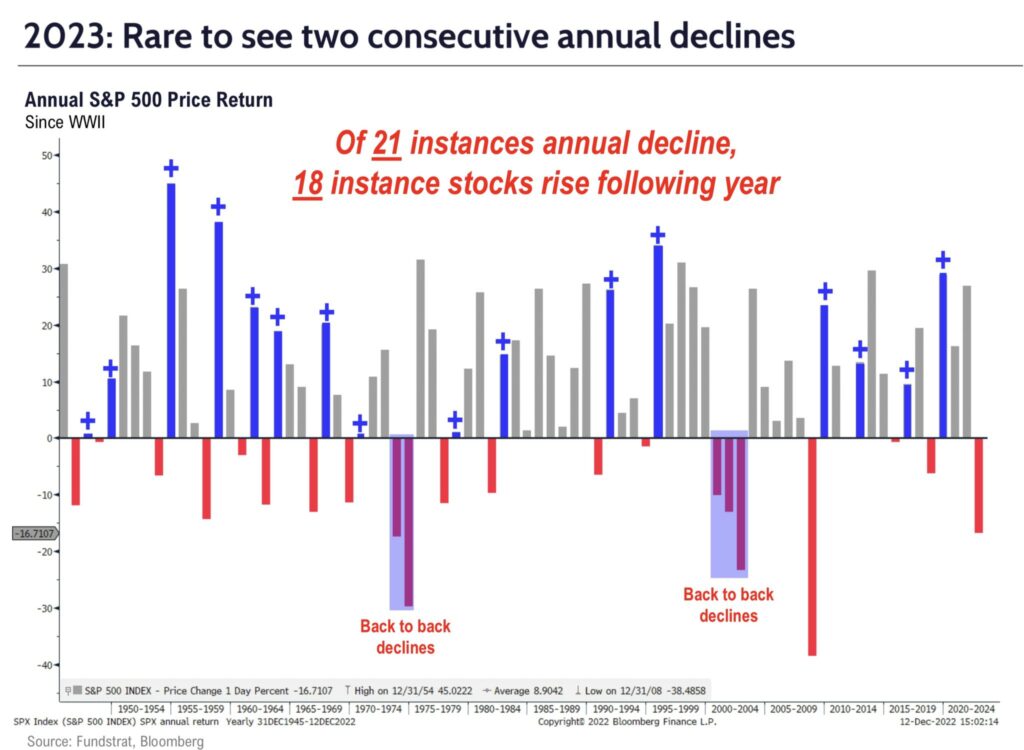

Lee also says stocks tend to bounce back after bad years. Based on this, he makes the following assessment:

Unless the inflation crisis continues, financial conditions will ease. This means that stocks rise and rarely record consecutive annual declines. In fact, three of the best five-year earnings ever came after a ‘negative’ year. And it still amazes me why the US is the worst performing global stock market in 2022 outside of countries like the China region. Why is Europe performing better when Europe is in the teeth of an energy crisis/inflation spiral?

Source: Fundstrat/Twitter

Source: Fundstrat/TwitterLee points to a statistic shared by Matt Cerminaro, a research fellow at Fundstrat. Cerminaro notes that in the last 50 years (1974, 2002 and 2008), there have been only three years for the S&P 500 to be as bad as it was in 2022. According to Cerminaro, the years following 1974, 2002 and 2008 saw an increase of at least 23%.

Analyst updates XRP and VET view

cryptocoin.com Popular crypto analyst Michaël van de Poppe, whose predictions we have included, updates his views on XRP (XRP) and VeChain (VET). The analyst says that if XRP fails to recover quickly to a significant level, it will likely fall by more than 22%. In this context, the analyst makes the following statement:

We saw a strong rejection at $0.370. So this seems a bit odd. I would rather see XRP recover the level relatively quickly at $0.343. Otherwise, a ton of liquidity to be taken is on the downside. It is possible to compare it with Bitcoin. There is solid support at $0.265.

Source: Michaël van de Poppe/Twitter

Source: Michaël van de Poppe/TwitterNext, the analyst says, VET is on a downward trajectory. However, he notes that if the enterprise solution Blockchain breaks above a key price area, there is a small chance of a bullish reversal. Van de Poppe comments:

This is clearly going downhill. And it continues to do so. Potentially: bullish divergence implying a reversal. The bullish divergence is only valid if $0.016 is cleared. Otherwise, the trend remains down.

Source: Michaël van de Poppe/Twitter

Source: Michaël van de Poppe/TwitterAlso, the analyst analyzes support and resistance levels for Bitcoin (BTC). The analyst says a rally to $17,700 is possible. Additionally, he notes that a new support level to $15,800 is likely if there is a drop. In this direction, the analyst draws attention to the following levels:

The moment we break to the upside, the $17,400 resistance will be pretty clear. The same goes for $17,700. If we’re going to do a reversal, I think I’d look at a run towards these levels when it comes to Bitcoin’s price action. On the downside, we have some support levels. First of all, we got this space at $16,600. This created a bit of a splash. Also, $16,400 is more substantial. If we look at this whole structure then, if we continue with the bear trend, we may see $15,800 as the next support.