Bitcoin (BTC) bounced over $43,000 Wednesday for the first time since Monday’s flash crash, pulling the crypto market and shares of digital asset-focused companies higher with it as the Federal Reserve (Fed) signaled interest rate cuts for next year.

While the U.S. central bank officials left the Fed funds rate at 5.25%-5.5% on Wednesday concluding the December Federal Open Market Committee (FOMC) meeting, they projected the rate would come down to 4.6% by the end of 2024, indicating roughly three 25 basis point cuts.

Bond yields and the U.S. dollar index (DXY) fell sharply on the Fed’s dovish projection, supporting a broad-market rally for risk-assets including stocks and cryptocurrencies.

BTC, the largest crypto asset, surpassed $43,000 by late U.S. afternoon hours, climbing almost 5% from below $41,000 earlier in the day.

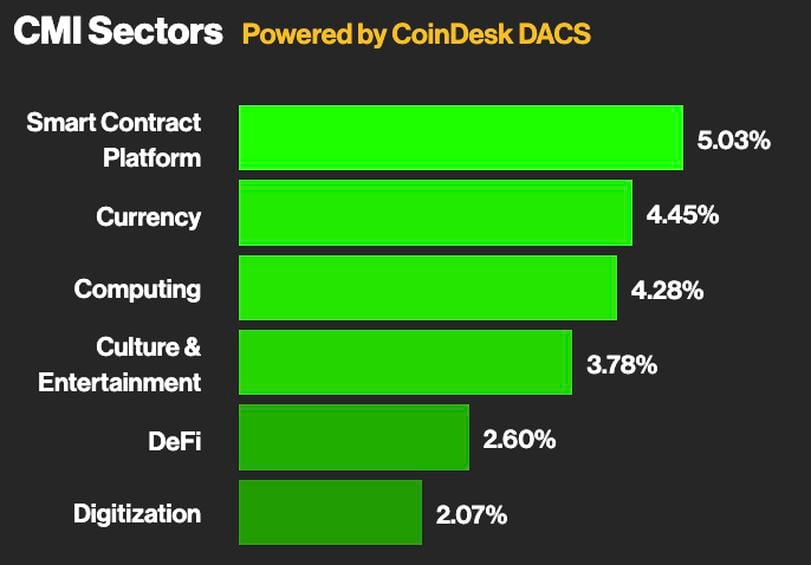

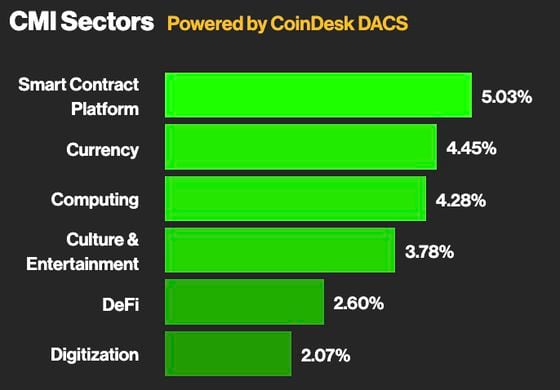

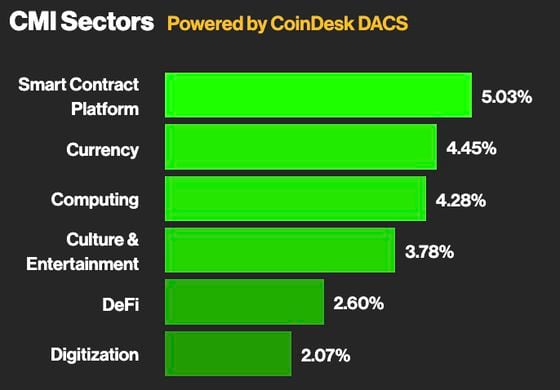

Large-cap tokens of Avalanche (AVAX), Cardano (ADA) and Injective (INJ) posted near 10% gains, making the CoinDesk Smart Contract Platform Index (SMT) the best-performing among CoinDesk’s crypto sectors.

CoinDesk Market Index sector performances (CoinDesk)

The CoinDesk Market Index (CMI), which tracks a weighted basket of almost 200 digital assets, was up 3.8% over the past 24 hours.

Crypto-related stocks also bursted higher. Crypto exchange Coinbase (COIN) closed the trading session almost 8% higher, while Michael Saylor’s MicroStrategy (MSTR) gained 5%.

U.S.-listed bitcoin miners Marathon Digital (MARA), Riot Platforms (RIOT), CleanSpark (CLSK) – often seen as a leveraged bet on BTC – were up 8%-16% through the day.

“Historically, a hold or reduction in interest rates tends to inject optimism among investors, as it implies more disposable income and potentially greater investment in various asset classes,” Bitfinex analysts said Tuesday. “This effect is not limited to traditional markets but extends to novel assets such as cryptocurrencies.”