Bitcoin (BTC)’s status as a hedging asset has taken a steep plunge with global financial markets. He was then questioned in the second quarter of 2022. Also, Ethereum performed worse than Bitcoin as liquidity dried up on all major cryptocurrency exchanges.

Low liquidity before the third quarter of 2022

It is possible that Bitcoin and Ethereum will be ready for more losses in the next quarter of the year. The first two cryptoassets closed the second quarter of 2022 with a negative stance amid declining interest in the market and the worsening macroeconomic environment. Bitcoin suffered a loss of over 56% quarter-on-quarter. Ethereum, on the other hand, is down more than 67%.

The Federal Reserve raised interest rates this year to curb inflation. Moreover cryptocoin.com As you follow from , it has committed to take tightening measures. This hit risky assets like crypto hard. Also, economists warned that a global recession could be on the horizon, creating fear among investors.

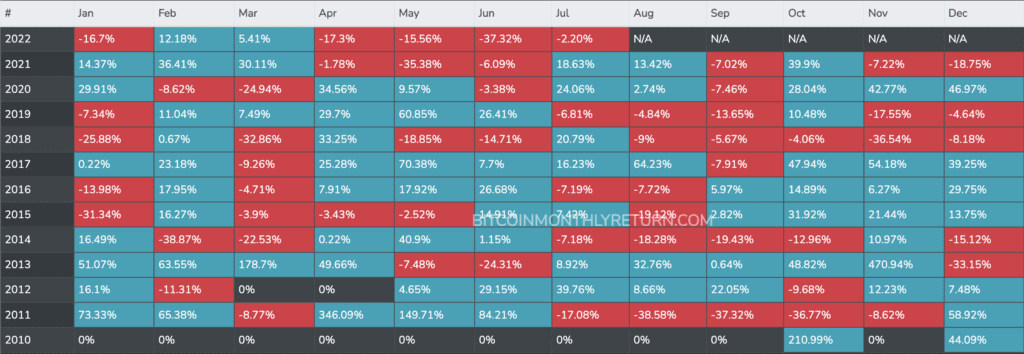

The bearish trend for Bitcoin and Ethereum was steep in the second quarter. Even so, the trading history shows that both assets could accelerate their losses in the next three months. In the 2011, 2014, and 2018 crypto bear markets, Bitcoin fell 68%, 40%, and 2.8%, respectively, in the third quarter of the year.

Source: Bitcoin Monthly Return

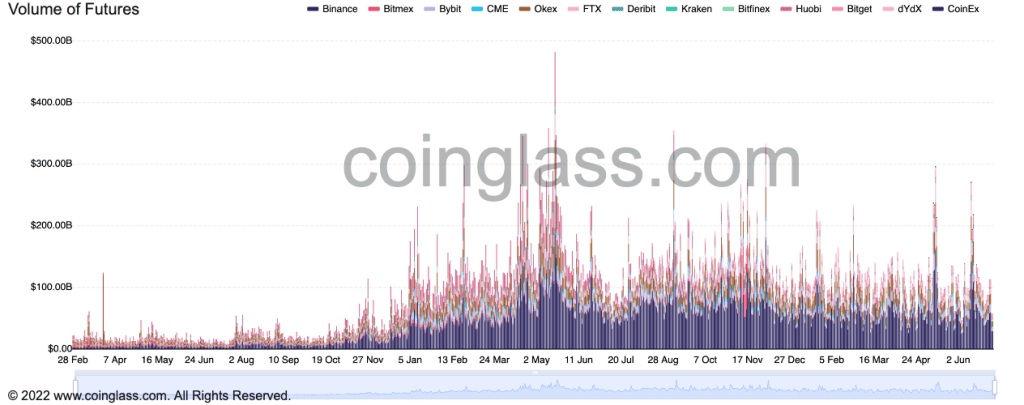

Source: Bitcoin Monthly ReturnThere has been a recent decline in trading volumes and open interest on crypto derivatives exchanges. This implies that the market may face more pain in the future. Futures volumes on top crypto exchanges peaked at $481.7 billion in May 2021. Since then, the volume has recorded a series of lower highs. The most recent increase occurred on June 14, when roughly $270.7 billion worth of derivatives were traded in one day. Today, trading volumes hover at $57.2 billion. This indicates low liquidity and interest for Bitcoin and the broader cryptocurrency market.

