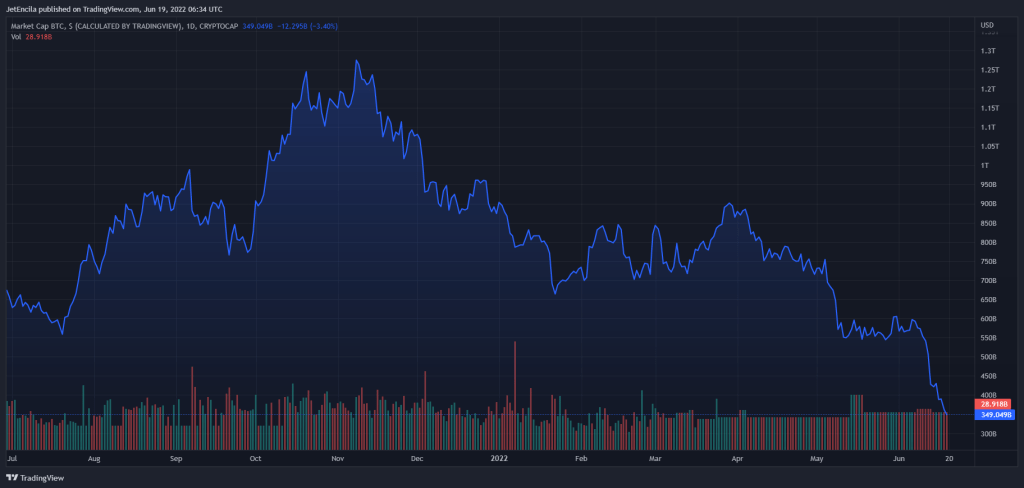

Bitcoin (BTC) dropped to around $17,750 for the first time in December 2020, with the intensification of sales in the cryptocurrency markets. As we reported on cryptokoin.com, the price of Bitcoin is still falling steadily and is currently testing the all-time high of 2017 in the $17,000 to $20,000 range. However, the decline shows no signs of subsidence and analysts are not so sure they will see a bottom right now. After breaking the critical $20,000 level in the leading cryptocurrency, the critical level was broken in Ethereum (ETH). ETH fell below $1,000.

The next few days are crucial for Bitcoin and the cryptocurrency market.

The next few days could be crucial for Bitcoin as failure to establish support at these levels could lead to a $15,000 market drop. Alternatively, if the price rebounds from the current zone, the $24,000 level will be the first hurdle before the $30,000 resistance and 50-day moving average. The current “crypto winter” is different from 2018. That’s because cryptocurrencies are falling along with tech stocks as the broader economy is fragile. Inflation is rising and a full-scale recession seems to be approaching.

Over the past week, the price of Bitcoin has dropped more than 30 percent and the markets are in a state of great panic. A significant amount of cryptocurrencies bought and held in the last two years are put on exchanges, as indicated by currency inflows. On Friday, Antoni Trenchev, founder of cryptocurrency lending platform Nexo, stated in an interview that the current crash “reminds me of the 1907 bank panic.” On Saturday, Dan Held, Kraken’s director of growth marketing, warned that “we are on the path to maximum loss.”

These developments affect the collapse of the cryptocurrency market

Bitcoin’s decline had been going on for several months and was accelerated in recent weeks by the collapse of two major cryptocurrency projects, Terra-Luna and Celsius. These crashes have raised concerns about the resilience of the market. Pressure from macroeconomic factors such as rising inflation and a series of rate hikes by the Federal Reserve is also adding to the catastrophe in the cryptocurrency market. The panic and downturn in the markets is fueled by the fact that crypto companies are putting many people out of work and some of the industry’s most recognizable brands are facing solvency failures.

Meanwhile, the latest data from crypto analytics website Glassnode shows that the revenue generated by Bitcoin miners continues to decline. With rising mining costs and a worsening macroeconomic environment, it shows that miners are now making much less profit, or even at a loss…