Source: Coinglass

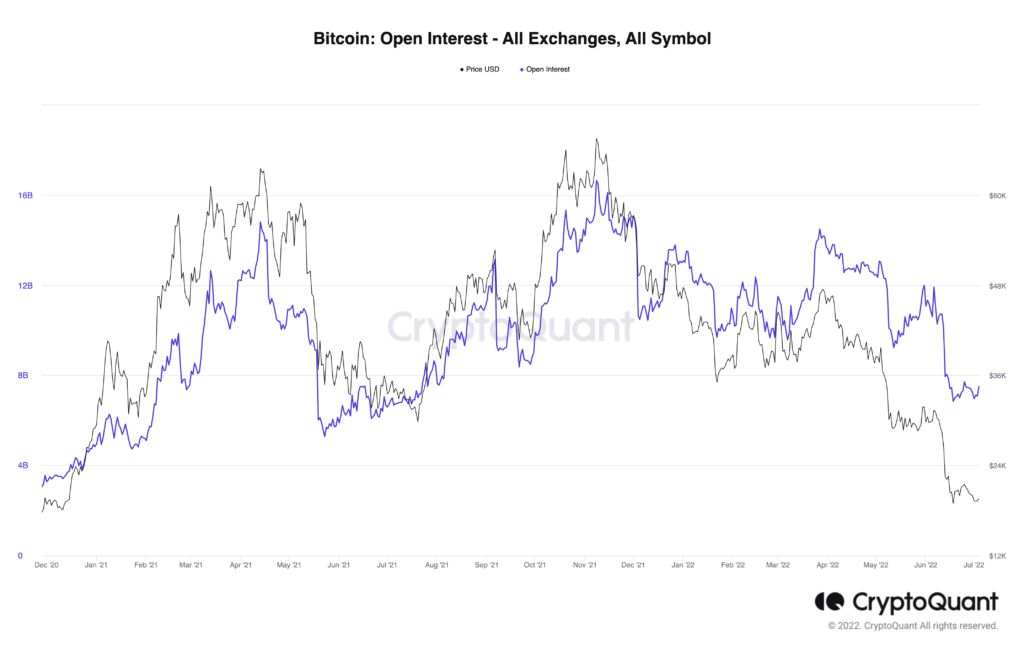

Source: CoinglassSimilarly, open interest on Bitcoin is trending downwards. This indicates that traders are closing their futures positions. This metric highlights the number of open long and short BTC positions on crypto derivatives exchanges. If open interest continues to decline, this is likely to indicate that money is flowing through the market, potentially leading to a steep correction.

Source: CryptoQuant

Source: CryptoQuantBitcoin and Ethereum remain stagnant

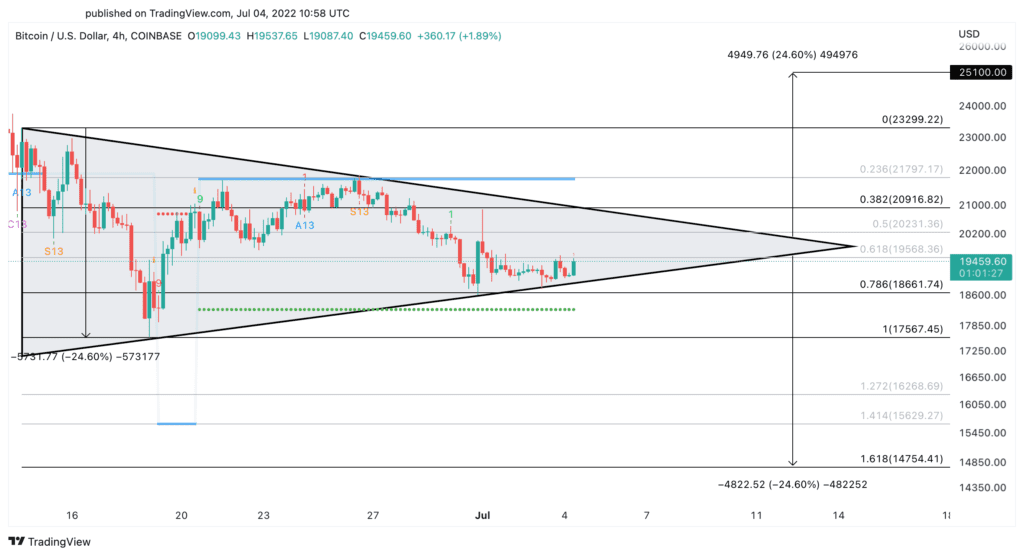

A few data points indicate that Bitcoin and Ethereum could drop. However, both cryptos show uncertainty from a technical point of view, according to analysts. Analysts make the following assessments.

BTC appears to be consolidating within a developing symmetrical triangle on its four-hour chart. The closer you get to the top of the pattern, the higher the probability of a significant price action. The height of the triangle’s Y-axis indicates that the top cryptocurrency is tied for a 24.6% move on break of the $20,900 resistance or the $18,660 support level.

Source: TradingView

Source: TradingViewETH also appears to be consolidating within an emerging ascending triangle on its four-hour chart. The technical pattern suggests that a sustained close below $1,020 could result in a decline towards $750. However, according to the chart pattern, if ETH can overcome the $1,290 resistance, it could rally to $1,700.

Source: TradingView

Source: TradingViewBased on the current position of Bitcoin and Ethereum, it remains unclear how it will play out the next quarter. The odds seem to support the bears. However, it is possible that high volatility in the crypto market may trigger a short bullish break ahead of lower lows.